The housing market will change in 2025. 📊 To determine which options will save you money, 💰 start weighing your home purchasing power 💪 against Mortgage Rates and Home Prices for Metro Detroit.

Unlocking Your Home Purchasing Power 💪

📉 Mortgage rates play a huge role in your home-buying journey in Metro Detroit! They directly impact your monthly payments and overall affordability. When rates rise or fall, so does your buying power.

Right now, home prices remain steady due to a tight market—while we’re not seeing the bidding wars of the Unicorn Years, a drop in mortgage rates could ignite another buying frenzy🔥 amid the ongoing housing shortage in Metro Detroit.

💡 What does this mean for you? Home prices could rise again depending on demand—just like we saw in 2020 and early 2021. The key is to run the numbers now and determine the best time to buy! 🕰️🏠

💰 What’s Up with Mortgage Rates: Track the Trends🤔

Thinking about buying a home? 🏠 Then your Home Purchasing Power 💪 should be at the top of your radar! 📉📈 Mortgage rates play a huge role in how much home you can afford, directly impacting your monthly payments and shaping your financial plan. But with headlines shifting daily🚨, it’s easy to feel overwhelmed. 😵💫 The key?🗝️ Understanding how mortgage rates impact your home purchasing power and staying ahead of the curve.

Don’t worry—we’ve got you covered! ☑️ Here’s a simple, no-nonsense guide to help you stay on top of mortgage rate trends and maximize your Home Purchasing Power—without the confusion! 🚀✨

📊 Understanding Mortgage Rates Impact on Home Prices 🏡💰

Let’s break it down! 📉📈 Mortgage rates and home prices go hand in hand when shaping your monthly payment. When rates rise, home prices tend to cool off, causing some buyers to hit pause ⏸️—building up pent-up demand. But when rates drop, the market heats up 🔥 as buyers jump back in, increasing competition. Both scenarios affect your home purchasing power. 🔄️

With the ongoing home supply shortage, we could see another frenzy like the “Unicorn Years” 🦄—when prices soared due to multiple buyers bidding on the same homes! 🏠💨Mortgage rate impacts home affordability, affecting monthly payments and buyer demand 📉📈

💡 Know Your Options

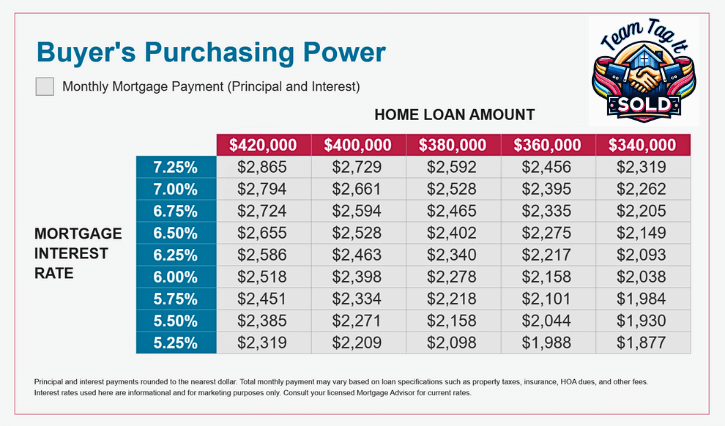

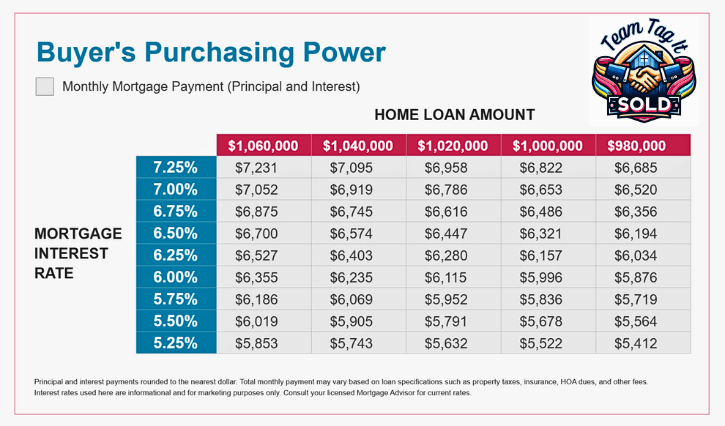

📊 Time to crunch the numbers so you know your home purchasing power💪! Would you rather:

✅ Buy now with higher mortgage rates, aiming to refinance later and snag a better deal on the home price?

☑️Wait for lower rates, but risk paying more for the house due to increased demand?

Both impact your monthly payment and home purchasing power 🤔, so understanding these key factors is crucial. With talks of a potential recession, making an informed decision is more important than ever—especially in Metro Detroit’s housing market! 🏙️📊

🔍 First Learn the New Rules: Predict 🔮 Where Mortgage Rates Are Heading 📈📉

Trying to figure out what impacts mortgage rates in Metro Detroit? You’re not alone—it feels like they change every time you blink. 😅 But there’s a simple formula that helps make sense of it all:

👉 10-Year Treasury Yield + MBS (Mortgage-Backed Securities) Price Gap = Mortgage Rates

Every morning, we kick off the day with a quick market snapshot 📊 to get a pulse on where mortgage rates might be headed. But the real question isn’t just WHAT’s happening—it’s WHY these rates change.

That’s where I come in!🙋♀️ I’ll break it all down in a way that actually makes sense—no confusing jargon, just straight-up insights 👀 on why mortgage rates rise 📈 or fall. 📉 You’ll get a behind-the-scenes look at the formula lenders use to set rates, plus expert tips on how you can start predicting where mortgage rates are heading next.

🔥 Why This Matters

Understanding how mortgage rates work can save you thousands over the life of your loan 💰. Locking in the right rate at the right time ⏳ can make all the difference.🚀 Ready to take control of your mortgage future? Let’s get started! ⤵️

🏡 Now You Understand Rates ~ Let’s Find Your Home Purchasing Power 💰🔍

Now that you know how to track home prices 📉 and monitor mortgage rates 📊, it’s time to focus on your budget! ✅ Before locking in a loan, make sure you’re calculating your true monthly payment—not just principal & interest.

💡 Pro Tip: When shopping for a lender, ask how much it would cost to refinance later 🔄 and work that into your overall budget.

📌 What Goes Into Your Mortgage Payment?

☑️Principal & Interest (P&I) 💵

✅Property Taxes 🏡

☑️Homeowner’s Insurance 🔥

✅PMI (if you put down less than 20%) 🏦

📊 Calculating Your Property Taxes in Metro Detroit

🚨 BIG factor alert! Property taxes WILL increase based on your home’s purchase price—not what’s posted! 📈 Tax rates are adjusted June 1 & November 1, so be prepared for an increase.

📞 Call your local municipality and ask for their millage rates (these vary by school district!). Then, use this formula:

🧮 Home Sale Price ÷ 2 = X

📊 Millage Rate× X ÷ 12 = Your Monthly Tax Payment

🔎 Explore Buyer Scenarios

To make things easier, I’ve prepared several charts showing different monthly payment scenarios based on principal & interest only. Click the picture to enlarge! 📸

📌 Your Monthly Payment Formula:

💲 P&I + Taxes + Homeowner’s Insurance + PMI (if applicable) = TOTAL Monthly Payment ✅

Start calculating your buying power today and make informed financial decisions with confidence! 🚀💡

📍 Know What Homes Are Selling For in Metro Detroit 💲

Take control of your home-buying or home-selling journey with direct MLS access—no middleman, no guesswork! 🚀 Our exclusive bridge access lets you explore what homes are selling for 💰, all at your own pace. 🖥️

✨ You’ve got instant access to up-to-date sold data—so you can skip the headlines and go straight to the facts!

📌Metro Detroit Sold Homes by City 🏡

Start exploring now and make informed decisions with confidence! 💡📊

Macomb County Sold Homes by City

Oakland County Sold Homes By City

🚀 Boost Your Homebuying Power

Let’s Explore Together! ⤵️

Wow! 🤯 There’s a lot to think about when buying a home, and feeling a little overwhelmed is normal. The big question is: When is the perfect time financially to jump into the market and buy your ideal home? 🏡💰Let’s connect and break it all down together! We’ll review recent rate cuts and home price trends and determine the magic numbers that work for you. We can schedule a Zoom call, and I’ll share my screen to walk you through everything step by step. Would you prefer an in-person meeting or a quick phone call 📞 instead? No problem! Let’s set up a time that fits your schedule. I’m here to help you make the most of these opportunities! ✅✨

💡 Need to sell first? Check out the Top 3 Home Selling Questions Answered. I’ll guide you through Steps 1 & 2 of the Price-Driven Approach, so you’ll know exactly what your home is worth and how much equity you can gain! 💰📈Let’s get started on your home buying journey today! 🎉🔑

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

🏡 Final Thoughts: Mortgage Rates Impact on Home Affordability 🚀

Are you curious about the Metro Detroit housing market and how it impacts your home-buying plans? 🤔💰 Let’s connect! I’ll help you navigate the current market, break down key trends, and understand what it all means for you and your home purchasing power.💪

Now that you know your magic number, it’s time to take control of your home purchasing power. 🎯 With direct Multiple Listing Service (MLS) access, you can browse homes for sale in real-time—no middleman, no guesswork! 🏠🔎

🎥 Watch the Video! Learn to use the MLS just like a Realtor—adjust your criteria, change status filters, and compare prices & features with ease! 📊💡

🔑 Why This Matters:

☑️Stay informed & prepared with real-time listings 📉📈

✅Become a pro at market research 🎓💼

☑️Compare prices & features to find the perfect home 🏡

📩 Want to stay ahead of the market? Sign up for our newsletter, and I’ll keep you updated on the latest trends, insights, and opportunities—so you never miss a beat! 📰✨

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Slight Rise Alert📢

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Your Home Didn’t Sell: Let’s Fix That! 🔄🏡

3% Mortgage Rate vs. Real Life: Is It Worth Staying Put❓🏡

Mortgage Rate Dips 📉 vs. Home Price Spikes📈Which Matters❓

More Homes for Sale: A Warining⚠️ or Opportunity💡

Mortgage Mistakes to Avoid After Applying🏡😱

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.