We are going to see changes in the housing market in 2024. You will need to start weighing your Home Purchasing Power vs Mortgage Rates for Metro Detroit so you will know which option will save you money.

How Mortgage Rates Impact Your Home Buying Journey

Mortgage rates play a big part in your home-buying journey in Metro Detroit. They decide how much you pay every month for your new home. When mortgage rates go up or down, what you can afford changes, too. Let’s say you’re okay with paying $2,400 to $2,500 a month. A chart could show homes that fit this budget, even when rates change.

Unlocking Your Home Purchasing Power is Closer than You Think

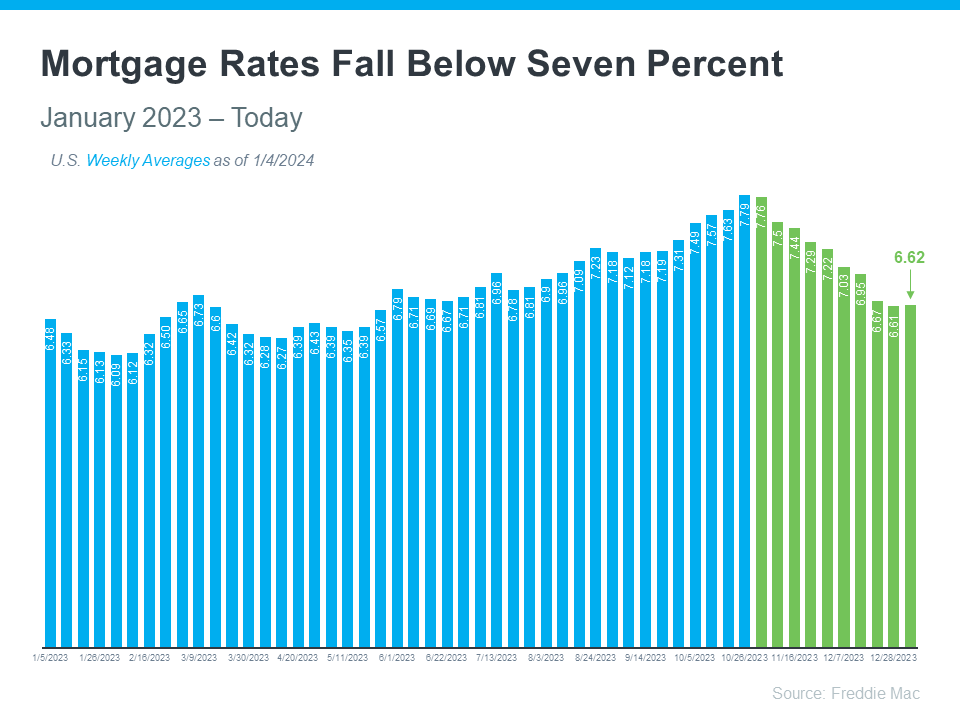

Interest rates might not drop by March, but we’re crossing our fingers for June. Knowing how mortgage rates affect your monthly costs and overall budget is key. While we haven’t seen home prices dip, the landscape is steady, thanks to a tight market. We’re not witnessing the skyrocketing prices of the Unicorn Years, yet a decrease in mortgage rates could spark a buying frenzy amid the ongoing shortage of homes in Metro Detroit. This means prices could rise again. How much? It hinges on demand, recalling the surge between 2020 and early 2021. Now’s the moment to crunch some numbers and pinpoint the optimal time to make your move. Good news: Freddie Mac reports that 30-year fixed mortgage rates have dipped below 7% since late October. Let’s navigate these waters together and maximize your home purchasing power.

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

And according to Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA):

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Here’s a bit more context on how this could help with your plans to buy a home.

Buyer Purchasing Power Principal and Interest Only (P & I)

Once you determine your monthly payment, you will need to add in your Payment Mortgage Insurance (PMI) + your homeowner insurance.

Calculating Your Taxes

This is the biggie: your property taxes in Metro Detroit. Don’t use the posted taxes because your taxes will increase based on what you paid for the house. Tax payments are calculated on June 1 and November 1, so be prepared that your payment will go up. Contact the municipality and find out their mileage rates for different school districts. Take the home sale price and divide by 2 = X. Next, take the millage rate, multiply by X, and divide by 12; that will be your payment with the following tax rate.

Your Home Buying Budget

Your formula Mortgage payment P & I + PMI + Home Owner’s Insurance + Monthly Taxes = your budget.

Home Purchasing Power Between $360k – $440k

Home Purchasing Power Between $445k – $525k

Home Purchasing Power Between $530k – $610k

Home Purchasing Power Between $620k – $700k

Navigating Mortgage Rates

As you can see, even small rate changes can affect your budget and the loan amount you can afford. Now, you need to take the next step and understand how mortgage rates are determined. Your first clue is that they are not determined by The Federal Reserve raising Interest Rates. Find out how you can learn to predict where mortgage rates are heading next before you start shopping for a home in Metro Detroit.

Get Help from Reliable Experts To Understand Your Budget and Plan Ahead

When buying a home in Metro Detroit, getting guidance from a local real estate agent and a trusted lender is essential. They can help you explore different mortgage options, understand what makes mortgage rates go up or down, and how those changes impact you.

By looking at the numbers and the latest data together and adjusting your strategy based on today’s rates, you’ll be better prepared and ready to buy a home.

Bottom Line

If you’re looking to buy a home in Metro Detroit, you should know the recent downward trend in mortgage rates is good news for your move. Let’s connect and plan your next steps.

More Help Is 1️⃣ Click Away⤵️

Contact me with any Questions 🤩 Testimonials Scroll Down…👍