This post compares renting vs. buying a house in Metro Detroit 🏠📊. Learn how homeownership builds equity, benefits from home price appreciation, and offers cost stability 💰. Discover why buying a home is a smart move for long-term wealth growth in Metro Detroit 📈.

🎯 Should You Rent or Buy a House in Today’s Market?

You’ve probably asked yourself, “Is it even worth buying a house right now?” 🤔With high home prices and rising mortgage rates, renting can feel like the safer move—or maybe the only move. That feeling is totally normal. And honestly, buying a home isn’t always the right step right now. You should only buy when you’re ready, financially prepared, and the timing feels right for you.

🏠 But Here’s What You Should Know About Renting

Renting might seem easier at the moment. In fact, it could even cost you less month-to-month — for now. But here’s the catch: it could cost you more in the long run. ⏳💸A recent Bank of America survey shows 70% of future buyers are worried about what long-term renting means for their future. And they’re right to be concerned.

💡 The Long-Term Power of Homeownership

Don’t give up if owning a home in Metro Detroit feels out of reach. 🙅♀️Start with a simple plan. Set a goal. Take small steps. 📝When the time is right, buying a home in Metro Detroit can offer big financial rewards. You build equity, gain stability, and stop paying off someone else’s mortgage.

So, should you rent or buy a house? The answer depends on your situation. But one thing’s sure: owning builds your future, not your landlord’s.

💰 Owning a Home Helps Build Wealth Over Time

Owning a home isn’t just about having a roof over your head — it’s an investment in your future. 🏠✨

Every time you make a mortgage payment, you’re building something valuable: equity. 💪📈

🌟 Perks of Buying a Home ~ Your Home Equity

🚫 No long-term gain with rent – Every rent check goes to your landlord, not toward building wealth.

📈 Rent is unpredictable – Unlike a fixed-rate mortgage, your rent can increase every time your lease renews.

💸 No tax breaks – Homeowners can qualify for tax deductions, but renters miss out on those savings.

If you plan to rent for the next 5 to 10 years, consider how much money you’ll spend with zero return. 💸 Meanwhile, homeowners build equity with every payment, creating a stronger financial future. 🧱💼

📈 Home Equity Grows as Home Values Rise

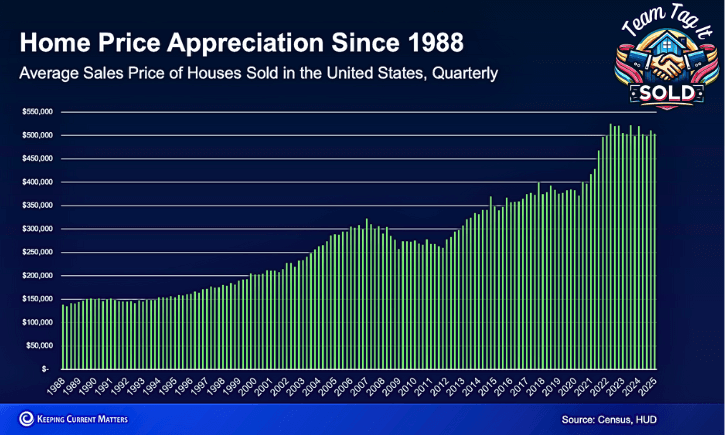

As home values rise, so does your equity when you’re a homeowner. 🏠💰

That’s the difference between what your home is worth and what you still owe.

With every mortgage payment, your equity grows. 📊 Over time, that adds to your net worth — and that’s a big deal.

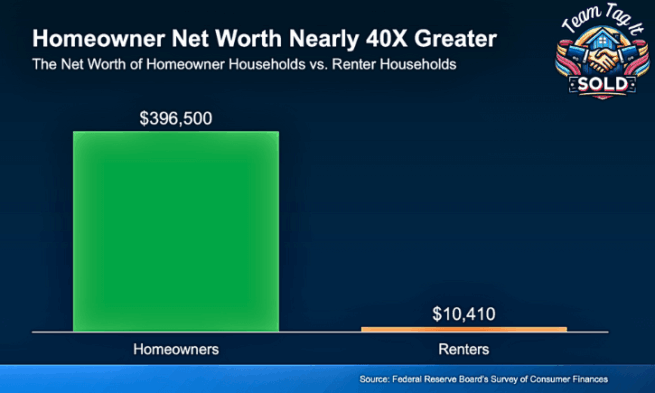

💸 The Wealth Gap: Rent or Buy a House in Metro Detroit

Right now, the average homeowner’s net worth is almost 40X greater than a renter’s. 🤯

That’s not just a number — it’s a life-changing financial difference. And the dollars in the visual below don’t lie. 👇 (see graph)So if you’re still wondering whether to rent or buy a house in Metro Detroit, remember: Equity = Wealth and ownership builds your future.

🏡 Why Owning Still Beats Renting

It’s one of the biggest reasons to consider whether to rent or buy a house in Metro Detroit. 🤔📍Forbes puts it perfectly: “While renting might seem like the less stressful option, owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.” 💬💡

Renting feels easier now, but owning a home builds equity, stability, and wealth over time. 📈💰

That’s why so many still choose to buy a house in Metro Detroit — and build a better future. 🔑🏠

📉 The Rising Costs of Renting in Metro Detroit

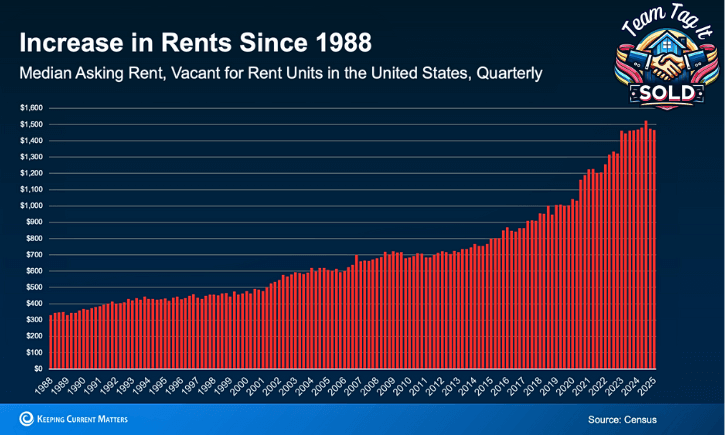

Renting might seem more affordable, especially with today’s home prices and mortgage rates. 💵 But here’s the catch: Rent almost always goes up. 📈 And unlike a fixed-rate mortgage, your rent will never stay the same forever.

According to U.S. Census data, rental prices have steadily climbed for decades.

That means you could face a rent hike every time your lease ends. 📆 Over time, those increases add up fast, making it harder to save for homeownership later on. 💸

🚫 Why Renting Can Be Financially Draining

❌ No equity buildup – Your monthly rent helps your landlord build wealth, not you.

🔁 Rent keeps increasing – Unlike a fixed mortgage, rent makes budgeting tough and unpredictable.

💸 No tax benefits – Homeowners can enjoy tax deductions. Renters? Not so much.

While renting can work if you’re not ready to buy a house in Metro Detroit, it’s smart to consider the long-term cost. The money you spend on rent is gone — but a mortgage payment helps you build equity and financial security. That’s the #1 perk of owning a home. 🔑🏡

🏡 Renting vs. Buying: The Long-Term Impact

When you look at renting vs. buying a house in Metro Detroit, the long-term benefits of homeownership stand out. 💡📍

💥 Perks of Buying a Home – Why It Can Be a Better Choice

💸 You’re investing in yourself – Every mortgage payment helps you build equity, while rent only benefits your landlord.

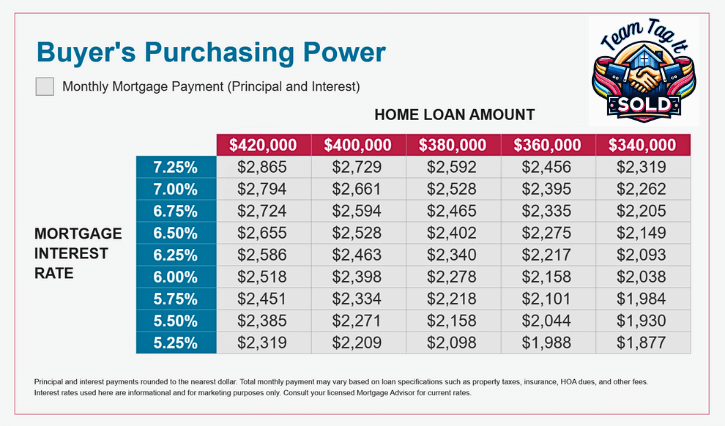

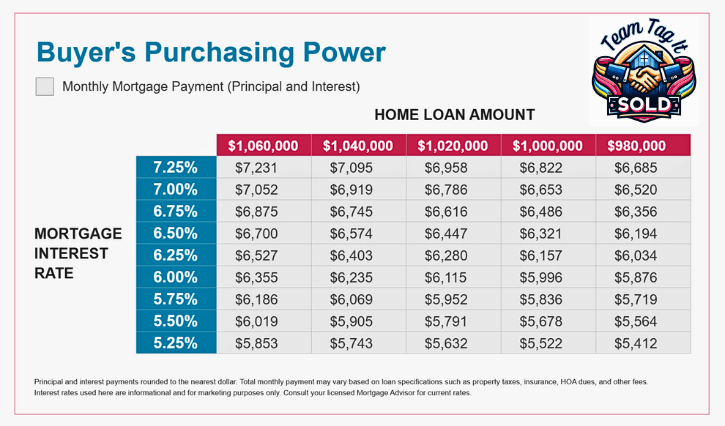

📊 Your costs stay more predictable – A fixed-rate mortgage means stable payments. But rent? It can rise every year.

🛠️ You have more freedom – Want to paint that wall or hang shelves? As a homeowner, you can! No more landlord rules. 🎨🪚

Sure, renting can be a smart move if you need flexibility or aren’t ready to commit just yet. 🧳 But if buying a home in Metro Detroit is within reach, it offers financial security, stability, and long-term growth that renting simply can’t match. 🚀📈

Now, let’s take the next step — build your budget to determine how much of a home you can afford. 💼🔍

CLICK PICTURE TO ENLARGE

🚀 Boost Your Homebuying Power

Let’s Explore Together! ⤵️

Wow! 🤯 There’s a lot to think about when buying a home, and feeling a little overwhelmed is normal. The big question is: When is the perfect time financially to jump into the market and buy your dream home? 🏡💰Let’s connect and break it all down together! We’ll review recent rate cuts and home price trends and determine the magic numbers that work for you. We can schedule a Zoom call, and I’ll share my screen to walk you through everything step by step. Would you prefer an in-person meeting or a quick phone call 📞 instead? No problem! Let’s set up a time that fits your schedule. I’m here to help you make the most of these opportunities! ✅✨

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

🔍 Final Thoughts

Renting might feel more manageable right now, but it could cost you more over time, without helping you build anything for your future. 💸⏳If homeownership feels out of reach, you’re not alone. 🙋♀️🙋♂️The first step to escaping the rental trap is simple: make a plan. 📝✨

Let’s connect, define your home goals, and walk through your best options — so you’re ready to buy a house in Metro Detroit with confidence when the time is right. 🏡📈📞 Bottom Line? Let’s turn your rent money into wealth. Call or text 248-343-2459 to get started today. 📲💬

Smart choices today build wealth tomorrow — let’s start the journey, Metro Detroit. 💼📍

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates:

Metro Detroit MI Homes for Sale by City

Crack the Mortgage Rate Code: Know the WHY and Save💲

Metro Detroit MI Sold Home Prices by City

Metro Detroit MI Housing Market Trends by City

Learn How To Master Pricing Your Home Like a Pro 💥🏡

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Metro Detroit Home Prices and Real Estate Trends by City 🏘️💲

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

Real Estate Guides for Buying and Selling a Home ~ With Video

What Is A True Real Estate Expert: How to Find One🏡💥

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.