🏡 Thinking About Buying a Home in Metro Detroit? 🤔💰 Home prices are still rising, and waiting could cost you more in the long run. This post breaks down what’s happening in the market, how mortgage rates and home prices impact affordability, and why having a plan now can help you make the best move. Whether you’re ready to buy or just exploring your options, this guide gives you the tools to make a smart, confident decision! 🚀📊

🏡 Should You Buy a Home Now in Metro Detroit?

Are you debating whether to buy a home in Metro Detroit now or wait? 🤔 You’re not alone—many buyers are facing the same decision. While your personal situation plays a key role, another factor to consider is being in the market instead of waiting for the “perfect” time. Let me explain. ⏳

⏳ The Downside of Trying to Time the Market

Trying to predict the perfect moment to buy is risky—Metro Detroit’s housing market can shift unexpectedly. 📈 Last year, many experts forecasted that mortgage rates would drop in 2024, but inflation remains stubborn, keeping rates higher than expected.

💡 Here’s what you should know:

✅ Banks don’t set mortgage rates—they’re influenced by Wall Street’s supply and demand for bonds and securities.

✅ You CAN negotiate with a lender to secure a better rate—most buyers don’t realize this!

✅ I’ll show you how to predict mortgage rate trends and when to lock in before rates spike. 🔍

🔽 Ready to dive deeper? Keep reading to gain an edge in this market! 🔽

🔍 Learn the New Rules: Predict Where Mortgage Rates Are Heading 📈📉

Trying to figure out what impacts mortgage rates in Metro Detroit? You’re not alone—it feels like they change every time you blink. 😅 But there’s a simple formula that helps make sense of it all:

👉 10-Year Treasury Yield + MBS (Mortgage-Backed Securities) Price Gap = Mortgage Rates

Every morning, we kick off the day with a quick market snapshot 📊 to get a pulse on where mortgage rates might be headed. But the real question isn’t just what’s happening—it’s why these rates change.

That’s where I come in! I’ll break it all down in a way that actually makes sense—no confusing jargon, just straight-up insights on why mortgage rates rise or fall. You’ll get a behind-the-scenes look at the formula lenders use to set rates, plus expert tips on how you can start predicting where mortgage rates are heading next.

🔥 Why This Matters

Understanding how mortgage rates work can save you thousands over the life of your loan 💰. Locking the right rate at the right time can make all the difference.🚀 Ready to take control of your mortgage future? Let’s get started! ⤵️

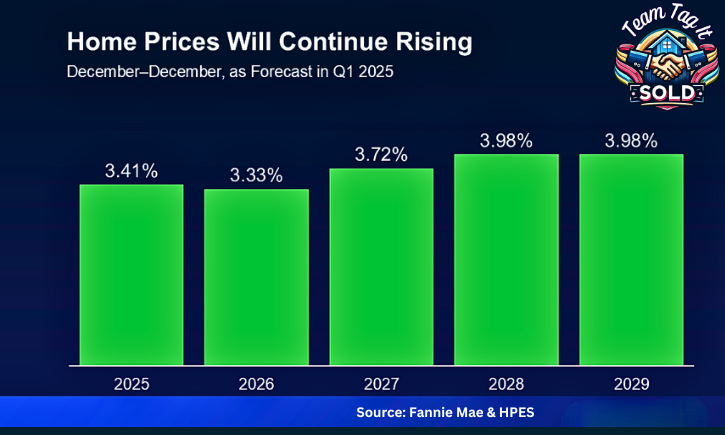

📈 Home Prices Are Still Going Up – But at a More Normal Pace 🏡

If you’re waiting for home prices to crash, you might be waiting a long time. ❌ The truth is that home prices are still rising, just not as fast as before.

According to the Home Price Expectations Survey from Fannie Mae, experts predict that prices will continue to climb through at least 2029. While we’re not seeing those huge spikes from the past few years, home values are still expected to grow 3-4% per year, which is a normal, healthy pace.

💡 Why is this good news?

☑️ A steady market is better for both buyers and sellers.

✅It keeps home values stable—no sudden drops or wild jumps.

☑️ If you’re thinking, considering waiting for prices to drop might not be the best move.

So, if you’re on the fence about buying a home, now might be the right time to make your move! 🚚 Check out the data below to see what the experts are saying! ⤵️

Home Prices for Macomb and Oakland County

Median Home Price

Average Home Prices

📢 What This Means for You

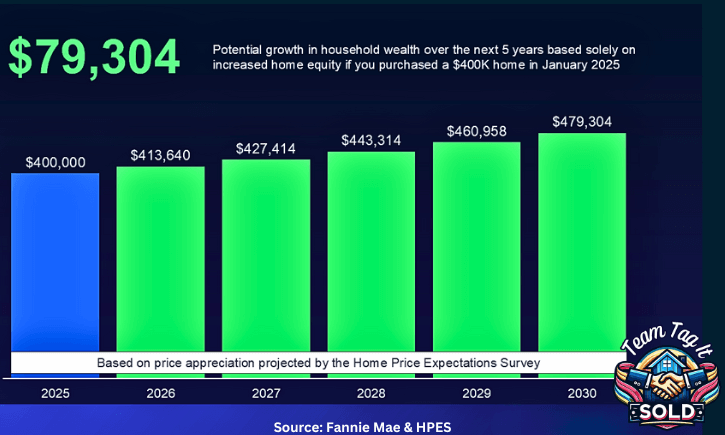

Are you thinking about waiting for lower home prices or better mortgage rates? That makes sense—it’s a big decision! But here’s something to consider: waiting could cost you more in the long run.

☑️ 🏡 Home prices are still rising – and history shows they tend to keep going up. The longer you wait, the more expensive that home might be when you’re finally ready to buy.

✅ 📉 Mortgage rates are unpredictable, and while they may go down, home values could go up at the same time. A higher purchase price might cancel your savings, even if you get a lower rate.

☑️ 💰 Buying sooner helps build wealth over time. As home prices climb, so does equity—the value of what you own. Buying now means you start growing your investment immediately instead of watching prices rise from the sidelines.

For example, if you buy a $400,000 home today, experts predict it could be worth $83,000 more in just five years. That’s a pretty big jump!

Of course, the right timing depends on your personal situation. But if you’re thinking about making a move, it might be worth looking at the numbers to see what makes the most sense for you. 🚀 (Check out the graph below! ⤵️)

🤔 Why Haven’t Prices Dropped? It All Comes Down to Supply and Demand

If you’re hoping for home prices to drop, the truth is that might not happen anytime soon. Even though there are more homes for sale now than this time last year—or even last month—there still aren’t enough to keep up with buyer demand. And when more people want homes than are available, prices keep increasing.

🔍 As Redfin puts it: “Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

🏡 So what does this mean for Metro Detroit?📊 Some areas might slow down slightly, but not a significant price drop? 📈 Prices are still going up at a slower, steadier pace.💰 Even with more homes for sale, demand is still strong, which is keeping prices from falling.

If you’re wondering, “Should I wait or buy now?” there’s no perfect answer. But if prices keep creeping up, waiting could mean paying more down the road. Either way, it’s watching what’s happening so you can make the right move when the time feels right for you. 🚪💭

🤔 Curious to see the latest trends? Check out the data below! ⤵️

💡 Here’s Something to Consider If You’re Able to Buy Now

If you’re holding off on buying because of mortgage rates, that totally makes sense. But have you thought about home prices? 🏡📈

Prices in Metro Detroit are still going up, just not as fast as before. Even small increases can add up over time, making homes more expensive the longer you wait. And while mortgage rates affect your monthly payment, so does home equity—the value your home gains as prices rise. The sooner you buy, the sooner you start building wealth instead of watching prices climb.

Trying to time the market is tricky. Even if rates drop, rising home prices could cancel out any savings. So if you’re ready and able to buy now, it’s worth considering whether waiting will help or make your future home more expensive.

The best time to buy is when it feels right for you, but knowing how the market works can help you make a smart move. 🚀

Home Prices vs. Mortgage Rates

📊 Let’s Look at the Numbers! 💡Before making a move, it’s smart to check the numbers and see where the market is heading. That’s why I’ve put together a simple plan to help you figure out the best time to buy your next home. 🏡✨

I’ve also put together a helpful graph to make things easier. You can compare two scenarios: lower home prices with higher mortgage rates vs. higher home prices with lower mortgage rates. Which one fits your monthly budget better? 🤔

Looking closer now can help you stay ahead before the market shifts again. If you’re thinking about buying, having a plan in place could make all the difference when the right opportunity comes along. Knowledge is power, and the more you know, the better you’ll be at buying confidently. Let’s find out when the timing is right for you! 🚀🔎

🚀 Boost Your Homebuying Power

Let’s Explore Together! ⤵️

Wow! 🤯 There’s a lot to think about when buying a home, and feeling a little overwhelmed is normal. The big question is: When is the perfect time financially to jump into the market and buy your dream home? 🏡💰Let’s connect and break it all down together! We’ll review recent rate cuts and home price trends and determine the magic numbers that work for you. We can schedule a Zoom call, and I’ll share my screen to walk you through everything step by step. Would you prefer an in-person meeting or a quick phone call 📞 instead? No problem! Let’s set up a time that fits your schedule. I’m here to help you make the most of these opportunities! ✅✨

💡 Need to sell first? Check out the Top 3 Home Selling Questions Answered. I’ll guide you through Steps 1 & 2 of the Price-Driven Approach, so you’ll know exactly what your home is worth and how much equity you can gain! 💰📈Let’s get started on your home buying journey today! 🎉🔑

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

Final Thoughts: Time in the Market Beats Timing the Market

If you’re debating whether to buy now or wait, here’s something to keep in mind: real estate rewards those who get in the market, not those who try to time it perfectly. 🏡⏳

Sure, today’s housing market has its challenges, but there are ways to make it work:

🔹Explore different neighborhoods – you might find hidden gems! 🏙️

🔸 1st-time Home Buyers: – Consider condos or townhomes a great way to build equity without stretching your budget. 🏘️

🔹 Ask your lender about creative financing options – there’s more flexibility than you think! 💰

🔸 1st-Time Homebuyers – Look into down payment assistance programs – extra support could make a big difference. 💡

The key is to make a move when it makes sense for you instead of waiting for a “perfect” moment that may never come. Curious about what’s happening with home prices in Metro Detroit? Whether you’re ready to buy now or just exploring your options, having a plan can set you up for success.

📌 This website is packed with tips, tools, and market insights to help you make an informed decision. And if you’re ready to take the next step toward building equity and securing your future, let’s connect and make it happen! 🚀🔑 ⤵️

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Dip Alert📢

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

More Homes for Sale: A Warining⚠️ or Opportunity💡

Should You Rent or Buy a House in Today’s Market💲📊

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

Should You Buy a Home Now in Metro Detroit or Wait❓🏡

Home Purchasing Power – Do You Know Your’s❓🏡

How Mortgage Rate Cuts Affect Your Home-Buying Power💪

Will a Recession Crash the Housing Market in 2025🌩️🏠

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.