Thinking about an 🔁 Adjustable Rate Mortgage (ARM) in today’s market? Discover how ARMs work, what’s changed since the 2008 crash, and why more Metro Detroit buyers are taking a second look. This post breaks down the pros and cons 💡 so you can make a wise, confident choice 📊.

💡 Why Adjustable-Rate Mortgages Are Making a Comeback

If you’ve been house hunting in Metro Detroit lately, chances are you’ve felt the sting of today’s mortgage rates. 💸 With rising home prices and affordability getting tougher, many homebuyers are searching for creative loan options to make the numbers work. One standout solution? 👉 Adjustable Rate Mortgages (ARMs).

But wait—does “ARM” make you think of 2008? 😬 You’re not alone. Many buyers worry that this could be history repeating itself. Good news: Today’s adjustable-rate mortgages in Metro Detroit aren’t the same as they were back then.

The “Crash of ’08”

Back in 2008, some borrowers were approved for loans they couldn’t afford once their rates adjusted. 😟 But now? Lenders are stricter. They carefully check if you can still afford the mortgage even if the rate increases. ✅ That means more protection for buyers and less risk of a repeat crash.

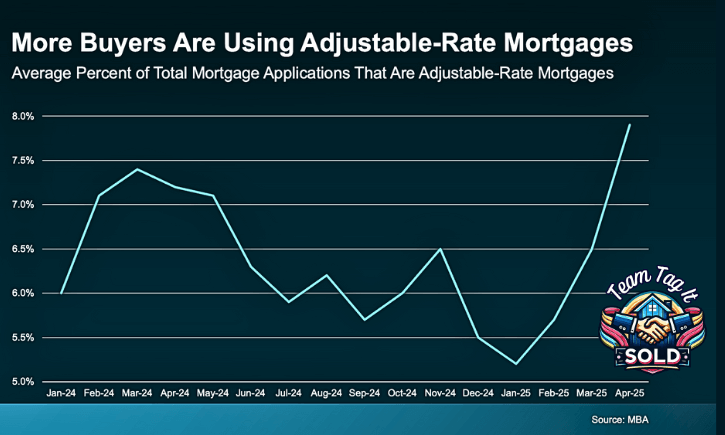

📊 So, why are more buyers choosing ARMs now? Simple: They’re looking for flexibility when affordability is tight. And that’s showing up in the data.

📈 According to the Mortgage Bankers Association (MBA), more people in Metro Detroit are turning to adjustable-rate mortgages. (Check out the graph below to see the trend!)

How an Adjustable Rate Mortgage Works in Metro Detroit

Adjustable-rate mortgages (ARMs) aren’t right for everyone, but in the right situation, they can offer some serious benefits. 💡Let’s break it down.

🔁 With a fixed-rate mortgage, your interest rate never changes. That means your monthly payment stays the same for the entire loan. 📆✅But an adjustable-rate mortgage in Metro Detroit? It works differently.

According to Business Insider:

“With a fixed-rate mortgage, your interest rate remains the same for the entire time you have the loan. This keeps your monthly payment the same for years . . . Adjustable-rate mortgages work differently. You’ll start off with the same rate for a few years, but after that, your rate can change periodically. This means that if average rates have gone up, your mortgage payment will increase. If they’ve gone down, your payment will decrease.”

📌 So, what’s the key difference?👉 With a fixed-rate loan, the base mortgage cost stays steady—though taxes or insurance can still change.📈 But with an adjustable rate mortgage in Metro Detroit, your rate can shift—up or down—after the fixed period ends.

⚠️ That’s why knowing your financial goals and timeline is important. The right loan depends on how long you plan to stay and what you can handle if rates rise.

⚖️ Pros and Cons of an Adjustable Rate Mortgage in Metro Detroit

Wondering why some buyers are giving adjustable-rate mortgages a second look? 🤔 Let’s explore the upsides and trade-offs so you can decide if an ARM in Metro Detroit fits your goals.

✅ Pros: Lower Initial Rates = More Buying Power

One of the biggest perks of an adjustable-rate mortgage is the lower starting interest rate. 💰 That means you could:

🔶 Lower your monthly payment 🔷Qualify for more house ♦️Boost your buying power during high-rate markets.

📌 As Business Insider explains:

“Because ARM rates are typically lower than fixed mortgage rates, they can help buyers find affordability when rates are high. With a lower ARM rate, you can get a smaller monthly payment or afford more house than you could with a fixed-rate loan.”

Sounds pretty good. 👍 But let’s not stop there.

⚠️ Cons: Rates Can Rise Later

Here’s the catch: that low rate isn’t forever. Your ARM will adjust after the initial period—and that’s where risk enters the picture. 📈🔎 Barron’s explains it this way:

“Adjustable-rate loans offer a lower initial rate, but recalculate after a period. That’s a plus if rates drop or you sell before it adjusts, but it can mean higher costs if you stay and rates rise.”

So while the savings now might help you get into a home, it’s critical to think about what could happen down the road. 🛣️ Even though some forecasts say mortgage rates may ease in the next year or two, nothing is guaranteed. That’s why…

💬 Talk It Through Before You Commit

Before locking an adjustable-rate mortgage in Metro Detroit, talk with your lender and financial advisor. Make sure the loan fits your goals—and your comfort with risk. 💼✔️

Because the right decision isn’t just about today—it’s about where you see yourself in five years, too. 🏡

🔍 Learn How to Predict 🔮 Where Mortgage Rates Are Heading 📈📉

Trying to figure out what impacts mortgage rates in Metro Detroit? You’re not alone—it feels like they change every time you blink. 😅 But a simple formula helps make sense of it all ~ ✔️ Check out the blog post!

Every morning, we kick off the day with a quick market snapshot to get a pulse on where mortgage rates might be headed. And the real question isn’t just WHAT’s happening—it’s WHY these rates are shifting. 📉📈

🏡 Let’s Decode the Mortgage Market Together! 💰🔎

Let’s Connect ⤵️

Wow! 🤯 There’s a lot to take in, but don’t worry—I’ve got you! Mastering this step is key before you even start searching for your dream home. 🔑Understanding how mortgage rates are determined and how to negotiate with lenders on rates and fees can save you thousands over time. 💵 But it doesn’t have to be complicated! Let’s simplify the process together.📅 Schedule a Zoom call with me, and we’ll review the data step by step. I’ll share my screen, giving you a clear view of market insights so you can make confident, informed decisions about your next steps! ✅✨Got questions❓ or prefer a quick chat 💬Call or Text 📞 248-343-2459. I’m here to help anytime! 🆘 Stay up to date and ahead of your future competition by visiting the website for updated articles 3 to 4 times a week. Mortgage Rates are updated daily.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

🏁 Final Thoughts: Is an ARM Right for You?

For the right buyer, an adjustable-rate mortgage in Metro Detroit can offer real advantages, such as lower payments and greater flexibility. 🙌 But remember, they’re not one-size-fits-all.

The key? 👉 Understand how they work, weigh the pros and cons, and ask yourself:

📊 Does this fit my budget, timeline, and long-term goals? 💬 Before you decide, make sure to connect with a trusted lender and financial advisor. They’ll help you run the numbers, break down the risks, and choose the right loan for you. 🧠💼📲 Questions? Ready to dive deeper? Call or text me at 248-343-2459 — I’m here to help you make smart, confident moves in today’s market.

📌Smart financing starts with smart planning—Metro Detroit style.

More Help Is 1️⃣ Click Away⤵️

Pick Your Topic by Scrolling

Today’s Mortgage Rates: What’s Driving the Change 📈📉

Real Estate Guides for Buying and Selling a Home📚

Discover How Home Equity Can Fund Your Next Move💰

Top 3 Home Selling Questions Answered 🏡❓

Metro Detroit MI Housing Market Trends by City 🔎📊

Metro Detroit MI Homes for Sale by City 🏘️🎯

Metro Detroit MI Sold Home Prices by City

Learn How To Master Pricing Your Home Like a Pro 💥🏡

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

What Is A True Real Estate Expert: How to Find One🏡💥

Selling Your House As-Is OR Make Repairs Pros🌟 and Cons🚫

Top Real Estate Agent Skills for Selling Your Home🏡💲

Thinking of Selling Your House: How Long Will It Take?

Is Now a Good Time to Sell Your House❓Let’s Find Out 🥳

Downsizing Your Home Can Help You Fuel Your Retirement🤩🏡💲

Master Your Mortgage Rate: Control the Controllable💰🏡

Inspection vs. Appraisal: Understaning the Key Difference🕵️🏡💲

Should You Rent or Sell Your House❓🏡

How to Market Your House for More Money💲🏡🎥

How to Tell if Your House is Priced Right? Let’s Find Out 💲🤯

If you find this information useful, like and share it with your friends and family. 🥰💯

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.