Today’s Mortgage Rates: Prediction Dip Alert 📢

UPDATED: FEBRUARY 27, 2026 • 12:43 PM ET 🕐

TRACK THE WHY, NOT THE WHAT, and Learn to predict Mortgage rates: 🗓️ February 27, 2026

Today’s Mortgage Rates: What’s driving the change isn’t just about the daily number that pops up. I’m going to break down and explain the WHY behind Today’s Mortgage Rates: What’s Driving the Change in Metro Detroit! Learn the WHY the rate moves so you can spot trends before they shift. By understanding the bond market, the MBS gap, and the Fed’s hidden influence, you’ll know when to lock your rate on a dip—not a spike.

- 🔖 Bookmark Crack the Code and Save for next week’s Mortgage rate predictions.

- 📩 Notifications to your email in-box

- 🔖Bookmark Today’s Mortgage Rates- What’s Driving the Change

The Why Behind Today’s Mortgage Rates Starts with the formula

The 10-year Treasury yield is the interest rate the U.S. government pays to borrow money for 10 years. It acts like a weather vane for long-term rates, including mortgage rates. When investors expect higher inflation or stronger economic growth, they demand higher returns. That pushes the 10-year yield up ⬆️, and mortgage rates usually rise with it.

When investors worry about a slowdown, a recession, or global trouble, they move money into safe U.S. Treasuries. That buying pushes the 10-year yield down ⬇️, and mortgage rates tend to fall. So when you hear about hot inflation, strong job numbers, or a tough-talking Federal Reserve, rates usually move higher 📈. But if you hear about weak data, recession fears, or market stress, rates often move lower 📉.

The 10-Year Treasury Yield Your Base – 2-27-2026 Updated by 10:30 🕥Dip or Spike?

Yield has continued to dip lower

The US bond market is suddenly flashing a warning sign about the economy, then the gift 🎁from SCOTUS. Now that the high tariffs are gone for now, and the new ones will not exceed 15% for only 150 days, the “Street” investors see this as a sign that inflation will go down and the Federal Reserve will step up interest rate cuts. The bond market has been declining for two days.

Step 1: Why the Yield is Dipping 📉

It appears the mechanics and math will influence mortgage rates moving forward. Wall Street is closely monitoring the policies and the Treasury bond market. The Treasury auction has been extremely weak for months, and investors are jumping in ONLY IF the Treasury is covering their risk and offering higher coupon rates. Those higher coupon rates are what are causing the yield to spike. It’s going to take months before we feel relief from inflation, because the goods on shelves and in warehouses were purchased under the higher tariff regime.

1️⃣ Bond market reaction to Tariff Policies 📉

With the White House invoking Section 122, the tariff landscape becomes simpler and less inflationary than the patchwork system we had before 📉 A flat global 10% rate replaces dozens of higher, uneven tariffs, and because it automatically expires in 150 days, Wall Street sees a clear endpoint instead of a long-term threat ⏳📊

Congress is unlikely to extend it in an election year, adding even more certainty and stability 🗳️The only real work ahead is diplomatic — Canada and Mexico will need reassurance that USMCA isn’t being abandoned, only temporarily overridden by a broad emergency measure 🤝Once the 150-day window closes, all three countries snap back to normal trade terms, restoring the existing framework and cross-border confidence ✅🌎

The Fed’s latest messaging reinforced that rate cuts are not guaranteed yet. Officials want more confirmation that inflation is sustainably cooling before shifting policy. Even without raising rates, this “wait for proof” stance keeps upward pressure on yields and mortgage pricing because markets must price in the risk that policy stays restrictive longer.

3️⃣ Labor market signals remain mixed 💼

While longer-term trends show cooling hiring and rising continuing claims, the most recent weekly data did not confirm a rapid deterioration in labor conditions. When jobless claims fail to show meaningful acceleration, investors assume the economy remains stable, reducing the urgency for lower rates and nudging yields higher. The issue here is that initial jobless claims and unemployment are based on a survey, not on actual numbers from each state’s unemployment rolls. In this day and age, I don’t understand why we don’t have actual numbers for accurate measurements, so much for transparency.

4️⃣ Consumer spending is slowing but not collapsing, YET 🛍️

Retail sales have weakened compared to earlier momentum, reinforcing the narrative of a cooling consumer, yet the slowdown is gradual rather than recessionary. Markets typically need clear deterioration — not moderation — to push mortgage rates meaningfully lower. December year-over-year retail was down 2.3% from 4.7% to 2.4%

5️⃣ Payroll data credibility and market skepticism 📊

Markets continue to weigh the differences among ADP payroll data, jobless claims trends, and BLS reporting. That uncertainty creates volatility. When investors lack conviction that the economy is weakening quickly, bond markets hesitate to rally, which prevents mortgage rates from sustaining downward momentum.

✅ Bottom line:

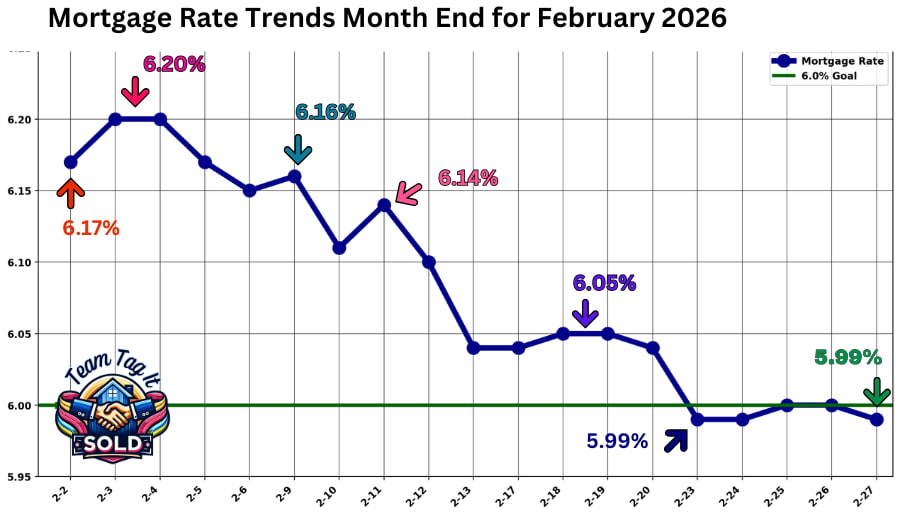

Mortgage rates moved slightly higher yesterday after bond yields rose, even as the Fed’s caution and labor data failed to confirm rapid economic weakness. The broader trend still reflects a slowing economy, but until investors see clearer signs of deterioration — especially in jobs and inflation —ate increases will likely remain uneven and temporary.

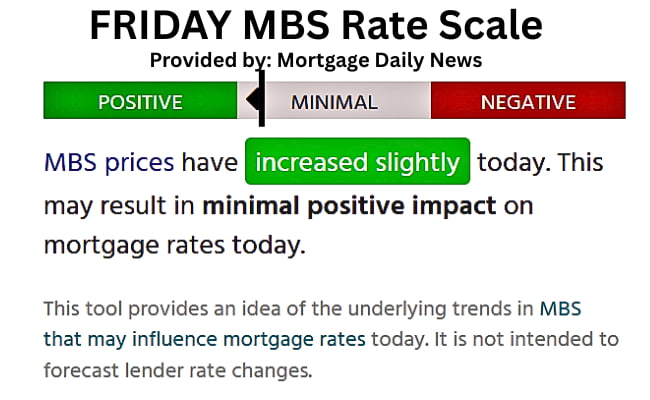

Step #2: Mortgage-backed Securities (MBS) Prices Today – Updated by 11:15 🕚 Early rate Predictions Alert 📢

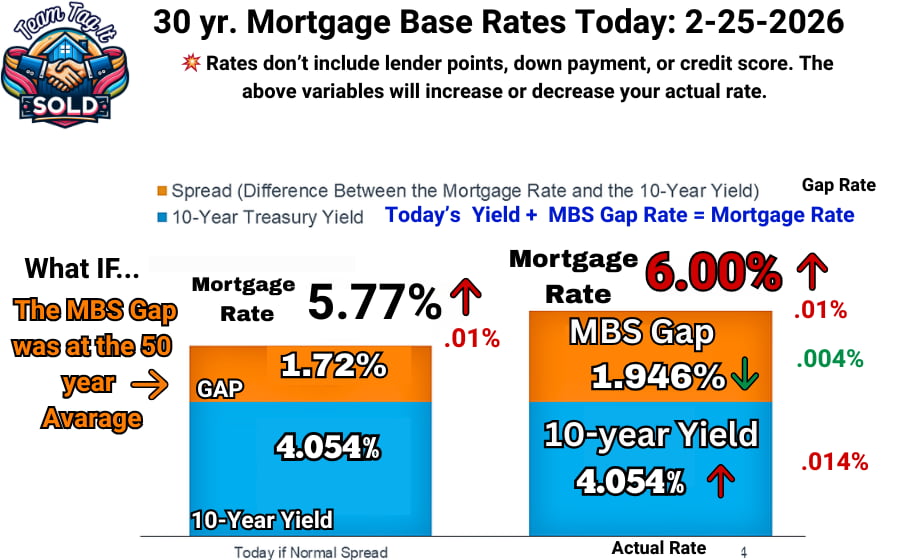

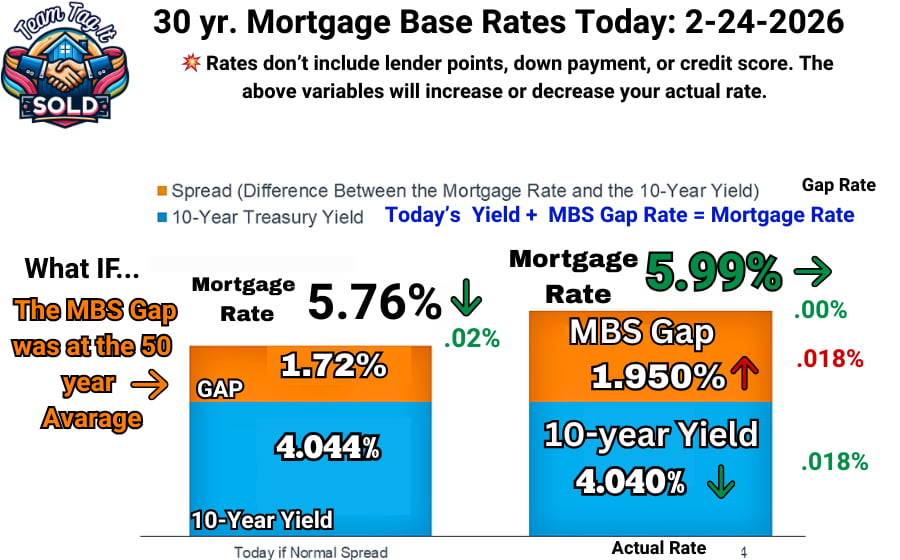

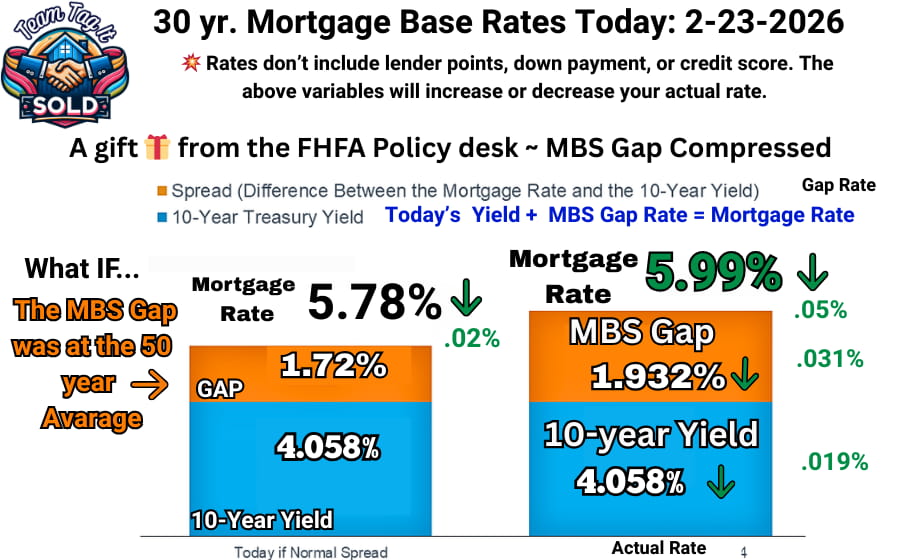

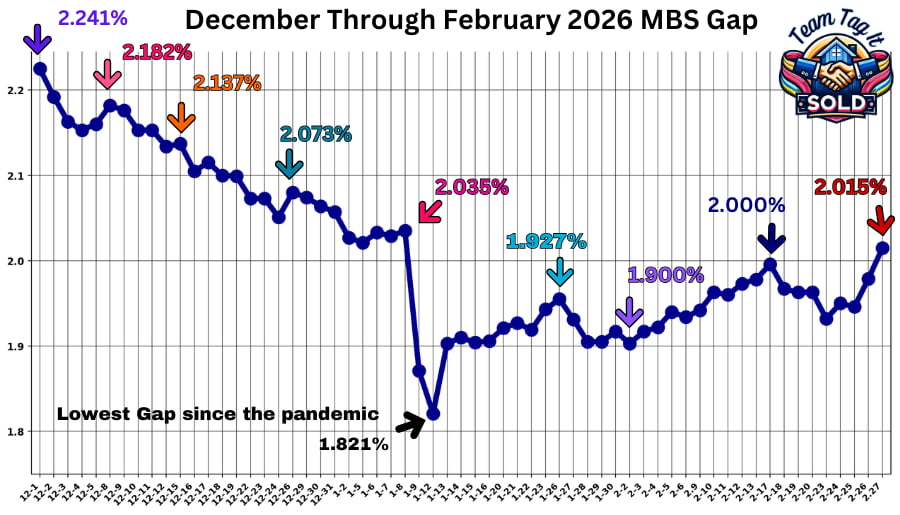

🚨 The second piece in determining mortgage rates is the all-important Mortgage-Backed Securities. Historically, the 50-year average between the 10-year Treasury yield and MBS rates has hovered around 1.72%. Currently, the average range has plummeted from 2.528% on January 3rd, 2025.

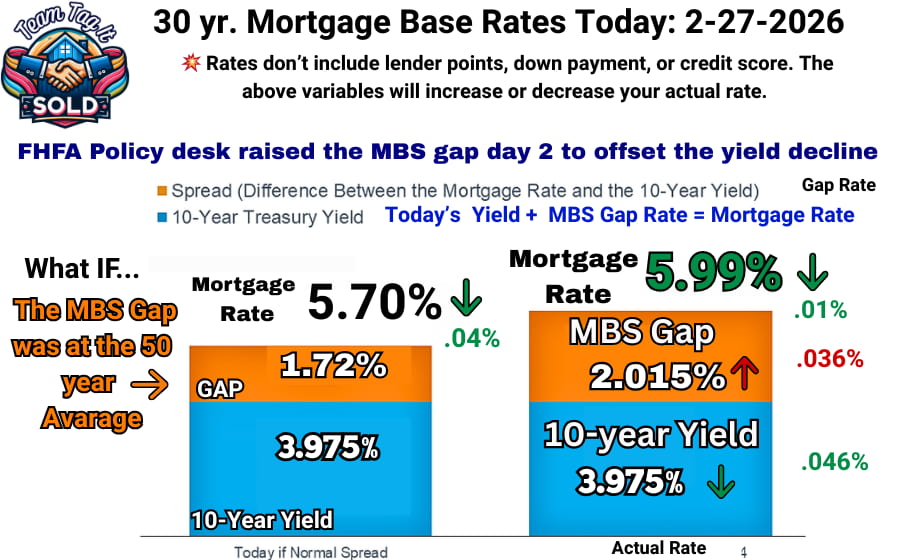

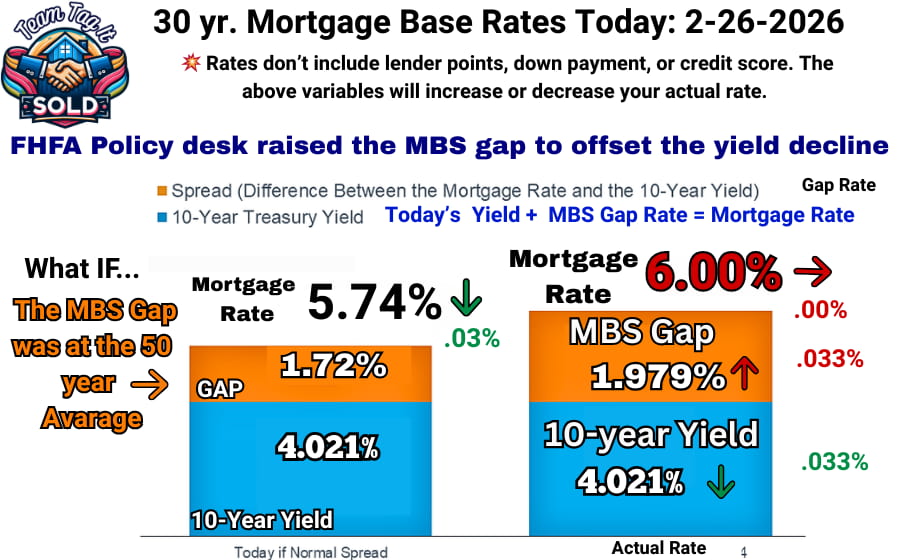

📌 Today’s MBS Gap: Hero 🦸 or Villain 🦹 with prediction at 11:15🕚FHFA will determine today’s rates, not the math

🔮 The prediction today will fall in the FHFA policy desk. WHY? Yesterday, the yield dipped, and the FHFA policy desk increased the gap to offset the decline. Today is day two of the dip, and the FHFA policy desk could do a gap adjustment lower today. The question is, how low will they go? 📰 Mortgage Daily News reports that MBS prices have moved down slightly and could have a minimal impact on Mortgage Rates today.

🦸 Hero Mode:

When Mortgage-Backed Securities (MBS) prices go up, it means investors are willing to accept lower yields in exchange for the stability of mortgage payments. Today’s Math: FHFA could implement a gap correction today, further lowering mortgage rates. 🦸♂️

⚖️Balanced:

Today’s Math: The Yield at 3.975% plus the same MBS Gap as yesterday at 1.978% would equal a mortgage rate of 5.95%.

🦹Villain Mode:

Falling MBS prices mean investors demand higher yields to take on mortgage risk, creating upward pressure on mortgage rates.❌ Result: Lenders increase rates to keep spreads profitable or temporarily pause quoting. Additionally, when the yield skyrockets, 🚀 the Fed Security Desk or Freddie and Fannie 🏦 have been using the gap to correct and stabilize volatility in the Mortgage market. Buyers lose buying power, and the urgency to lock on a dip becomes critical. Today’s Math: FHFA policy desk may start balancing the GSE books now that the yield is starting its trend down. Remember, the FHFA policy desk has been artificially compressing the MBS gap to keep rates stable; they may start to ease up.

Important 📢 Know Your Lender’s Policy on Rate Revisions – Morning vs Afternoon

⚠️ Before locking your rate, always understand how your Lender determines their daily mortgage rate. Remember: yield and MBS prices fluctuate throughout the day, so knowing the Lender’s timeline before locking your rate is crucial to saving. 🔏

📊 Mortgage Daily News article on the importance of understanding why lenders adjust mortgage rates midday. 💥Know your Lender’s 🏦 protocol for rate changes. 🔁💡 Do you offer rate revisions if the bond market shifts lower in the afternoon? ❓Know the WHY and save.💵

Today’s Mortgage Rate: WHY Answered

Today, the math didn’t apply. On Day 2, the FHFA policy desk performed an MBS gap correction and increased MBS to stabilize the spread between the yield and the MBS.

Mortgage Rates Trends

Why the FHFA is compressing MBS Prices

📌 The MBS gap hasn’t been following the math consistently since August. 🧮 The FHFA Policy Desk is determining the outcome of where they want rates to land. Remember, the Federal Reserve doesn’t determine mortgage rates; instead, the 10-year Treasury yield (set by Treasury Department bond sales) and the Mortgage-Backed Securities (MBS) gap (set by the Federal Housing Finance Agency) do.

FHFA Policy Desk

⬇️⬇️⬇️

Fannie Mae & Freddie Mac

Capital Markets Desks

⬇️⬇️⬇️

MBS Market

(Pricing & Spreads)

⬇️⬇️⬇️

Lenders

(Rate Sheets

⬇️⬇️⬇️

Borrowers

(Final Mortgage Rate)

Get online Mortgage Quotes from Mortgage Daily News ⤵️ Click to View

Base Rate: adjustment not made for your FICO score, your down payment, location, purchase price, and MORE! access Morgage Daily News for Quotes ⤵️

Where Are Mortgage Rates Heading Next 🔮

Mortgage rates don’t move on headlines 📰 alone—they move on patterns. This weekly breakdown shows how to identify the signals that trigger a mortgage rate spike ⬆️ or a dip ⬇️. By tracking bond market behavior, MBS gap shifts, and lender pricing trends, you’ll learn when rates may stabilize and when risk is building ⚠️.

Do You Know Your Home Purchasing Power

💰 If you’re thinking about buying in Metro Detroit, there’s more to the story than just mortgage rates. 📉📈 Your true buying power depends on timing, affordability, and demand—and the market is shifting fast. Don’t guess—get the facts! I’ll walk you through the calculations and provide clear graphs 📊 so you can determine what mortgage payment fits your budget. 🔍Take control of your next step!

🏡 Let’s Decode the Mortgage Market Together! 💰🔎

Wow! 🤯 There’s a lot to take in, but don’t worry—I’ve got you! 🔑Understanding how mortgage rates are determined and how to negotiate with lenders on rates and fees can save you thousands over time. 💵 But it doesn’t have to be complicated! Let’s simplify the process together. 📅 Schedule a Zoom call with me, and we’ll review the data step by step. I’ll share my screen to give you a clear view of market insights so you can make confident, informed decisions about your next steps! ✨If it’s easier, contact my cell at 📞248-343-2459 and we’ll schedule an appointment.

More Help Is ONE Click Away⤵️

Pick Your Topic by Scrolling

Today’s Mortgage Rates: What’s Driving the Change 📈📉

Home Pricing Missteps 😱

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

New Construction in Metro Detroit: Homes for Sale W/Video🏡🔎

Home Purchasing Power – Do You Know Your’s❓🏡

FHA Mortgage: What is It and How Can You Benefit in Metro Detroit

Real Estate Guides for Buying and Selling a Home📚

Discover How Home Equity Can Fund Your Next Move💰

Top 3 Home Selling Questions Answered 🏡❓

Metro Detroit MI Housing Market Trends by City 🔎📊

Metro Detroit MI Homes for Sale by City 🏘️🎯

Metro Detroit MI Sold Home Prices by City

Learn How To Master Pricing Your Home Like a Pro 💥🏡

1st-Time Homebuyers: Tips to Make Your Dream Come True🏡🥳

1st-Time Homebuyers Saving Strategies🏡🔑💲

Is Owning a Home Still Your Dream – Help is Here💥🏡

Home Down Payment Assistance Programs : Need Help? 🥰💯

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

What Is A True Real Estate Expert: How to Find One🏡💥

Selling Your House As-Is OR Make Repairs Pros🌟 and Cons🚫

Top Real Estate Agent Skills for Selling Your Home🏡💲

Thinking of Selling Your House: How Long Will It Take?

☎ +1 (248) 343-2459

© 2017–2026 Pam Sawyer @ Metro Detroit Home Experts. All Rights Reserved.

The information contained and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Pam Sawyer does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts or Pam Sawyer will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.