Wondering what really impacts mortgage rates in Metro Detroit? 🏠📊 The market may be unpredictable, but there are things you can control. 💡 Click to uncover what’s driving today’s rates—and how you can stay one step ahead. 🚀

What Impacts Mortgage Rates in Metro Detroit? 💸📊

Have you noticed how mortgage rates seem to play a game of ping-pong lately? One day, they dip slightly ⬇️… and the next, they bounce back up ⬆️. If you’re thinking of buying a home in Metro Detroit, this back-and-forth can feel confusing—and a bit stressful.

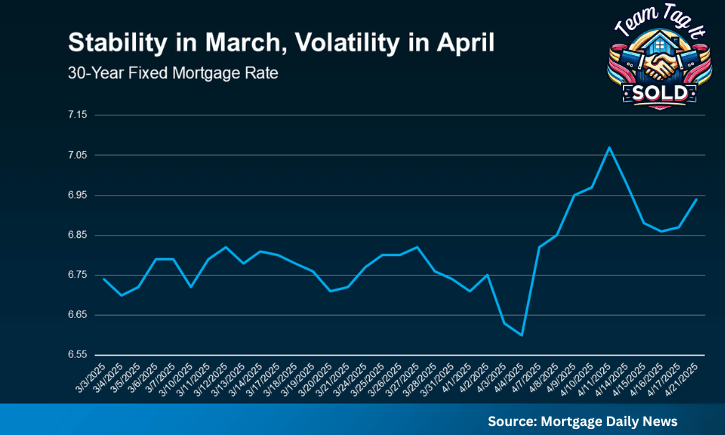

You’re not alone. Many sellers are asking the same thing: Should I sell now, or wait? 🤔 What if rates jump again next week? 👉 Take a look at the graph below, using real-time data from Mortgage News Daily. After a steady March, April has been a rollercoaster, with rates fluctuating rapidly. As a result, it’s become even harder to pinpoint the perfect moment to list.

Here’s the good news:

We’re going to break it all down for you ✅. Understanding what impacts mortgage rates—especially in markets like Metro Detroit—can help you make smarter timing decisions when selling your home. Keep reading to discover the real reasons behind the rate swings, how to stay ahead of market changes, and why this knowledge could give you a serious edge as a home seller in today’s market 🧠💼.

This kind of up-and-down swing in mortgage rates? 🎢 Totally expected during times of economic change—and yes, the Metro Detroit housing market is definitely feeling it.

However, here’s the truth: trying to “time the market” rarely works out. ❌ What impacts mortgage rates isn’t random—it’s driven by factors far outside your control, like inflation, Federal Reserve policy, and even global events 🌎💼. But don’t worry—you’re not stuck on the sidelines. 🙌 In fact, you may have more control than you think.

👉 For example, even in a volatile market, you can still make smart moves as a seller. Want to lock in a better rate when buying your next home? Start by focusing on what you can control: Your credit score ~ 📈 Your loan type 🏡~ And your loan term. ⏳These three things can make a huge difference, especially in a changing Metro Detroit real estate market.

Therefore, while you can’t control the economy, you can get prepared to score the best mortgage rate possible in today’s shifting market 💪📉.

💳 What Impacts Mortgage Rates? Your Credit Score Does!

When it comes to what impacts mortgage rates and Metro Detroit real estate, your credit score plays a major role. Even a slight bump up or down can lead to a higher or lower monthly payment—and that can really add up 💸.

📌 As Bankrate puts it:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

If you’re planning to sell your Metro Detroit home and buy your next one, this is the perfect time to check your score ✅. Maintaining a strong credit score is one of the easiest ways to secure a better mortgage rate in the Metro Detroit housing market. And the good news? It’s totally in your control.

🤔 Not sure where you stand?

Talk to a loan officer you trust. They’ll walk you through your credit report, explain what it means, and help you build a plan to strengthen your score before you make your move 🧠🔍.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

🏦 What Impacts Mortgage Rates? Your Loan Type Matters!

When it comes to what impacts mortgage rates in places like Metro Detroit, your loan type is a big piece of the puzzle. 🧩 For example, not all loans are created equal. Each loan type—conventional, FHA, USDA, and VA—comes with its own set of rules and qualifications. 📋 According to the Consumer Financial Protection Bureau (CFPB):

👉 “There are several broad categories of mortgage loans… Rates can be significantly different depending on what loan type you choose.”

Choosing the right loan type can significantly impact the rate you qualify for and the amount you pay each month. 💰 Lenders don’t all offer the same options, so it pays to shop around. 🛒 Consulting with multiple mortgage professionals helps you compare terms and make an informed decision based on your unique situation.

In short, your loan type can either save or cost you thousands over the life of your loan. 💡 Take the time to learn about your options and partner with a trusted lender who will guide you toward the best fit. 🙌

⏳ What Impacts Mortgage Rates? Your Loan Term Counts!

When discussing the factors that impact mortgage rates, especially in Metro Detroit, your loan term plays a more significant role than you might think. 🧠 For example, just like there are different loan types, there are also different loan terms, and that choice can change everything from your monthly payment to how much interest you’ll pay overall. 💸

As Freddie Mac explains:

👉 “When choosing the right home loan for you, it’s important to consider the loan term… Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Most lenders typically offer 15, 20, or 30-year loans. 🏡 Shorter terms often mean lower interest rates but higher monthly payments, while longer terms usually offer lower monthly payments, but more interest over time. Therefore, it is essential to discuss with your loan officer what works best for your budget and future goals. 📊 Comparing terms side by side can help you choose the option that saves the most in the long run, without stretching your budget too thin. 💪

🔍 Learn the New Rules: Predict Where Mortgage Rates Are Heading 📈📉

Trying to figure out what impacts mortgage rates in Metro Detroit? You’re not alone—it feels like they change every time you blink. 😅 But there’s a simple formula that helps make sense of it all:

👉 10-Year Treasury Yield + MBS (Mortgage-Backed Securities) Price Gap = Mortgage Rates

I break this down every day, starting with the big headlines from Wall Street. 📰Next, I’ll move into the numbers: where the yield is, what the MBS gap looks like, and what it all means for today’s rates.

For example, some mornings it makes sense to lock in your rate right away. Other times, there’s good news coming, and it might be smart to wait it out. ⏳The best part? Once you understand the formula, you’ll feel way more confident when you talk to lenders. You’ll know how to spot the good ones, ask the right questions, and negotiate like a pro. 💬💪

🏡 Let’s Decode the Mortgage Market Together! 💰🔎

Let’s Connect ⤵️

Wow! 🤯 There’s a lot to take in, but don’t worry—I’ve got you! Mastering this step is crucial before you begin searching for your dream home. 🔑 Understanding how mortgage rates are determined and how to negotiate with lenders on rates and fees can save you thousands over time. 💵 But it doesn’t have to be complicated! Let’s simplify the process together.📅 Schedule a Zoom call with me, and we’ll review the data step by step. I’ll share my screen, giving you a clear view of market insights so that you can make confident and informed decisions about your next steps. ✅✨Would you prefer an in-person meeting or a quick phone call 📞248-343-2459 instead? No problem! Let’s schedule a time that fits your schedule.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

🏁 Final Thoughts: What Impacts Mortgage Rates Is Only Half the Story

You can’t control what’s happening in the economy or where mortgage rates will land tomorrow. 📉📈 However, you can take charge of the things that do matter, like your credit score, loan type, and loan term. 💪For example, working with a trusted lender who understands the factors that impact mortgage rates in Metro Detroit can make all the difference. 💼 As a result, you’ll be better prepared to lock in a great rate when the time is right.

Furthermore, being proactive today puts you in a powerful position. 🏡✨🔑 Let’s connect and walk through your next steps. I’ll help you understand what you can do to get ahead, so when the market moves, you’re ready to move with it.📲 Message me today at 248-343-2459.

💡 Need to sell first? Visit Top 3 Home Selling Questions Answered, where I’ll walk you through Steps 1 & 2 of the Price-Driven Approach. Knowing your home’s value is the first step toward maximizing your equity! 💰📈 Let’s kickstart your homebuying journey today! 🚀🏡

More Help Is 1️⃣ Click Away⤵️

Home Purchasing Power – Do You Know Your’s❓🏡

FHA Mortgage: What is It and How Can You Benefit in Metro Detroit

Today’s Mortgage Rates: What’s Driving the Change 📈📉

Real Estate Guides for Buying and Selling a Home📚

Discover How Home Equity Can Fund Your Next Move💰

Top 3 Home Selling Questions Answered 🏡❓

Metro Detroit MI Housing Market Trends by City 🔎📊

Metro Detroit MI Homes for Sale by City 🏘️🎯

Metro Detroit MI Sold Home Prices by City

Learn How To Master Pricing Your Home Like a Pro 💥🏡

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.