Thinking about buying a home but worried about your student loans? 😟 Good news—homeownership is still possible, especially in Metro Detroit! 🏡✨ This guide breaks it down with tips, facts, and next steps to help you confidently move forward. 💪🔑

🎓 Don’t Let Student Loans Stop You from Owning a Home in Metro Detroit 🏡

Did you know? A recent study found that 72% of people with student loans believe their debt will delay buying a home. 😟 Maybe you’re one of them. You might be thinking:

☑️ “Do I have to wait until my student loans are paid off before I can buy a house?”

✅ Or, “Can I still get a home loan if I have student loan debt?”

These are smart questions. 💡 And guess what? You’re not alone. Many first-time buyers feel the same way when starting this journey.

But here’s the truth…

You may not have to wait. 🕒 You could be putting your dream of homeownership on hold for no reason at all. Let’s break it down and see how owning a home—even with student loans—might still be within reach, especially if you’re buying in Metro Detroit. 🏘️✨

💰 Can You Qualify for a Home Loan if You Have Student Loans? 🏠

Let’s keep it simple. You’re probably asking: “Can I still buy my first home if I have student debt?” 🤔Great question—and the answer might surprise you. 🎉 Here’s what Yahoo Finance says:

“. . . Student loans don’t have to get in your way when it comes to becoming a homeowner. With the right approach and an understanding of how debt impacts your home-buying options, buying a house when you have student loans is possible.”

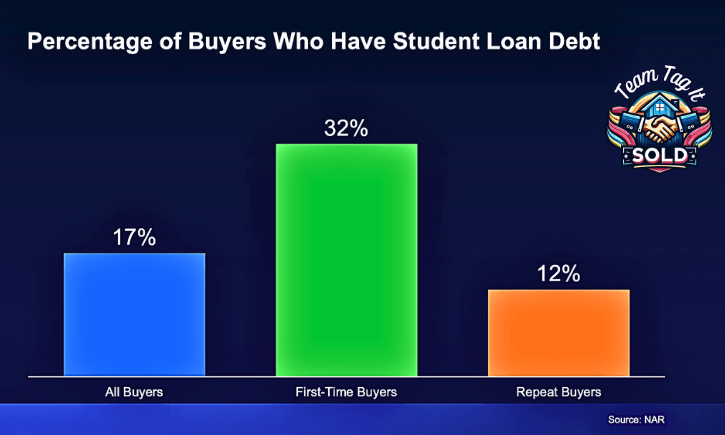

Yep, you read that right. ✅ Having student debt doesn’t mean your dream of homeownership is over. In fact, the numbers prove it! 📊According to the National Association of Realtors (NAR), 32% of first-time homebuyers still had student loan debt when they bought their homes. 🏡

So if you’re looking to buy a home in Metro Detroit, don’t count yourself out. 🙌

There’s a good chance you can qualify, even with student loans on your plate. Let’s talk about how to make it happen. 💬💼

💡 Yes, You Can Buy a Home with Student Loans — Even as a First-Time Buyer 🏡🎓

Everyone’s situation is a little different—but guess what? Your dream of owning a home may be closer than you think. 🙌Lots of people with student loans have already bought their first homes in Metro Detroit. If they can do it, why not you? 💪Let that give you some peace of mind—it’s definitely possible.

📊 Just so you know, the median student loan debt is about $30,000.

Sounds like a lot? Sure. But it hasn’t stopped many others from getting the keys to their first home. 🔑🏠And here’s a golden nugget from Chase Bank:

“It’s important to note that student loans usually don’t affect your ability to qualify for a mortgage any differently than other types of debt you have on your credit report, such as credit card debt and auto loans.”

Translation? 💬

If your income is steady and your finances are in decent shape, you’ve got options! 💼🎯 Living with student debt doesn’t mean hitting pause on homeownership. You can still move forward, especially if you’re buying in Metro Detroit. Let’s build a plan that works for you. I’ve got your back every step of the way. 🤝😊

Need Help?

Are you dreaming of buying a home in Metro Detroit 🏡? Tired of struggling to save for a down payment? The good news 🥳, you may not need as much of a down payment as you think. Did you know there are home down payment assistance programs? Discover what help is available and boost your homebuying power. 💪

How to Predict Mortgage Rates

Learn the Formula

Looking to save money 💲on your mortgage? Your first stop should be to learn how to crack today’s mortgage rates. I’ll share with you the formula used by lenders 🏦 and what economic trends affect mortgage rates to plummet 📉 or skyrocket.🚀 If you understand the WHY and put the WHAT aside, you’ll be a pro 🏆 in no time when it comes to negotiating your loan. 🎉

🚀 Boost Your Homebuying Power

Let’s Explore Together! ⤵️

Wow! 🤯 There’s a lot to think about when buying a home, and feeling a little overwhelmed is normal. The big question is: When is the perfect time financially to jump into the market and buy your dream home? 🏡💰Let’s connect and break it all down together! We’ll review recent rate cuts and home price trends and determine the magic numbers that work for you. We can schedule a Zoom call, and I’ll share my screen to walk you through everything step by step. Would you prefer an in-person meeting or a quick phone call 📞 instead? No problem! Let’s set up a time that fits your schedule. I’m here to help you make the most of these opportunities! ✅✨

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

✅ Bottom Line: You Can Still Buy a Home with Student Loans 🏡🎓

Having student loans doesn’t mean you must say goodbye to your dream home. 🚫🏠

It just means you need the right plan—and the right team by your side. 💡Before you count yourself out, talk with a trusted lender. 💬

They can help you understand what you really qualify for and how close you are to becoming a homeowner. Especially if you’re buying in Metro Detroit, flexible options, smart strategies, and programs are designed with you in mind. 🏙️💰

✨ Ready to Take the First Step? 🗝️

Let’s make your homeownership dream a reality. 📞 Contact me today—I’m here to help every step of the way! Your perfect place in Metro Detroit is waiting. 🏠💖

📰 Real Estate Insider 🎯 — Stay current with our expert analysis of economic trends, home prices, and market shifts, offering you valuable tips and strategies. Whether you’re buying or selling, you’ll have the insight to move with confidence.

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: What’s Driving the Change 📢 with Video

Crack the Mortgage Rate Code: Know the WHY and Save💲

Metro Detroit Housing Market Trends by City ~ December 2025

Metro Detroit Michigan Homes for Sale Search by City- LIVE MLS

Metro Detroit Sold Home Prices Search by City: Live Data

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Metro Detroit Home Prices and Real Estate Trends by City 🏘️💲

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

Real Estate Guides for Buying and Selling a Home ~ With Video

What Is A True Real Estate Expert: How to Find One🏡💥

Selling Your House As-Is OR Make Repairs Pros🌟 and Cons🚫

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.