🏡📉 Are mortgage rate dips really a good time to buy, or will home price spikes make waiting a costly mistake? In this post, we’ll break down how mortgage rates, home prices, and market trends impact your buying power so you can make a smart move before competition heats up. 🔥 Whether you’re looking to buy now or strategize for later, this guide will help you stay ahead of the game! 🚀💰

🏡 Mortgage Rate Dips vs. Home Price Spikes: Which One Matters Most?

After months of high mortgage rates 📈 and home price spikes 🏠💰, Metro Detroit buyers finally have a golden opportunity! Mortgage rates are dipping ⬇️, opening a limited-time window for those who’ve been waiting on the sidelines. But don’t wait too long—this shift won’t last forever ⏳. If you’ve been holding off, now is the time to save, strategize, and make your move before the market shifts again!

🔥 Rising Competition Could Spike Home Prices

Are you thinking about waiting? 🤔 Here’s the catch—what happens when everyone else sees mortgage rates dip? As rates decline, more buyers flood the market 🚀, leading to intense competition and potential home price spikes 📊.

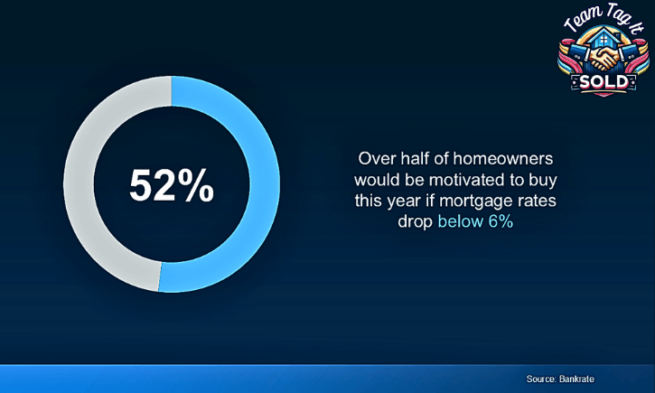

💡 A recent Bankrate survey found that over 50% of homeowners would jump back in if rates fall below 6%! With rates currently hovering around 7% 📉, that moment could be closer than you think. Remember fall 2024? Mortgage rates fell from 7% to 6.08% in just 60 days—and history has a way of repeating itself!

📢 Once mortgage rates dip below 6%, demand will surge. If you’re serious about buying in Metro Detroit, get ahead of the competition! Start preparing now—save 💰, get pre-approved ✅, and be ready to act before the market heats up again 🔥🏡.

🔥 First Up ~ Why the Mortgage Rate Dips and Home Price Spikes Matter📉📈

Mortgage rates don’t just randomly change—they react to economic forces like inflation 📊, Federal Reserve policies 💰, and investor demand for mortgage-backed securities 📑. Simply knowing today’s rate isn’t enough—understanding the “why” behind the moves gives you the power to predict what’s next! 🚀

✨ Timing is everything when buying or refinancing a home. The more you track trends, the better you can negotiate and lock in savings. Step #1? Start tracking mortgage rates like a pro. 📆🔎

📢 Stay ahead of the game with daily updates & future predictions—bookmark and follow:

📌 [Today’s Mortgage Rates: Crack the Code & Save]

📌 [Crack the Mortgage Rate Code & Save]

Key Step in Purchasing a Home

Every day, I break down mortgage rates so you can understand the WHY, not the WHAT. These tips will save you thousands over the life of your mortgage loan and provide better negotiation skills with lenders.

🏡 Buy Now or What? 🤔

Right now, Metro Detroit home buyers are in a sweet spot 🍬! With less competition 👥⬇️, you have a better shot at finding your dream home without a bidding war. Plus, recent mortgage rate dips 📉 make homeownership more affordable than before! 💰🏠

But here’s the real question… Buy now while rates hover under 7% and refinance later. Or wait for lower rates, knowing demand could skyrocket and cause home prices to spike? 🚀📈

⏳ Timing is everything. Now might be your best move to lock in savings before the market heats up! 🔥✅

📊 What Are Homes Selling For? Let’s Find Out! 🏡💰

You’ve got a vision of your dream home ✨—but do you know what it might cost? Tracking home price trends helps you spot opportunities before home price spikes happen. 🤔 Let’s break it down together!

✅ Step 1: Access the MLS and create an account. To make it easy, I’ve put together a quick video tutorial 🎥📌 to show you exactly how to navigate the system.🔍 Start Your Search:📍Filter by location or select from the Metro Detroit cities below.💾 Save your search based on price to track market trends. ✨ Looking for something unique? Clear your filters and search with specific features in mind!

📈 Stay Ahead of the Market: As homes sell in your price range, you’ll get real-time updates to see whether prices are rising or falling. 📉📊📢 Need help finding your perfect city? 📲 Call or text me at 248-343-2459, or 📩 send an email with your target areas—I’ll help you stay one step ahead!

🏠 Macomb County Sold Home Prices

🏡 Oakland County Sold Home Prices

💰 Next Up ~ What Is Your Home Purchasing Power? 🏡📊

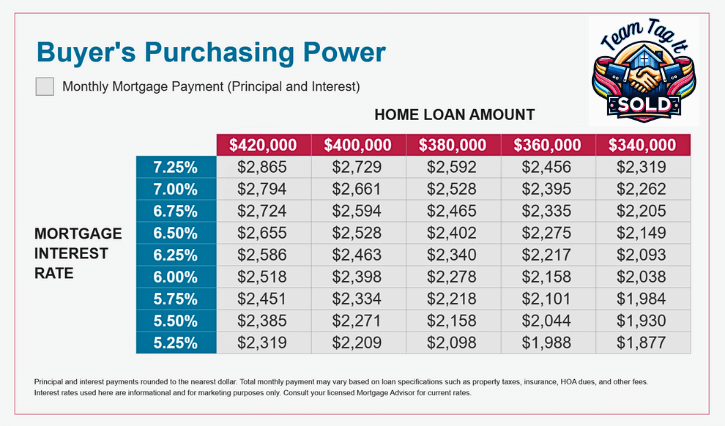

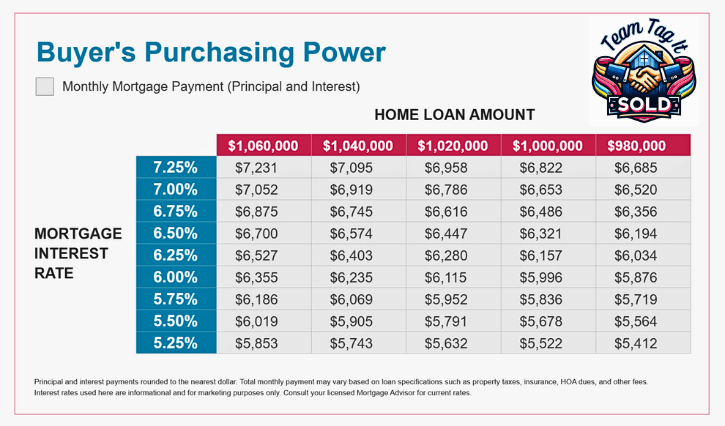

Understanding your home purchasing power is key to making a confident decision! The graphs below will help estimate your principal & interest (P&I) payments, but there’s more to consider than just your mortgage.

🔹 Homeowners Insurance: A Hidden Cost?

Before estimating your monthly payment, check with your insurance agent 🏠📞 for a homeowner insurance quote—you might be surprised! 📈 Insurance rates have increased, so shopping for the best deal is brilliant. Once you have an estimate, divide it by 12 and add it to your monthly mortgage payment to get a clearer picture of your costs.

🏡 Property Taxes Vary by City

Not all cities charge the same tax rate! 🏘️💰 Before making an offer, call the Assessor’s Office 📞 in your target city and ask for the current millage rate. They can estimate your property taxes if you give them a potential home price.

Want to calculate it yourself? 🤓 Here’s how:

📌 Home Price ÷ 2 x Millage Rate = yearly property tax and ÷ 12 = Your Monthly Property Tax

📊 Final Calculation: Your Monthly Mortgage Payment

📌 Principal & Interest (P&I) + Homeowners Insurance + Property Taxes = Your Total Monthly Payment

Now you have a clear breakdown of your total monthly homeownership cost! 💡 Do you need to adjust your budget? If you’re unsure about the numbers, reach out—I’m here to help! 👍📲

📸 Click Picture to Enlarge ⤴️

🏡 Finally ~ Metro Detroit Home Prices & Real Estate Trends by City 📈📊

Stay ahead of the market with real-time MLS updates, refreshed by the 15th of every month! Want to stay ahead of home price spikes? Watch these key market trends:

📅 Days on Market – How long are homes sitting before they sell? ⏳🏠

🏘️ Inventory Levels – Is supply growing, or is it still tight? 📉🏡

🧑🤝🧑 Showings Until Pending – How many buyers tour before a home goes under contract? 🔎👀

💡 Why it matters: These supply & demand trends give you early warning signs of market shifts. If homes sell faster and attract more showings, you might be heading into a multiple-offer situation!📢 The Market Right Now: For the past four years, Metro Detroit’s housing supply has been low 📉. While price spikes have slowed, prices have stabilized rather than dropped in most areas.

📍 Need data for a specific city? Let’s customize your report! If you don’t see your area listed, text 📲 248-343-2459 or email 📩 me, and we will send you the latest market trends for your location!

📊 Macomb County Home Prices & Trends

📈 Oakland County Home Prices & Trends

🚀 Boost Your Homebuying Power

Let’s Explore Together! ⤵️

Wow! 🤯 There’s a lot to think about when buying a home, and feeling a little overwhelmed is normal. The big question is: When is the perfect time financially to jump into the market and buy💰 your ideal home? 🏡Let’s connect and break it all down together! We’ll review recent rate cuts and home price trends and determine the magic numbers that works for you. We can schedule a Zoom call, and I’ll share my screen to walk you through everything step by step. Would you prefer an in-person meeting or a quick phone call 📞 instead? No problem! Let’s set up a time that fits your schedule. I’m here to help you make the most of these opportunities! ✅✨

💡 Need to sell first? Check out the Top 3 Home Selling Questions Answered. I’ll guide you through Steps 1 & 2 of the Price-Driven Approach, so you’ll know exactly what your home is worth and how much equity you can gain! 💰📈Let’s get started on your home buying journey today! 🎉🔑

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

✅ Key Takeaways & Next Steps 🏡📊

If you’re waiting for mortgage rates to drop, remember—you’re not alone! 🤔📉 When mortgage rates dip, buyer competition will surge 🚀, which could cause home prices to spike 📈. Right now, you have a rare advantage:

♦️Fewer buyers in the market 👥⬇️

🔷More home choices without bidding wars 🏘️✨

🔶Better negotiating power for price & terms 💰🤝

💡 Smart Strategy:

We’ll plan by factoring in refinancing options when rates stabilize. You can lock in your dream home today and refinance later when rates improve. 🏠🔑⏳ Don’t wait until the market shifts against you! Take action while Metro Detroit prices are steady and competition is low. Let’s find your perfect home before the next buying frenzy begins! 🚀🔥

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Slight Rise Alert📢

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Your Home Didn’t Sell: Let’s Fix That! 🔄🏡

3% Mortgage Rate vs. Real Life: Is It Worth Staying Put❓🏡

Mortgage Rate Dips 📉 vs. Home Price Spikes📈Which Matters❓

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

More Homes for Sale: A Warining⚠️ or Opportunity💡

Mortgage Mistakes to Avoid After Applying🏡😱

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.