This article breaks down how rising tariffs and foreign bond sell-offs 📉 are putting mortgage rates and financial stability at risk. As China dumps U.S. Treasuries and trade tensions escalate 🌐, the ripple effect is hitting the housing market in real time 🏠. Discover why these global moves matter — and what you can do to stay ahead 💡.

🔊 Mortgage Rates and Financial Stability At Risk: Trade War Fallout

We ended the week with a jolt: ⚡ President Trump just escalated tariffs on China to 145%, igniting a global trade storm. He carved out chips, computers, and phones, leaving nearly everything burning. 🔥

Over the weekend, I pulled the data — and what I found signals more than just a U.S.-China conflict.

This is shaping up to be a global economic powder keg. 💣

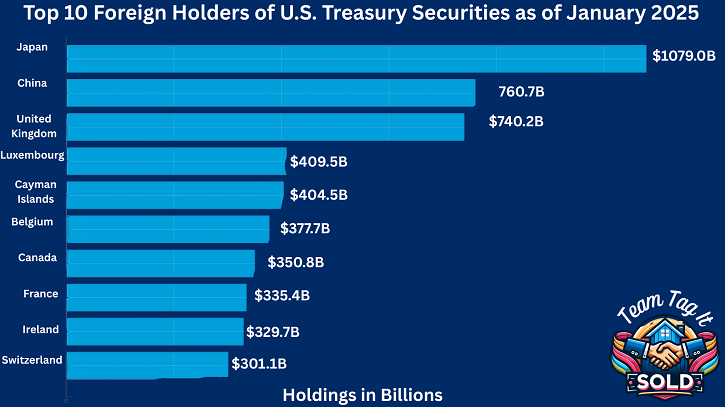

🌐 The Bigger Picture: Global Power Players Behind U.S. Debt

Yes, China is front and center — the #2 foreign holder of U.S. Treasury debt at $760.8 billion — and they did dump bonds last week, pushing the 10-year Treasury yield past 4.5%.

📉 That surge triggered higher mortgage rates within hours.

However, China isn’t acting alone. Countries like Japan ($1.079T), the UK ($740.2B), and Canada ($760.7B) are also holding massive stakes in U.S. debt.

If multiple nations begin even modest offloading, the ripple effect could send shockwaves through the U.S. bond market, putting our financial stability at risk—and straight into your monthly mortgage payment.

📊 Top 10 Foreign Holders of U.S. Treasury Securities (Jan 2025)

Financial Stability at Risk if Countries start dumping Bonds as a tool against Tariffs

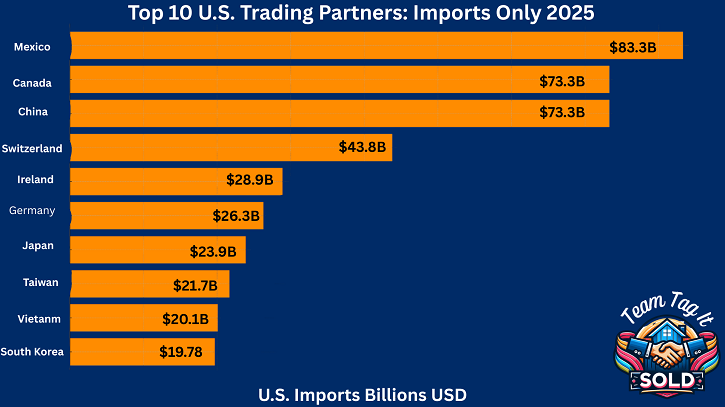

📦 Why the Top 4 Import Partners Matter

Now, let’s turn the lens to trade. The U.S. depends heavily on Mexico, Canada, China, and Switzerland for goods that fuel daily life and construction supply chains. But these imports aren’t just economic conveniences—they’re structural dependencies.

When we import far more than we export, we create a trade imbalance — and those imbalances can:

- 💰 Widen our current account deficit

- 🔁 Increase our reliance on foreign capital

- 📉 Put pressure on the U.S. dollar

- 📈 Push interest and mortgage rates higher due to higher borrowing needs

📥 Top U.S. Import Partners – 2025

The deeper the deficit, the weaker our leverage.

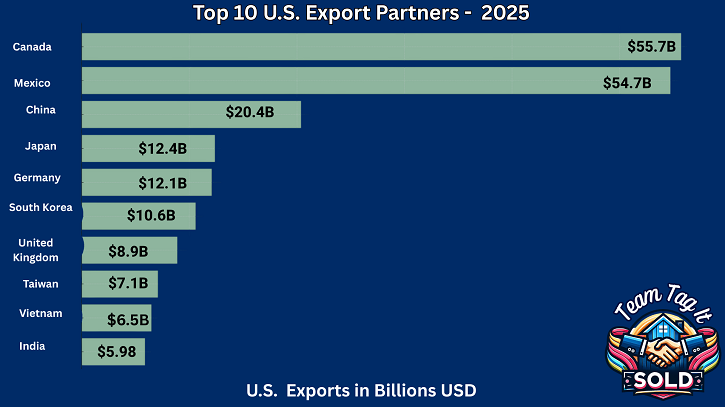

📤 Why Our Export Gaps Are a Red Flag

Even though we’re exporting to many of these same countries, the gaps are growing.

For example, China remains a top import partner, yet they take in far fewer U.S. products in return and are also a major holder of U.S. debt. That combination creates double leverage over our economy. 😬

Similarly, countries like Switzerland and Germany import heavily into the U.S., while our exports to them remain relatively low — increasing our exposure to external pressure and policy risk.

And when bondholders stop buying or start selling, mortgage rates rise, debt servicing becomes more expensive, and your cost to buy a home goes up — fast. 💸

📤 Top U.S. Export Partners – 2025

💡 The Bottom Line: This Isn’t Just About Tariffs

This is about the global economic engine that keeps mortgage rates steady — and what happens when it starts to misfire. We’re watching the collision of trade imbalances and debt exposure, and it’s showing up where it hurts: your housing costs.

💥 “One drives our economy. The other funds it. If either falters — your next mortgage payment could be hundreds more per month.”

🔹 Where to Go Next:

Tracking these trends isn’t optional anymore — it’s essential. 📊 After seeing the data firsthand, it’s clear why leading economists say that for tariffs to work, we need policies guided by a scalpel, not a chainsaw. If you’re ready to stay ahead of the curve, dive into the resources below and start connecting the dots between global finance and your next mortgage rate. 💡🔍

📊 Today’s Mortgage Rate: Crack the Code and Save — Get a quick snapshot of rate shifts and bond market influence daily.

📅 Crack the Mortgage Rate Code: Know the Why to Save — Take a deep dive into how trade, debt, and global finance are shaping future mortgage rates.

📰 Real Estate Insider 🎯 — Stay current with our expert analysis of economic trends, home prices, and market shifts, offering you valuable tips and strategies. Whether you’re buying or selling, you’ll have the insight to move with confidence.

💬 One Last Thing…💡 Need to sell first?

Check out the Top 3 Home Selling Questions Answered

➡️ I’ll walk you through Steps 1 & 2 of the Price-Driven Approach so you’ll know: ♦️🏡 What your home is worth 🔶💰 How much equity you can gain.

🏡 Let’s Decode the Mortgage Market Together! 💰🔎

Let’s Connect ⤵️

Wow! 🤯 There’s a lot to take in, but don’t worry—I’ve got you! Mastering this step is key before you even start searching for your dream home. 🔑Understanding how mortgage rates are determined and how to negotiate with lenders on rates and fees can save you thousands over time. 💵 But it doesn’t have to be complicated! Let’s simplify the process together.📅 Schedule a Zoom call with me, and we’ll review the data step by step. I’ll share my screen, giving you a clear view of market insights so you can make confident, informed decisions about your next steps! ✅✨🔥Would you prefer an in-person meeting or a quick phone call 📞248-343-2459 instead? No problem! Let’s set up a time that fits your schedule.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates:

Metro Detroit MI Homes for Sale by City

Crack the Mortgage Rate Code: Know the WHY and Save💲

Metro Detroit MI Sold Home Prices by City

Metro Detroit MI Housing Market Trends by City

Learn How To Master Pricing Your Home Like a Pro 💥🏡

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Metro Detroit Home Prices and Real Estate Trends by City 🏘️💲

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

Real Estate Guides for Buying and Selling a Home ~ With Video

What Is A True Real Estate Expert: How to Find One🏡💥

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.