🏡 Will a Recession Crash the Housing Market in 2025 in Metro Detroit? The headlines say “maybe,” but the data tells a deeper story. 📉 From home prices to mortgage rate hacks and even unemployment trends, this guide breaks it all down—plus gives you direct access to sold home data and a free home valuation so you can make a smart move, not a risky one 💡💰.

Will a Recession Crash the Housing Market in Metro Detroit? 🏠📉

Recession fears are popping up everywhere lately in Metro Detroit. 📺 Turn on the news, and you’ll hear experts buzzing about a possible economic downturn. So it’s no surprise that many home buyers and sellers are asking the big question: Will a recession crash the housing market in Metro Detroit?

Before we hit the panic button 🚨, let’s look back at the bigger picture. 📊 History leaves clues—and when we look at how the housing market performed during past recessions (back to the 1980s!), we can spot some helpful trends. These insights can help you make smart, confident decisions in today’s market, without the guesswork. 💡✅

Recession Doesn’t Mean Home Prices Will Fall 🏡📈

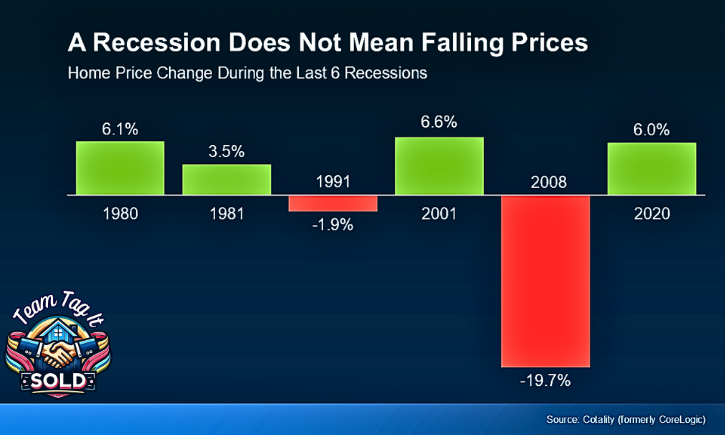

Many worry that if a recession hits, home prices in Metro Detroit will crash like they did in 2008. But here’s the thing: 2008 wasn’t normal. 🚫 That crash was a rare event caused by risky lending and a weak economy. It’s the only time we’ve seen such a big drop in home values. 📉

Home prices in Metro Detroit usually stay steady or even rise during a recession. Sounds surprising, right? But the data backs it up. ✅ According to CoreLogic, home prices increased in 4 of the last six recessions. 🔼

So if you’re wondering, “Will a recession crash the housing market in Metro Detroit?” — the past says it’s not likely. 📊💪

Are You Curious About Home Prices in Your City?

Macomb and Oakland County Sales Price ~ Median and Average

Median Sales Price

Average Sales Price

Macomb County Home Prices and Trends by City

[sp_wpcarousel id=”49804″]

Oakland County Home Prices and Trends by City

[sp_wpcarousel id=”49864″]

Find Out What Your Home is Worth Like a Pro 💰

🔢 Step #1 ~ The Price-Driven Approach 💡

Not long ago, the only way to price your home in Metro Detroit was to hire a real estate agent 🧑💼. But now? That’s changed 🙌. You can directly analyze the local market and compare similar homes on my website 💻🏘️. That means no more second-guessing. You’ll have the tools and data to avoid overpricing your house from the start 📊.

✅ #1 is the price-driven approach. It focuses on real numbers—what homes like yours sell for today’s market. And you’re wondering, “What’s the difference between price-driven and value-driven pricing?” This blog post explains it all 🧠.

Still unsure where your price range should begin?

Just enter your address, and you’ll receive an instant report delivered straight to you 📬—designed to help you make confident, data-backed decisions. This step is the starting point range when you start your Multiple Listing Service (MLS) search by price.💲

🔢 #2 Step ~ Compare Your House to Sold Properties

Now that you have your report and a general price range, it’s time to dig deeper! 🏡👉 Scroll through the carousel and find your City, then tap into my MLS system using a special bridge I built just for you. 🚀You’ll get access to real sold prices — not rough estimates — so you can see exactly what buyers are paying in today’s market. 💵 I’ve also included a quick how-to video that shows you how to search like a Realtor. 🎥✨

Step #2 is about your home’s upgrades, condition, and unique features—the things that set it apart 🛠️✨. This two-step approach helps you hit the sweet spot that grabs buyers’ attention and increases your chance of getting multiple offers 📈💌. Let’s get started! ⤵️

Macomb County Sold Home Prices

[sp_wpcarousel id= “51560”]

Oakland County Sold Home Prices

[sp_wpcarousel id= “12297”]

What a Recession Means for Mortgage Rates 🏦📉

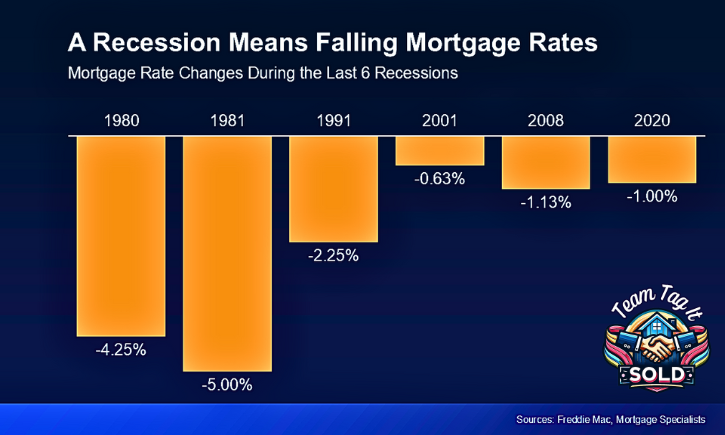

When the economy slows down, mortgage rates often drop. The Federal Reserve usually cuts interest rates to boost spending and keep things moving. 💸 And when interest rates fall, it often leads to lower mortgage rates, giving homebuyers a better shot at affording more homes. 🏠✅

Right now, things are a bit unpredictable. 📈📉 Mortgage rates have been bouncing around, mostly because of high inflation and now tariffs. Lately, in April and May, the rates have been between 6.8*% % and 6.9*% %, which makes it harder for some buyers to jump in. 😬

But here’s the interesting part: If we do hit a recession, there’s a good chance rates could go lower again. ⬇️ Don’t expect those sweet 3% rates we saw during the pandemic—those were emergency moves by the Fed 🏦and won’t return anytime soon. 🚫

Want some perspective? 👀⤴️

In 1983, mortgage rates hit a sky-high of 16.06%. 😲 It wasn’t until the Great Recession in 2008 that they dropped below 6%, and it was not until 2012 that they finally dipped to 3.88% for the first time.

So, will a recession crash the housing market in Metro Detroit? Probably not. But if inflation cools, it could bring us something we do want: more affordable mortgage rates. 💥 We might see them settle into the high 5% range sooner than expected. 🤞🏽📉

How to Predict Mortgage Rates 💲

Learn the Formula

Looking to save money 💲on your mortgage? Your first stop should be to learn how to crack today’s mortgage rates. I’ll share with you the formula used by lenders 🏦 and what economic trends affect mortgage rates to plummet 📉 or skyrocket.🚀 If you understand the WHY and put the WHAT aside, you’ll be a pro 🏆 in no time when it comes to negotiating your loan. 🎉

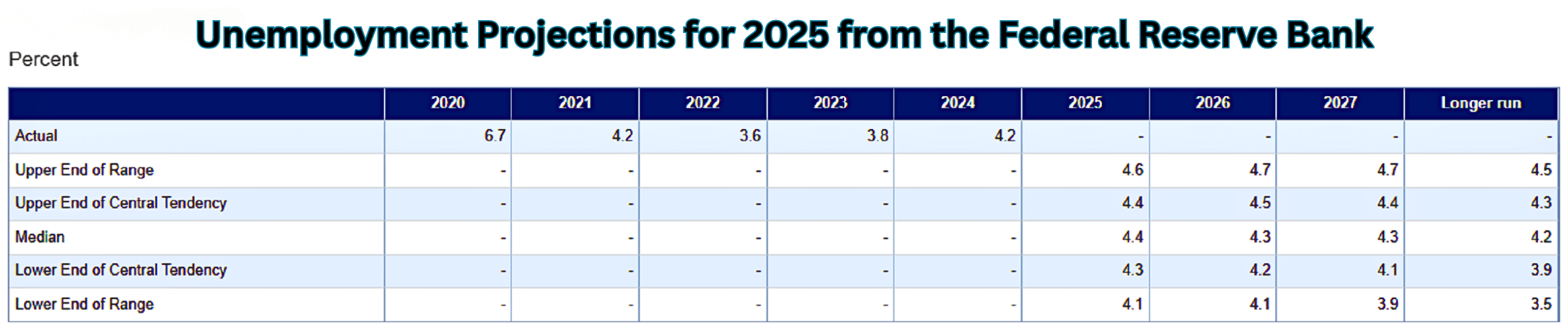

🔍 How Unemployment Impacts Recession Risks

The job market in Metro Detroit has been holding strong 💪—but how long will it last is the question. ❓ Looking back, the 2008 financial crisis didn’t begin with housing; it started with unemployment 😬. The jobless rate hit 8.3% about the time the housing market crashed. People were not paying their mortgages because they didn’t have a job. 💥 🏚️.

To make things worse, many homeowners treated their equity like an ATM 🏦. Lending was wild, appraisals were inflated, and people borrowed more than their homes were worth. That’s when everything changed. New laws were passed to protect homeowners, including the Dodd-Frank Bill, which became law in July 2010 🧾.

Fast-forward to today, and most homeowners have positive equity and plenty of it. 🏠💰. That’s a huge difference from 2008. Now, let’s take a quick look at the past 12 months of unemployment using data from Trading Economics 📉. As you’ll see, the unemployment rate is still historically low, which helps lower the risk of a full-blown recession.

📈 But Will the Unemployment Rate Go Up?

Great question! 🤔 To find the answer, check out the graph below. The graph below has been updated to include the downsizing of the federal government 🏛️, as well as tariffs. 🤔 While no one can say for sure, this data helps us stay ahead of the curve and watch for warning signs before they hit 🚨. Every week, I review where mortgage rates and the housing market stand, and then we’ll take a peek into my crystal ball 🔮 to see where we’re heading next. Check out “Crash the Mortgage Rate Code: Know the Why and Save 💲”

🔮What’s Next for Unemployment?

Projections show that unemployment is expected to stay below 5% 📉. Losing a job is challenging for both people and their communities 😔. However, the projected mild uptick in unemployment isn’t expected to cause a flood of foreclosures in Metro Detroit or trigger a housing market crash 🏠🚫.

In fact, with today’s stronger lending rules and solid homeowner equity, the market is in a much better position than it was in past downturns 💪📊.

Let’s Decode the Housing Market Together! 🏡📊

Let’s Connect ⤵️

Wow! 😮 There’s much to consider when buying or selling a home. Keeping up with the latest housing market trends is key because these numbers directly impact your decisions—and your money! 💰But don’t worry, I’ve got you covered! Let’s make it simple together. Schedule a Zoom call with me, and we’ll break down the data step by step. I’ll share my screen so you’ll get a clear view of market insights, helping you feel confident about your next move. ✅🔥Would you prefer an in-person meeting or a quick phone call 📞 at 248-343-2459? No problem! Let’s set up a time that fits your schedule.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

🧠 Final Thoughts: What Should You Do Next?

We may not know if a recession is coming, but the chances are higher than before 📉. Even so, that doesn’t mean it’s time to panic about the housing market in Metro Detroit 😰. If history is any indication, the picture is more than most expect. Most recessions haven’t caused home prices to crash. Instead, prices often stayed steady, and in many cases, mortgage rates even dropped 📊🏡.

So, if you’re asking, “Will a recession crash the housing market in Metro Detroit?” — the data says it’s not likely. Now’s the time to get the facts, ask the right questions, and make a smart move, not an emotional one. 💡Got questions❓ or prefer a quick chat 💬 Call or Text 📞 248-343-2459. I’m here to help anytime! 🆘 Stay current and ahead of your future competition by visiting the website for updated articles 3 to 4 times a week. Mortgage Rates are updated daily.

💡 Need to sell first? Visit Top 3 Home Selling Questions Answered, where I’ll walk you through Steps 1 & 2 of the Price-Driven Approach. Knowing your home’s value is the first step toward maximizing your equity! 💰📈 Let’s kickstart your homebuying journey today! 🚀🏡

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: What’s Driving the Change 📢 with Video

Metro Detroit Michigan Homes for Sale Search by City- LIVE MLS

Crack the Mortgage Rate Code: Know the WHY and Save💲

Metro Detroit Sold Home Prices Search by City: Live Data

Metro Detroit Housing Market Trends Search by City ~ Jan 2026

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Metro Detroit Home Prices and Real Estate Trends by City 🏘️💲

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

Real Estate Guides for Buying and Selling a Home ~ With Video

What Is A True Real Estate Expert: How to Find One🏡💥

Selling Your House As-Is OR Make Repairs Pros🌟 and Cons🚫

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.