📌 Thinking of holding onto your 3% mortgage rate? We explore how home prices in Metro Detroit 🏡 are rising and what waiting could mean for your future bottom line. 💬 Learn how to run the numbers, plan your move, and make the smartest choice for your life, not just your interest rate. 🔍

3% Mortgage Rate vs. Real Life: Is It Worth Staying? 🏡💭

You’re probably holding on tight if you’ve got a 3% mortgage rate. 💸 Even if you’ve thought about moving, that little voice in your head says, “Why would I give that up?” 🤔But here’s the thing…You might be putting your real needs on the back burner without realizing it. Most people don’t move because of interest rates — they move because life changes. 🎯So, let’s flip the script:

👉 What are the chances you’ll still be in your current home 5 years from now?

🚗 Is your commute draining your time and energy?

👶 Are you thinking about adding to your family soon?

🎓 Do you have grown kids getting ready to move out?

😩 Are you running out of space and patience?

⏳ Is retirement around the corner, and you’re craving less upkeep?

🔮Take a second and ask—does your current home still fit the future you?

If life’s not changing and you love where you live, great — staying may be the right move. ❤️But if change is even on the horizon, it’s smart to start planning your next move now, especially with rising home prices in Metro Detroit. 📈Because even waiting 1 or 2 years could cost you thousands more for the same home. 💰

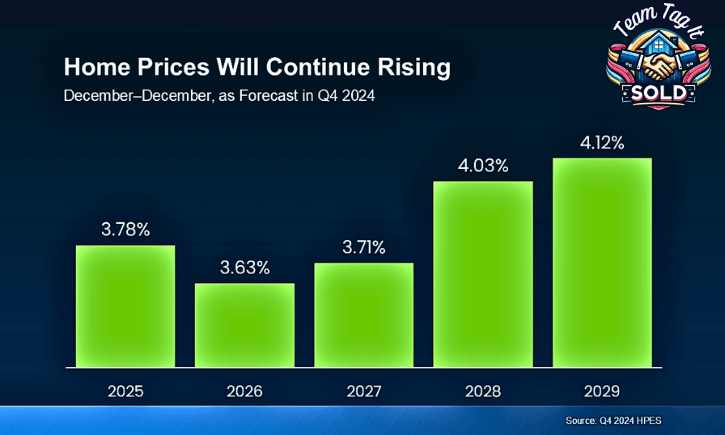

📊 What the Experts Say About Home Prices Over the Next 5 Years

Fannie Mae surveys over 100 housing market experts each quarter on where home prices are headed. 🔍 The latest results? Home prices are expected to rise every year through 2029. 🗓️ That’s a big deal — especially if you’re sitting on the fence.

📈 What Waiting Could Cost You

While the projections don’t scream huge jumps, home prices are still rising, year after year. 🏡Sure, some markets may see slower growth or small dips in the short term. But zoom out. 🔍In the long run, prices almost always go up. Over the course of 5 years, even small increases can snowball. 💥

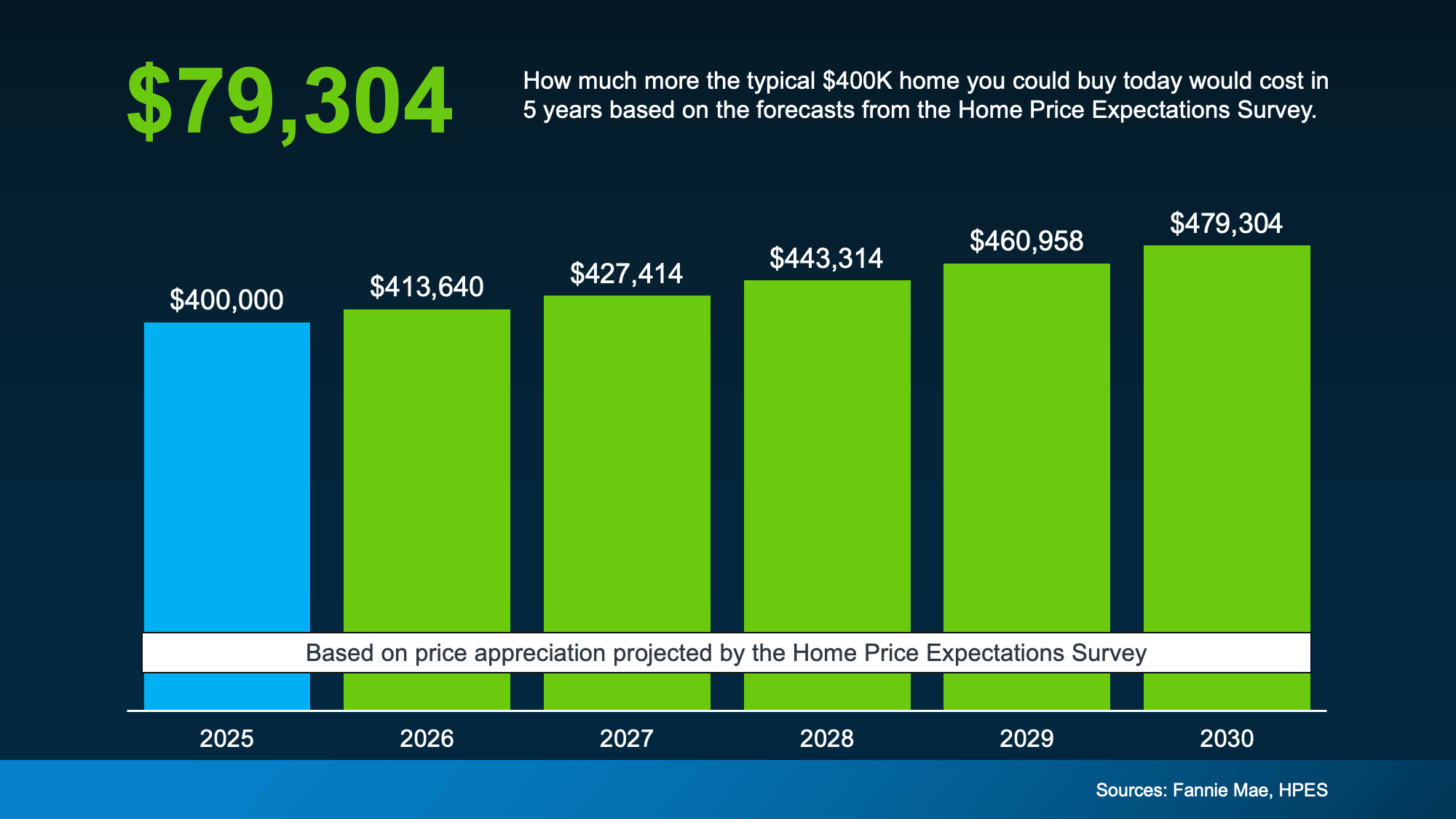

Here’s a quick example:

Let’s say you plan to buy a home for around $400,000. 💰

If you wait just 5 years, experts say it could cost nearly $80,000 more based on projected price trends. 😲 (see graph below)

Even with 3% mortgage rates locked in now, waiting too long could cost you big, especially in Metro Detroit, where prices are already trending up. 📍If you have a home to sell, think about how much equity you’ll put down on your new home and still have enough to buy down your mortgage rate. 🥳 The bottom line ~ which home is going to give you the most joy?

Macomb and Oakland County Home Prices

Median Home Sales Price

Average Home Sales Price

⏳ The Cost of Waiting Just Keeps Climbing

That means the longer you wait, the more your future home could cost you, plain and simple. 💸📈If you know a move is coming, now’s the time to think about your timeline. 🧭You don’t have to move today, but it’s smart to weigh your options early. 🎯

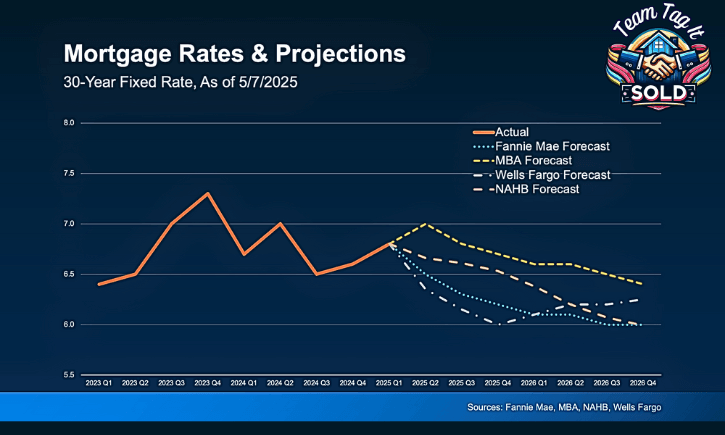

Why? Because even if mortgage rates drop, it won’t be by much. 📉And those dreaming of 3% mortgage rates making a comeback, Experts agree—it’s not happening. 🙅♀️ (see graph below) So, if you’re in Metro Detroit and thinking about moving, now’s the time to start the conversation. 🏡📲Waiting could cost you way more than you think. 💬💰

🤔 It’s Not If You Should Move — It’s When

So the real question isn’t, “Why would I move?” It’s actually, “When should I?” 🗓️🏡 Because once you see the numbers, waiting might cost more than you think. 💸If you’re planning your next step in Metro Detroit, now is the time to discuss your options. 📍

🏡📉 Are mortgage rate dips really a good time to buy? Home prices could spike due to bidding wars as buyers flood the market. Waiting could be a costly mistake. In this post, we’ll break down how mortgage rates, home prices, and market trends impact your buying power so you can make a smart move before the competition heats up. 🔥 Whether you’re looking to buy now or strategize for later, this guide will help you stay ahead of the game! 🚀💰

Let’s talk about the Elephant in the Room ~ Mortgage Rates

🔍 Learn the New Rules: Predict 🔮 Where Mortgage Rates Are Heading 📈📉Trying to figure out what impacts mortgage rates in Metro Detroit? You’re not alone—it feels like they change every time you blink. 😅 But there’s a simple formula that helps make sense of it all:

👉 10-Year Treasury Yield + MBS (Mortgage-Backed Securities) Price Gap = Mortgage Rates

Every morning, we kick off the day with a quick market snapshot 📊 to get a pulse on where mortgage rates might be headed. But the real question isn’t just WHAT’s happening—it’s WHY these rates change. That’s where I come in!🙋♀️ I’ll break it all down in a way that actually makes sense—no confusing jargon, just straight-up insights 👀 on why mortgage rates rise 📈 or fall

You’ll get a behind-the-scenes look at the formula lenders use to set rates, plus expert tips on how you can start predicting where mortgage rates are heading next. 🔥 Why This Matters? Understanding how mortgage rates work can save you thousands over the life of your loan 💰. Locking in the right rate at the right time ⏳ can make all the difference.🚀 Ready to take control of your mortgage future? Let’s get started! ⤵️

Learn What Affects Rates

Looking to save money on your mortgage? Your first stop should be to learn how to crack today’s mortgage rates. I’ll share with you the formula used by lenders 🏦 and explain how economic trends affect mortgage rates, causing them to plummet 📉 or skyrocket.🚀 If you understand the WHY and put the WHAT aside, you’ll be a pro 🏆 in no time when it comes to negotiating your loan. 🎉

Confidently Navigate Home 🏡Selling!

Let’s Connect⤵️

Wow! 😮 Selling your Home is a big deal, and there’s much to consider! But don’t worry, I’m here to help. Let’s schedule a Zoom call to review everything together. Whether you have questions, need help understanding the data, or want to determine your home equity, I’ll guide you through it step by step. I’ll even share my screen so you get a clear, real-time look at market insights. That way, you can make smart, confident decisions and get the best price for your Home! 🏡💰Got questions❓ or prefer a quick chat 💬Call or Text 📞 248-343-2459.I’m here to help anytime! 🆘 Stay current and ahead of your future competition by visiting the website for updated articles 3 to 4 times a week. Mortgage Rates are updated daily.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

💬 Final Thoughts & Let’s Talk Strategy

Keeping your low mortgage rate is smart — until it starts holding you back. 🚪💸If a move is even on the horizon, now’s the time to run the numbers and build your game plan. 📊🧠 You don’t have to decide today, but gaining clarity now puts you in control later. 🎯Want to see how this plays out for a different price point or area in Metro Detroit?📲 Let’s run the math together — no pressure, just real numbers.

👉 Call or text me at [248-343-2459], and let’s figure out what makes the most sense for your future.

Because it’s not just about chasing 3% mortgage rates — it’s about making smart moves that work for your life. 🏡💬

💡 Curious what your home is worth? Visit Top 3 Home Selling Questions Answered, where I’ll walk you through Steps 1 & 2 of the Price-Driven Approach. Knowing your home’s value is the first step toward maximizing your equity! 💰📈 Let’s kickstart your homebuying journey today! 🚀🏡

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Slight Dip Alert 📢

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Metro Detroit Sold Home Prices by City: Live MLS Data🥳🏘️

Should You Rent or Sell Your House❓🏡

How to Market Your House for More Money💲🏡🎥

How to Tell if Your House is Priced Right? Let’s Find Out 💲🤯

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

Your Home Didn’t Sell: Let’s Fix That! 🔄🏡

3% Mortgage Rate vs. Real Life: Is It Worth Staying Put❓🏡

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

More Homes for Sale: A Warining⚠️ or Opportunity💡

Your Home Equity Gains Are Growing: What’s Your Home Worth Now? 📊💲

Mortgage Rate Dips 📉 vs. Home Price Spikes📈Which Matters❓

Mortgage Mistakes to Avoid After Applying🏡😱

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.