Crack the Mortgage Rate Code and Save 💲

Updated 3-9-2026 at 4:00 PM, EST 🕓

Let’s Crack the Mortgage Rate Code and Save🏡💰 ~ March 6th, 2026

Mortgage rates don’t move on headlines 📰 alone—they move on patterns. This weekly breakdown shows how to identify the signals that trigger a mortgage rate spike ⬆️ or a dip ⬇️. By tracking bond market behavior, MBS gap shifts, and lender pricing trends, you’ll learn when rates may stabilize and when risk is building ⚠️. Understanding the “WHY” behind rate movement helps buyers and homeowners make decisions with clarity. This way you avoid costly surprises—right here in Metro Detroit 🏡. Over time, you’ll learn WHY rates spike ⬆️ or dip ⬇️, how to recognize repeatable patterns ⏳. Understanding the WHY and timing your lock matters—so you aim to lock on a dip, not a spike.

- 🔖Bookmark: Today’s Mortgage Rates — for Dip and Spike Alerts 📢 for daily updates.

- 💌 Want exclusive alerts? Subscribe to our newsletter and news alerts!

- 🔖 Bookmark: Crack the Mortgage Rate Code and Save – to track where we were and where we are heading next.

🔎 Your Why behind Mortgage Rates

Daily Breakdown for the Week

Every day, I break down WHY mortgage rates rise or fall daily—so you don’t have to guess! 📉What happened throughout the week sets the stage for what we can expect next week. For now, data from the Bureau of Labor Statistics (BLS) and the Department of Labor have not moved the yield needle as they have in the past. The decline in the bond market is thanks to SCOTUS removing the high tariffs. For now, tariffs fall under Section 122 at 10% and expire after 150 days; they cannot be used again.

Monday:

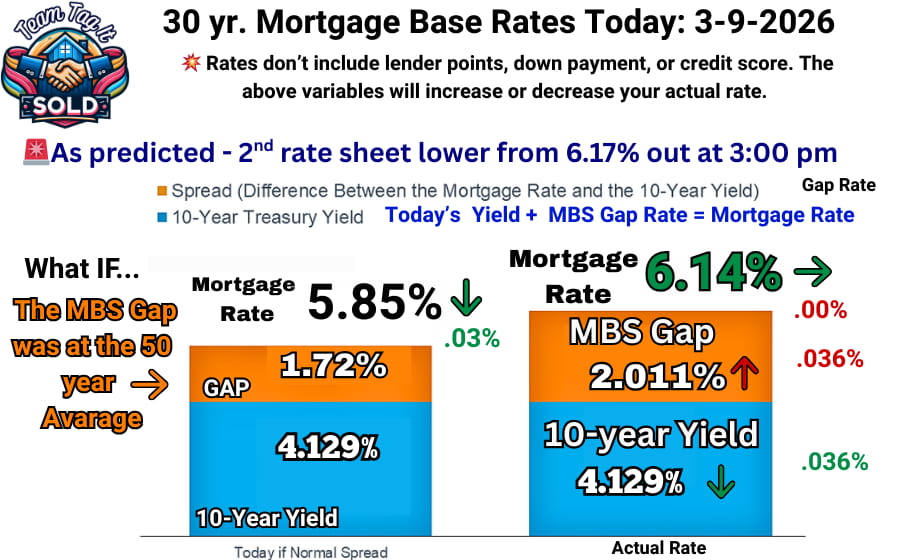

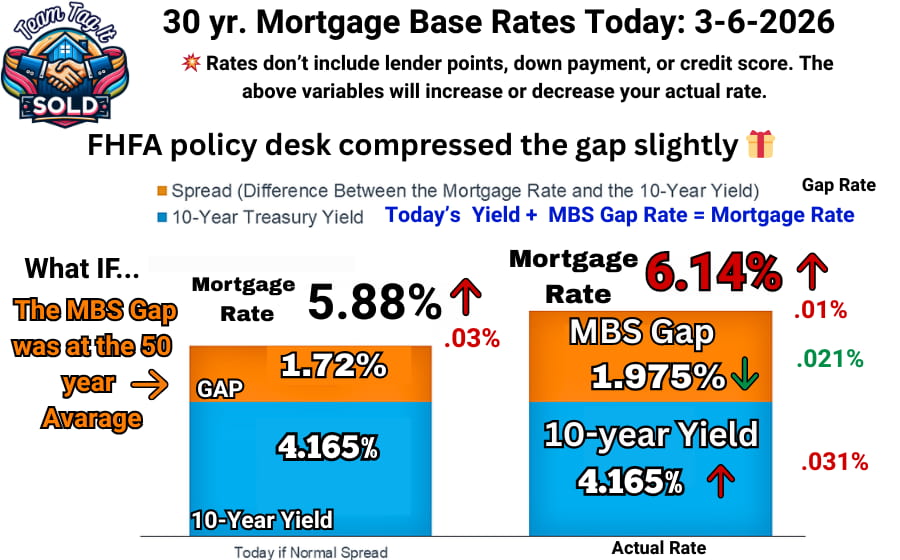

Today, the math didn’t apply. The FHFA policy desk gave you a gift 🎁 on Friday and took it away today. Wall Street has now moved Stagflation to the front of the line. This may be one of those days when the FHFA will have two rate sheets. By 1:00 today, the yield drifted down to 4.129%. Today is the perfect example of WHY you need to know the lender’s policy and rate sheet updates. There was a revision lower from 6.17% down to 6.14%

📅Tuesday:

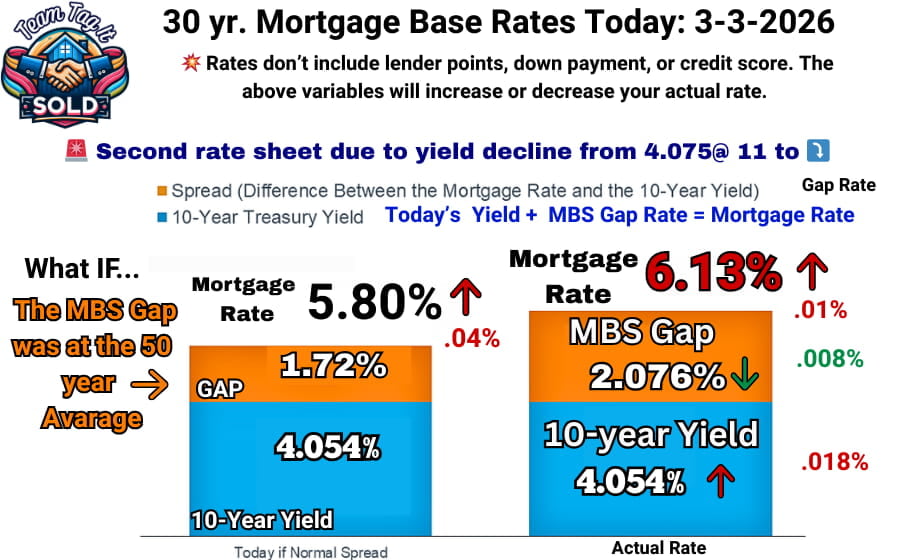

Today was one of those days when the FHFA policy desk issued a new mortgage rate sheet to lenders. The mortgage rate went up to 6.15% at noon, and at 2:30, rates were reprised down to 6.13%. This is the perfect example to watch for bond trends if they are consistently drifting down; know your lender’s policy on afternoon repricing. Sometimes it’s just better to wait until the afternoon to lock your rate. Know the TRENDS!

📅Wednesday:

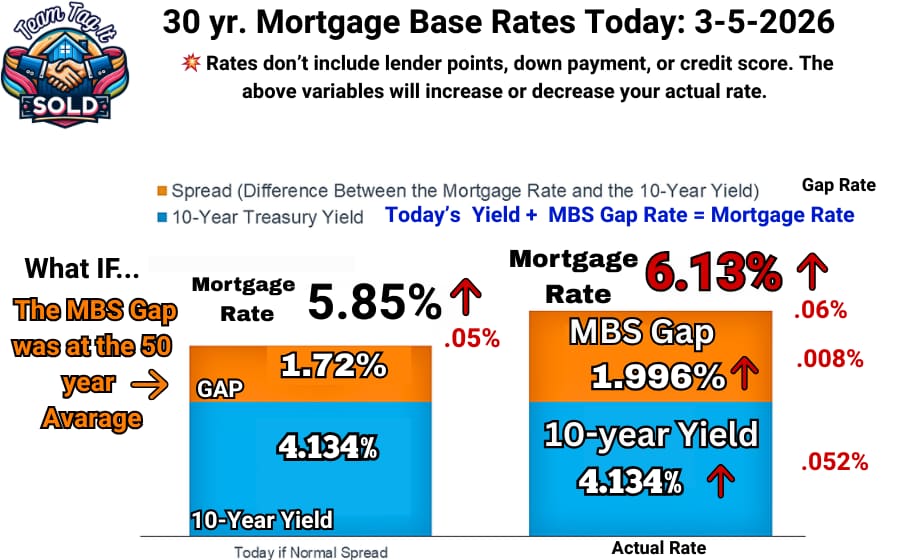

📅 Thursday: Buckle UP 🎢I din’t want

Today, we’re seeing the bond market react to the growing conflict involving Iran. For many Wall Street investors, the reaction is mostly mechanical. When global risk rises, markets begin thinking about government spending, deficits, and how the Treasury will fund them.

When that happens, investors typically demand higher yields, and that pressure can eventually filter through to mortgage rates. It doesn’t guarantee an immediate spike, but it does suggest the market could remain volatile in the near term. 🚨 Hold on — this market could get dicey next week. 📈

📅 Friday:

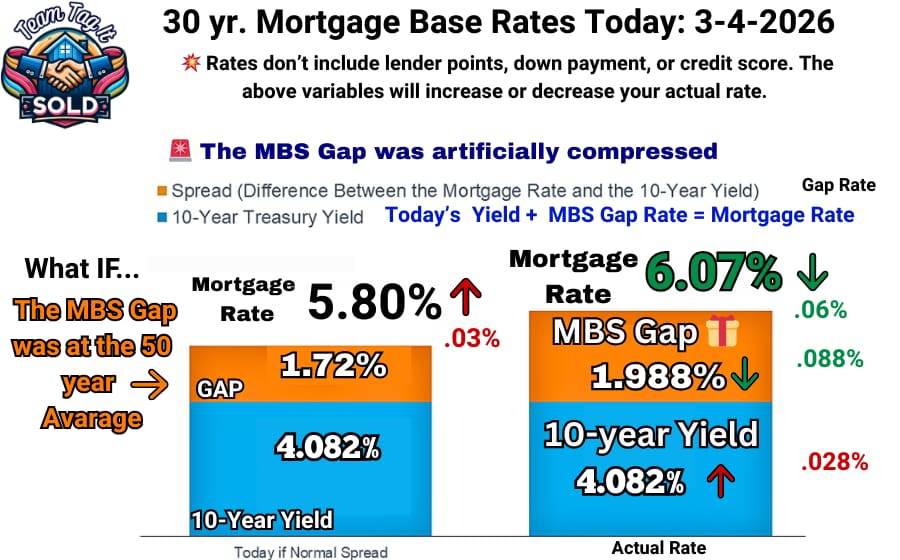

Today, the math didn’tt apply. The FHFA policy desk gave you a gift 🎁 today. Even though the UMBS 5 prices decreased, they compressed the gap anyway. Today’s main reason for the compression: unemployment rose to 4.4%, and December job openings (2 months behind due to the shutdown) plummeted. Investors are reading the job market as a definite wobble, the Iran conflict, SCOTUS overturning the high tariffs, and the Street investors are betting on an interest rate cut sooner rather than later. Now, next week could flip again and jump due to the Treasury bond auction. So the best way to describe the market is VOLATILE. 👿

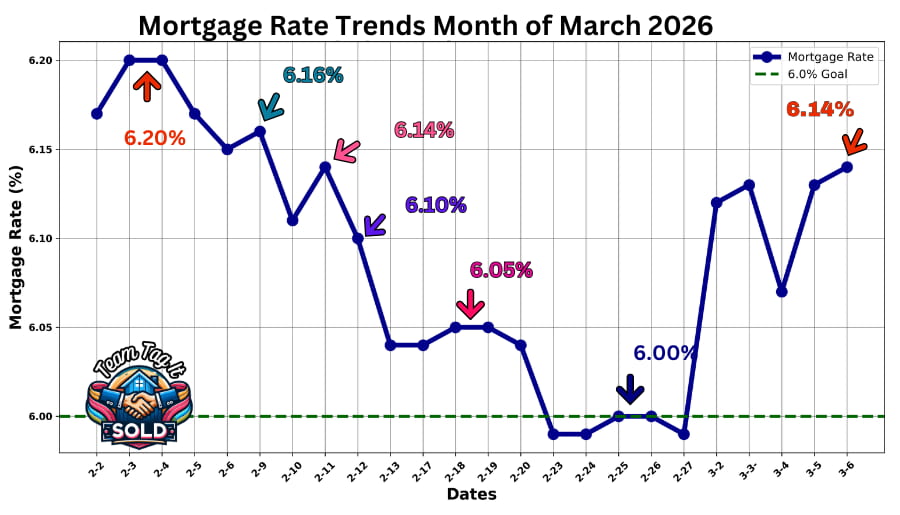

Mortgage Rates Trends

This graph shows the rise and fall of mortgage rates over the past several weeks, making it easy to see how quickly the market can shift as the bond market reacts to policy, economic data, and interest rate cuts. 📉Mortgage rates are lower, not because the economy is better or policy, but because the FHFA Policy Desk has been compressing the gap, forcing mortgage rates lower.

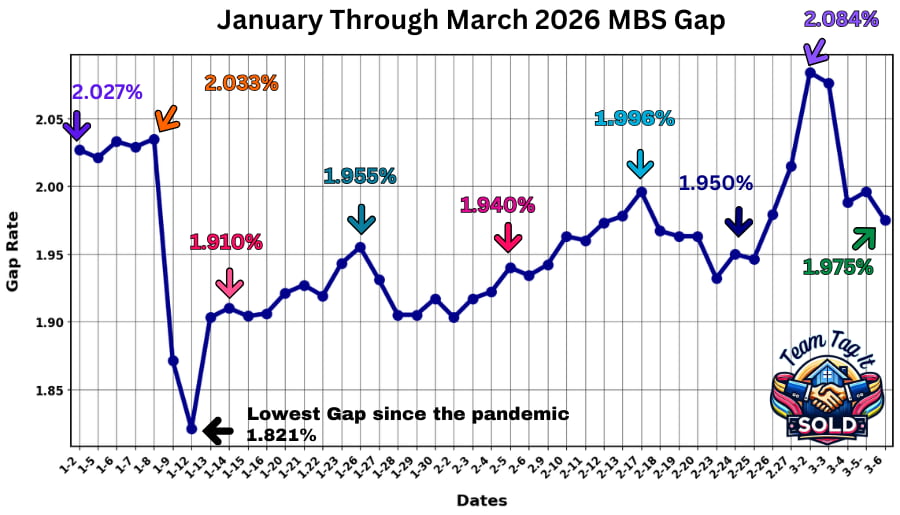

MBS Gap Trends:

This view highlights how the MBS Gap can compress like a hero 🦸 or widen like a villain 🦹, often driving mortgage rates more than the yield itself. The FHFA Fed desk compressed the gap to keep mortgage rates lower. FHFA sets policy for Freddie Mac and Fannie Mae, and most lenders use the Fed’s underwriting system for loans. This uptick is expected; the FHFA policy desk is working on balancing the GSE books.

🔎 Economic Reports that USED to affect the bond Yield and your mortgage Rate 📈📉

The bond and mortgage markets were back to basics and math. For now, these reports won’t make or break the bond market. The Data from the Bureau of Labor Statistics (BLS) and the Department of Labor (DOL) can trigger initial bond market reactions, shaping the 10-year Treasury yield, the MBS gap, and mortgage rates 📊. Reviewing these reports helps explain what the market saw before we break down why it responded—or didn’t—this week.

The key is to know which reports can trigger spikes or dips and when they are released.

The Iran conflict has now thrown the BLS reports out the window. Wall Street is more concerned about spending and the deficit than jobs and inflation. ⚠️ March 9th, 2026 Spike Alert: Bond auction has caused a spike for the past 3 months, closes March 11th.

What My Crystal Ball 🔮 is Telling Me about This Week’s Mortgage Rates – On hold for more data since the conflict broke out

⚠️ Disclaimer: This section reflects opinion and market interpretation, not a guarantee or rate prediction. Mortgage rates can change quickly in response to market conditions. Just like that, I blinked, and the mortgage market flipped from mechanical and mathematical to volatile overnight.

This Week 🚦 Stop, Slide, or Spike? Was Entering Volatility Phase

As we close out the week and move into next week, we’re seeing the bond market react to the growing conflict involving Iran. For many Wall Street investors, the reaction is mostly mechanical. When global risk rises, markets begin to think about government spending, deficits, and how the Treasury will fund them.

Over the past several months, Treasury auctions have already shown weaker demand, pushing investors to require higher coupon rates to absorb the risk. If geopolitical tensions expand or fiscal pressure increases, the Treasury may need to issue more bonds to finance the deficit.

When that happens, investors typically demand higher yields, and that pressure can eventually filter through to mortgage rates. Itdoesn’tt guarantee an immediate spike, but it does suggest the market could remain volatile in the near term.

For anyone watching mortgage rates, the takeaway is simple: the bond market may be entering a more uncertain stretch, and that can translate into choppy rate movements. 🚨Hold on — this market could get dicey.

⚠️ Caution Days for Possible Spike

The only short-term bump on the radar is the March 9–11 Treasury auction window 🗓️, where recent weak demand pushed coupon levels toward 4.175%. Still, outside that, the broader setup favors steady, math-driven rate behavior 📊.

🏡 Let’s Decode the Mortgage Market Together! 💰🔎

Wow! 🤯 There’s a lot to take in, but don’t worry—I’ve got you! Mastering this step is key before searching for your dream home. 🔑Understanding how mortgage rates are determined and how to negotiate with lenders on rates and fees can save you thousands over time. 💵 But it doesn’t have to be complicated! Let’s simplify the process together.📅 Schedule a Zoom call with me, and we’ll review the data step by step. ✨Got questions❓ or prefer a quick chat 💬Call or Text 📞 248-343-2459. I’m here to help anytime!

More Help Is 1️⃣ Click Away⤵️

Pick Your Topic by Scrolling

Today’s Mortgage Rates: What’s Driving the Change 📈📉

Mistakes Home Buyers Make Today: How to Avoid Them😨🏡

Seller Concessions: Can it be a Strategic Home-Selling Tool❓💡

Master Your Mortgage Rate: Control the Controllable💰🏡

Biggest Mistakes Home Sellers Will Make This Spring 2026😲💰

Crack the Mortgage Rate Code: Know the WHY and Save💲

When Interviewing Mortgage Lenders Ask these Questions First 📃

Buyers vs Sellers Market 🎯Tale of Two Housing Markets🏘️

How a Veteran Home Loan (VA) Can Help You Buy a Home🤩

Homeowners Association (HOA): What Buyers Need to Know📜💡

Common Real Estate Terms Explained for Metro Detroit

Mortgage Mistakes to Avoid After Applying🏡😱

Selling Your House As-Is OR Make Repairs Pros🌟 and Cons🚫

Mortgage Pre-Approval: Your Secret Power 🎓💲

Fixer-Upper Homes for Sale: See the Hidden Benefits 👀

Home Value Vs. Price Driven Approach to Home Pricing: Myth Busting Revealed 🤫⛓️💥

Learn How To Master Pricing Your Home Like a Pro 💥🏡

How to Choose the Right Buyers Agent:🏠 🛒

Metro Detroit MI Homes for Sale by City 🏘️🎯

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Thinking of Moving – How a Good Realtor Can Help Remove the Stress💯

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Real Estate Guides for Buying and Selling a Home📚

New Construction in Metro Detroit Homes for Sale🏡🔍

Discover How Your Home Equity Can Fund Your Next Move💰🚚

FHA Mortgage: What is It and How Can You Benefit 📊💰

Metro Detroit MI Housing Market Trends by City 🔎📊

Home Purchasing Power – Do You Know Your’s❓🏡

Top 3 Home Selling Questions Answered 🏡❓

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓📊

☎ +1 (248) 343-2459

© 2017–2026 Pam Sawyer @ Metro Detroit Home Experts. All Rights Reserved.

The information contained and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Pam Sawyer does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts or Pam Sawyer will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.