Knowing today’s mortgage rate is one thing. You need to learn how to Master Your Mortgage Rate and save money when buying a home in Metro Detroit. I will show you how.

Master Your Mortgage Rate: Control the Controllable

Chances are you’re hearing a lot about mortgage rates right now. You may see headlines about last week’s Federal Reserve meeting and what it means for rates. But the Fed doesn’t set mortgage rates, even if it sounds like it does. The Fed sets policies that affect the bond and securities market. To learn more, visit “Today’s Mortgage Rates: What’s Driving the Change.”

The truth is mortgage rates are influenced by many factors: inflation, the jobs market, and the economy. Trying to predict when these factors will align to lower rates is tricky. That’s why timing the market takes time to track and understand the trends. Too much is out of your control regarding mortgage rates. The best thing you can do is control the controllables. Here’s what you can influence to make your moving plans a reality in Metro Detroit.

Your FICO Credit Score

FICO credit scores play a huge role in your mortgage rate. Not all credit institutions use the FICO scoring system, but many banks post your score on your online banking. I recommend using Experian because they use a FICO score, not a credit score. Review your credit report to ensure there are no surprises. Some agencies offer tips to boost your score. CNET explains:

“You can’t control the economic factors influencing interest rates. But you can get the best rate for your situation by improving your credit score. Lenders look at your score to decide whether to approve you for a loan and at what rate. A higher score can help you secure a lower interest rate, maybe even better than the average.”

Is There Room to Improve Your Credit Score

Your credit score significantly affects your mortgage interest rate. Improve your score by paying bills on time, reducing debt, and correcting errors on your report. A higher score can lead to better loan terms and lower rates.

What If You’re Not Putting 20% Down: Understanding PMI

Did you know your down payment affects your interest rate. If you put down less than 20%, you’ll have an extra fee added to your monthly mortgage payment. Here’s what to know about Private Mortgage Insurance (PMI).

What is PMI?

PMI (Payment Mortgage Insurance) is insurance lenders need when a borrower puts down less than 20% of the home’s price. It protects the lender if the borrower defaults. While PMI increases your payment, it can make buying a home possible without a large down payment.

Different Rules for PMI Based on Loan Type

PMI rules vary by loan type. Here’s a quick look:

- Conventional Loans: PMI is needed if your down payment is less than 20%. The cost varies based on your credit score and down payment. Once you have 20% equity, you can ask to remove PMI.

- FHA Loans: FHA loans require a Mortgage Insurance Premium (MIP) instead of PMI. MIP includes an upfront and annual premium divided into monthly payments. It is required for the life of the loan unless you refinance.

- USDA Loans: These loans need an upfront guarantee fee and an annual fee, like PMI, but usually lower.

- VA Loans: These loans are available to veterans and active-duty service members, and they don’t need PMI. A one-time funding fee can be added to the loan.

Check for Special Programs

Ask lenders about special programs for first-time homebuyers or first responders in Metro Detroit. These programs often have reduced PMI rates, lower interest rates, or down payment help, making your home purchase more affordable.

By understanding loan types, PMI requirements, and special programs, you can control your mortgage rates and make intelligent decisions about your home financing.

Your Loan Term

The length of your loan matters, too. Freddie Mac” says:

“When choosing the right home loan, consider the loan term, which is the time it takes to repay your loan before you fully own your home. Your loan term affects your interest rate, monthly payment, and the total interest you will pay.”

Depending on your situation, the loan length can change your mortgage rate.

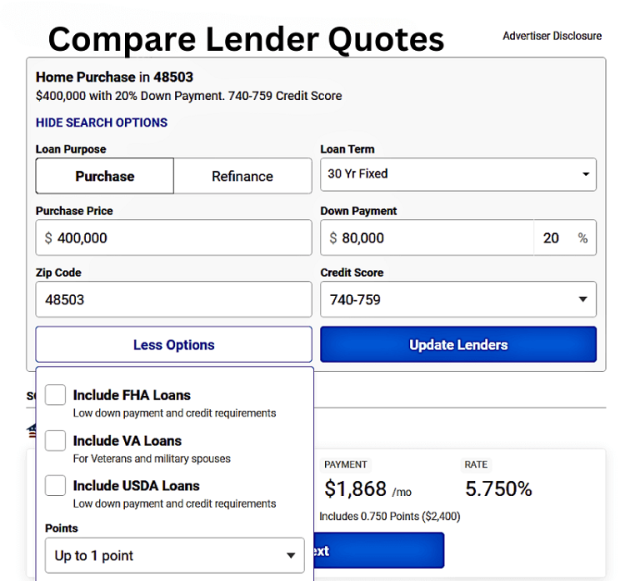

Shop Around for the Best Rates

Don’t settle for the first mortgage offer. Comparing rates from different lenders can save you money. Here are some tips:

- Know Your FICO Score: Before shopping, know your FICO score. Lenders need this number for an accurate quote.

- Limit Credit Inquires: Don’t give out your Social Security number until you find a lender. Too many hard inquiries can lower your score.

- Compare Loan Estimates: Ask for written loan estimates from multiple lenders. These estimates show interest rates, closing costs, and other fees. Compare and negotiate better terms. Discuss buying down your rate through points and ask about future refinancing fees upfront.

I provide mortgage rate updates every day for you, Metro Detroit! The updates include examples of different lenders and what they charge for fees and points. This helps you understand what lenders charge if they push their loans through the Freddie Mac Underwriting system and what lenders use other financial means to fund the loan. If you understand mortgage rates, you control your monthly payment.

Mortgage Daily News (for current mortgage rates) ~ Compare Today’s Mortgage Rates Examples ⤵️

Key Step in Purchasing a Home

Every day, I break down mortgage rates so you can understand the WHY, not the WHAT. These tips will save you thousands over the life of your mortgage loan and provide better negotiation skills with lenders.

Understand Mortgage Rates Before You Buy! Let’s Connect ⤵️

Boy, that’s a lot to pack in.🤩There are many moving parts to mortgage rates, and each person’s financial situation is different. If you’re ready to explore mortgage rates for your new home in Metro Detroit and your options, we can schedule an appointment in several different ways. In a Zoom meeting, we can review options, understand your purchasing power and property taxes, and answer your questions and concerns. I’ll share my screen to give you a clear view of the market insights and help you make informed decisions.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

In Summary ~ Master Your Mortgage Rate

The broader economy might be unpredictable, but you have control over certain factors. Mortgage rates have been on a roller coaster since January. I’ve prepared a quick little infographic with a graph on “How Mortgage Rates Affect Your Monthly Payment,” check it out! Understand your options and how to optimize your situation and achieve the best mortgage rate available in Metro Detroit.

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Slight Rise Alert📢

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Your Home Didn’t Sell: Let’s Fix That! 🔄🏡

3% Mortgage Rate vs. Real Life: Is It Worth Staying Put❓🏡

Mortgage Rate Dips 📉 vs. Home Price Spikes📈Which Matters❓

More Homes for Sale: A Warining⚠️ or Opportunity💡

Mortgage Mistakes to Avoid After Applying🏡😱

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.