Mortgage Rates these days are on a roller coaster ride for Metro Detroit. To better predict where they are heading next, let’s break down understanding mortgage-backed securities’ effects on mortgage rates.

Understanding Mortgage-Backed Securities

Have you ever wondered what’s really behind the rise and fall of Mortgage Rates? I sure did! After 20+ years in the business in Metro Detroit, I’ve seen higher 10-year treasury yield rates and lower mortgage rates. I noticed something interesting: comparing the yield and mortgage rates revealed a consistent gap. So, I made a spreadsheet with the 10-year treasury yield, gap numbers, and mortgage rates. And guess what? A pattern emerged!

The Next Step

I then turned to Google to understand the gap between the 10-year Treasury Yield and Mortgage Rates. That’s when I discovered that mortgage-backed securities play a massive role in determining current mortgage rates and predicting their future direction. This was a huge “aha” moment for me.💡So, since March 2020, I’ve been tracking the Mortgage-Backed securities gap rate and the effects on Mortgage Rates for Metro Detroit.

What Are Mortgage-Backed Securities?

Mortgage-backed securities, or MBS, are a bit like bonds. They’re made up of a bunch of home loans that banks have sold to investors. When homeowners pay their mortgages, investors in MBS get a share of those payments. It’s a way to invest in real estate without buying the property yourself. Understanding MBS can give you insights into how mortgage rates are determined, helping you make informed decisions whether you’re looking to buy or sell a home in Metro Detroit. Plus, knowing how to track yourself, you can bypass much of the noise you hear or read.

Why Mortgage-Backed Securities (MBS) Matter to You

MBS is a key player in making homes more affordable. They give banks the cash flow to lend more for home buying. This magic keeps your borrowing costs down and makes it easier for everyone to get a mortgage.

How Mortgage-Backed Securities Move the Needle on Mortgage Rates

The dance between the price of MBS and your mortgage rate is close. It’s all about supply and demand. When many investors want to buy mortgage-backed securities, their prices go up. But the interest they pay, or their yield, goes down. That’s good news because it means lower mortgage rates for you. On the flip side, if fewer investors want to invest in mortgage-backed securities, the interest rates and your mortgage rates go up. The big-picture factors like inflation, the job market, the economy’s health, and what the Federal Reserve does also shake things up.

Now You Know How to Cut Through Mortgage Rate Noise

Getting the lowdown on MBS can shine a light on how mortgage rates move. With this insight, you’re in a better spot to pick the right time for a home loan or a refi.

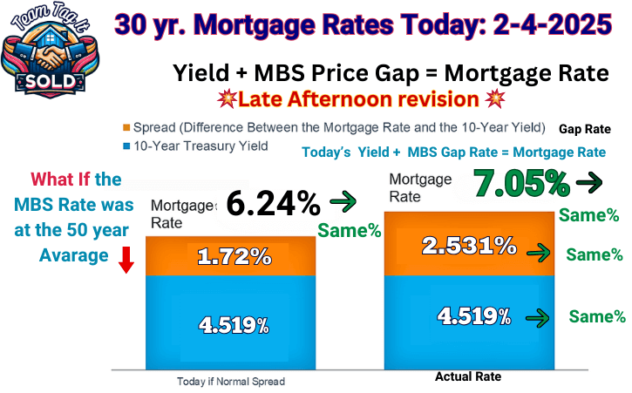

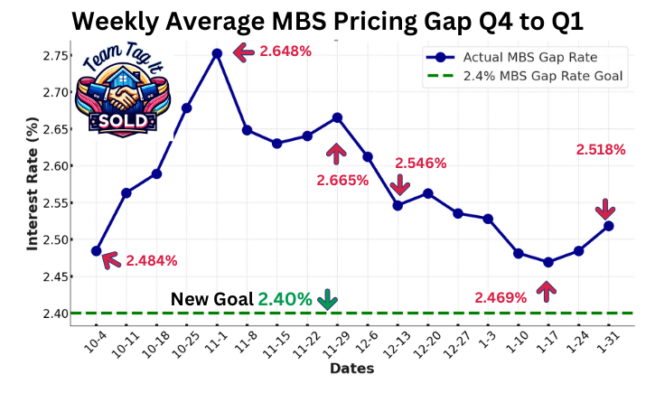

Important ~ Track the Gap

We are now at a turning point in the housing market and will see a shift in 2024. Tracking Mortgage Rates, the 10-year Treasury Yield, the MBS gap, and home prices will determine your mortgage payment. This is the most critical puzzle piece to know if mortgage rates are trending up or down. Let’s review what we do know. Goal # 1 is to see the MBS gap rate stay below the gap rate of 2.5% and work it way back to the 50+ year average of 1.72%. As you can see from the graph, we were heading in the right direction based on speculation about what the Federal Reserve would do with interest rates, but the economy and job market are strong, and there are no rate cuts. The Yield numbers and gap are up, and so are mortgage rates.

The MBS Gap Affects Mortgage Rates

Knowing how mortgage-backed securities (MBS) and mortgage rates work is key to saving money. Soon, you’ll master this, knowing exactly when to buy your new home.

Calculate the Gap

- Step #1 ~ Start with the 10-year Treasury Yield average for the week.

- Step #2 ~ It’s challenging to track the gap rate, but I’ve been doing it for years. Take the mortgage rate minus the yield rate to track trends to get your gap number.

- Step #3 ~ Calculate future Mortgage rates: ~ Today’s 10-year treasury Yield + MBS Gap = Mortgage Rate. The calculations are simple, but the predictions are more complex unless you track the economic numbers. I’ve seen mortgage rates climb by .50% on bad economic news over a 24-hour.

The graph uses teal to show the average 10-year Treasury Yield Rate and orange for the MBS gap rate. The mortgage rate is shown as a percentage on top. The graphs on the left and right sides show “What If Scenarios,” highlighting the importance of tracking the MBS Gap and its effect on your mortgage rate.

Example of Daily What If’s and Actual Mortgage Rates

For updated information daily, visit “Today’s Mortgage Rates: Crack the Code and Save.”

The Average MBS Price Gap

Let’s Decode the Housing Market Together! Let’s Connect ⤵️

Wow 😮, there’s a lot to consider! Whether looking to buy a new home or considering selling in Metro Detroit, keeping up with news regarding Mortgage Rate trends is essential. After all, these numbers impact your decisions. Let’s simplify the process together. Schedule a Zoom call with me, and we’ll review the data. I’ll share my screen so you can see the market insights clearly and feel confident about your next steps.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

Key Insight

Understanding the weekly MBS (Mortgage-Backed Securities) gap rate is a game changer for predicting mortgage rates. Want to get the lowdown on mortgage rates and their journey? To stay in the loop with daily mortgage rate changes, dive into “Today’s Mortgage Rates: What’s Driving the Change .” And for a sneak peek at future mortgage rates, don’t miss “Crack the Code~ Weekly Update and Future Predictions.” I’ve laid it all out in my blog, complete with extra links to turn you into a mortgage rates expert before you know it. Need help? Let’s connect!⤴️

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Rate Drop Alert📢

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

More Homes for Sale: A Warining⚠️ or Opportunity💡

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

Should You Buy a Home Now in Metro Detroit or Wait❓🏡

Home Purchasing Power – Do You Know Your’s❓🏡

How Mortgage Rate Cuts Affect Your Home-Buying Power💪

Will a Recession Crash the Housing Market in 2025🌩️🏠

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.