Today’s Mortgage Rates: Early Prediction 🔮Below

UPDATED: FEBRUARY 26, 2026 • xx AM ET

TRACK THE WHY, NOT THE WHAT, and Learn to predict Mortgage rates: 🗓️ February 26, 2026

Today’s Mortgage Rates: What’s driving the change isn’t just about the daily number that pops up. I’m going to break down and explain the WHY behind Today’s Mortgage Rates: What’s Driving the Change in Metro Detroit! Learn the WHY the rate moves so you can spot trends before they shift. By understanding the bond market, the MBS gap, and the Fed’s hidden influence, you’ll know when to lock your rate on a dip—not a spike.

- 🔖 Bookmark Crack the Code and Save for next week’s Mortgage rate predictions.

- 📩 Notifications to your email in-box

- 🔖Bookmark Today’s Mortgage Rates- What’s Driving the Change

The Why Behind Today’s Mortgage Rates Starts with the formula

The 10-year Treasury yield is the interest rate the U.S. government pays to borrow money for 10 years. It acts like a weather vane for long-term rates, including mortgage rates. When investors expect higher inflation or stronger economic growth, they demand higher returns. That pushes the 10-year yield up ⬆️, and mortgage rates usually rise with it.

When investors worry about a slowdown, a recession, or global trouble, they move money into safe U.S. Treasuries. That buying pushes the 10-year yield down ⬇️, and mortgage rates tend to fall. So when you hear about hot inflation, strong job numbers, or a tough-talking Federal Reserve, rates usually move higher 📈. But if you hear about weak data, recession fears, or market stress, rates often move lower 📉.

The 10-Year Treasury Yield Your Base – 2-26-2026 Updated by 10:30 🕥Dip or Spike?

Yield drifted lower and Stable

The US bond market is suddenly flashing a warning sign about the economy, then the gift 🎁from SCOTUS. Now that the high tariffs are gone for now, and the new ones will not exceed 15% for only 150 days, the “Street” investors see this as a sign that inflation will go down and the Federal Reserve will step up interest rate cuts. The bond market has been stable.

Step 1: Why the Yield Drifted Down 📉

It appears the mechanics and math will influence mortgage rates moving forward. Wall Street is closely monitoring the policies and the Treasury bond market. The Treasury auction has been extremely weak for months, and investors are jumping in ONLY IF the Treasury is covering their risk and offering higher coupon rates. Those higher coupon rates are what are causing the yield to spike. It’s going to take months before we feel relief from inflation, because the goods on shelves and in warehouses were purchased under the higher tariff regime.

1️⃣ Bond market reaction to Tariff Policies 📉

With the White House invoking Section 122, the tariff landscape becomes simpler and less inflationary than the patchwork system we had before 📉 A flat global 15% rate replaces dozens of higher, uneven tariffs, and because it automatically expires in 150 days, Wall Street sees a clear endpoint instead of a long-term threat ⏳📊

Congress is unlikely to extend it in an election year, adding even more certainty and stability 🗳️The only real work ahead is diplomatic — Canada and Mexico will need reassurance that USMCA isn’t being abandoned, only temporarily overridden by a broad emergency measure 🤝Once the 150-day window closes, all three countries snap back to normal trade terms, restoring the existing framework and cross-border confidence ✅🌎

The Fed’s latest messaging reinforced that rate cuts are not guaranteed yet. Officials want more confirmation that inflation is sustainably cooling before shifting policy. Even without raising rates, this “wait for proof” stance keeps upward pressure on yields and mortgage pricing because markets must price in the risk that policy stays restrictive longer.

3️⃣ Labor market signals remain mixed 💼

While longer-term trends show cooling hiring and rising continuing claims, the most recent weekly data did not confirm rapid labor deterioration. When jobless claims fail to show meaningful acceleration, investors assume the economy remains stable, which reduces the urgency for lower rates and nudges yields higher. The issue here is that initial jobless claims and unemployment are based on a survey, not on actual numbers from each state’s unemployment rolls. In this day and age, I don’t understand why we don’t have actual numbers for accurate measurements, so much for transparency.

4️⃣ Consumer spending is slowing but not collapsing, YET 🛍️

Retail sales have weakened compared to earlier momentum, reinforcing the narrative of a cooling consumer, yet the slowdown is gradual rather than recessionary. Markets typically need clear deterioration — not moderation — to push mortgage rates meaningfully lower. December year-over-year retail was down 2.3% from 4.7% to 2.4%

5️⃣ Payroll data credibility and market skepticism 📊

Markets continue weighing differences between ADP payroll data, jobless claims trends, and BLS reporting. That uncertainty creates volatility. When investors lack conviction that the economy is weakening quickly, bond markets hesitate to rally, which prevents mortgage rates from sustaining downward momentum.

✅ Bottom line:

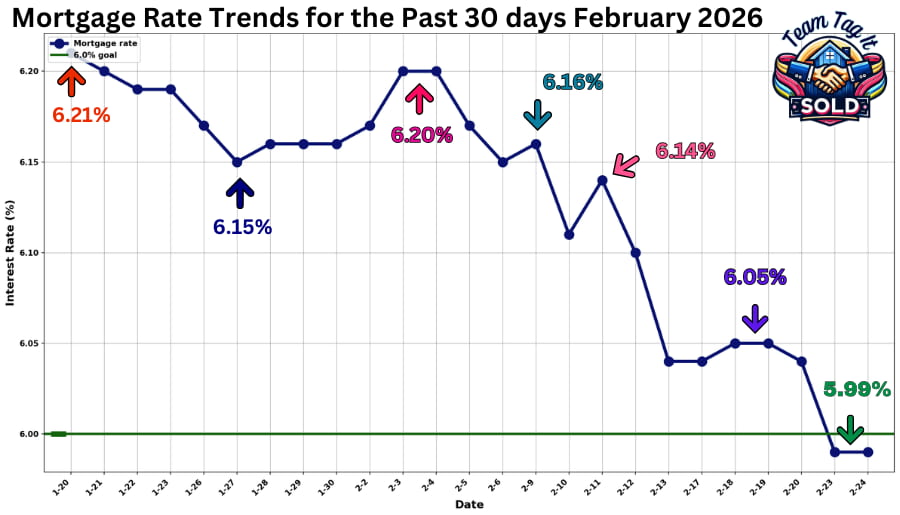

Mortgage rates moved slightly higher yesterday after bond yields rose, even as the Fed’s caution and labor data failed to confirm rapid economic weakness. The broader trend still reflects a slowing economy, but until investors see clearer signs of deterioration — especially in jobs and inflation —ate increases will likely remain uneven and temporary.

Step #2: Mortgage-backed Securities (MBS) Prices Today – Updated by 11:00 🕚 Early rate Predictions Alert 📢

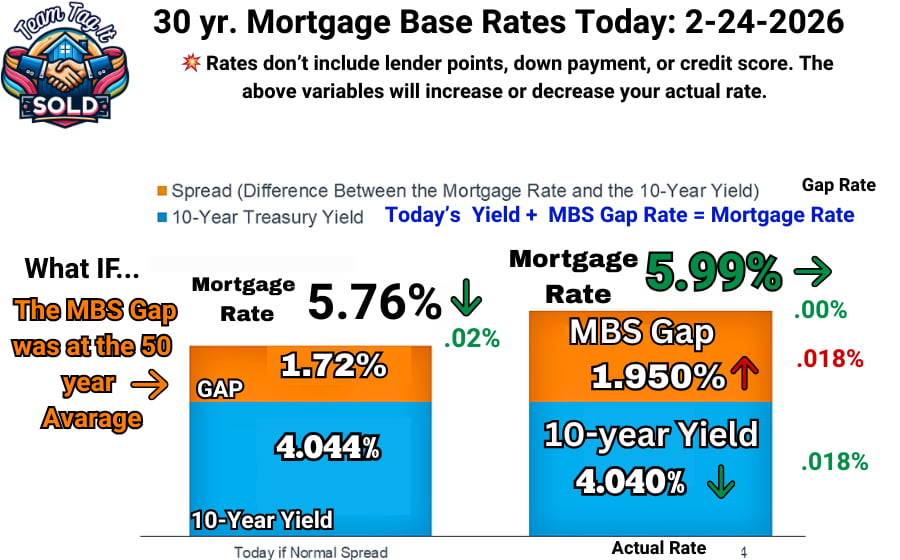

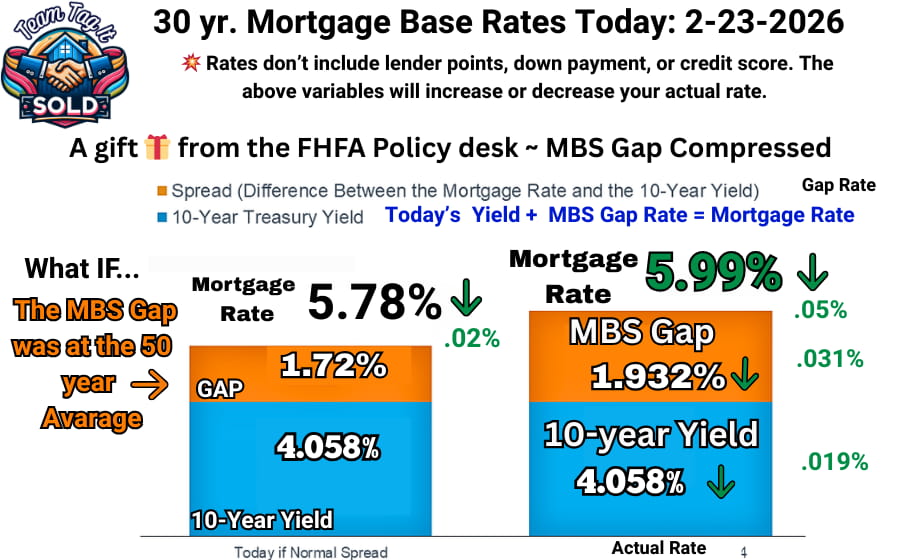

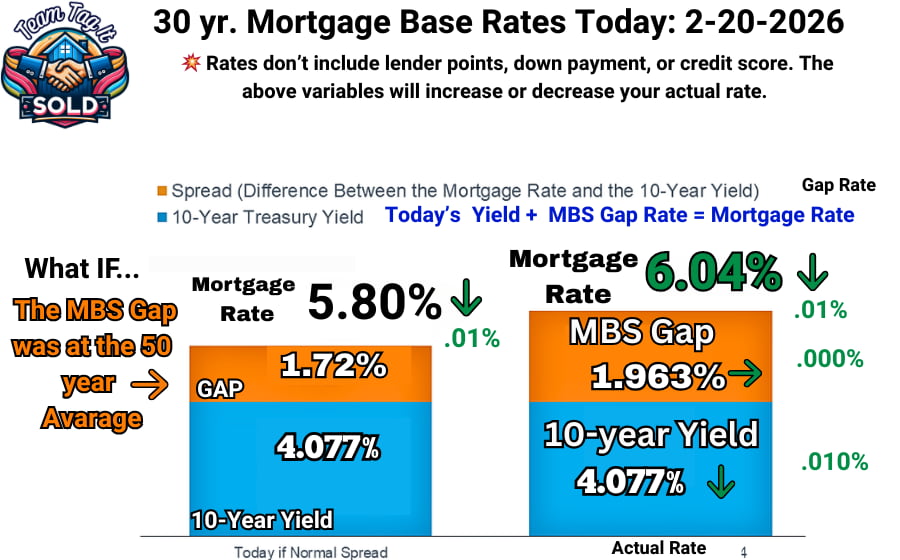

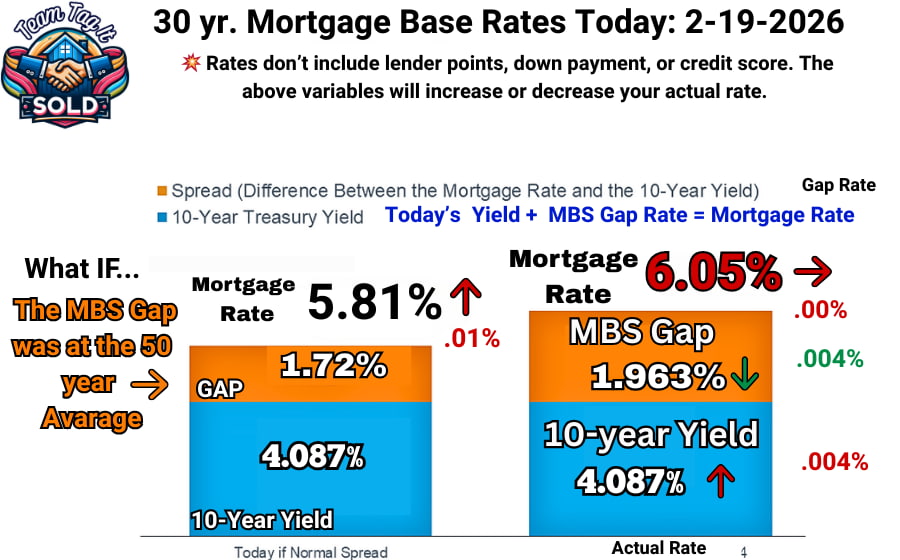

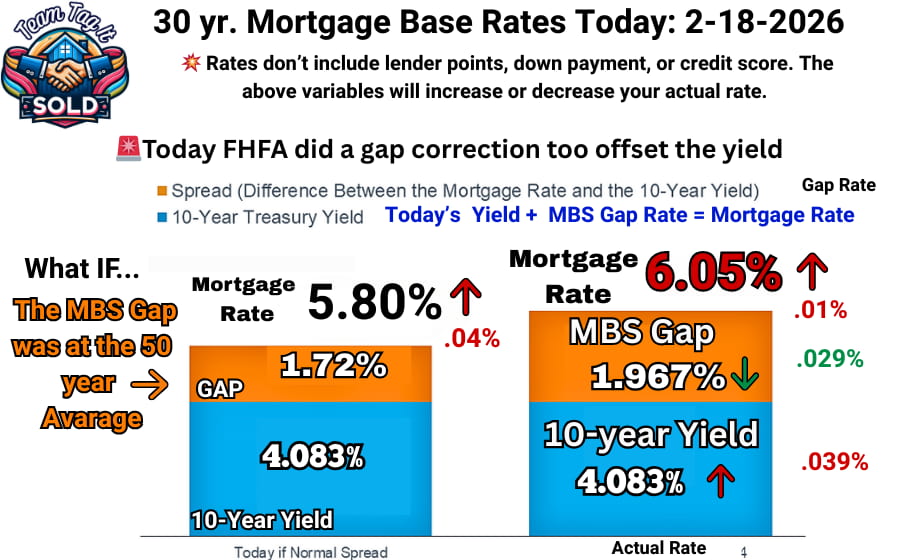

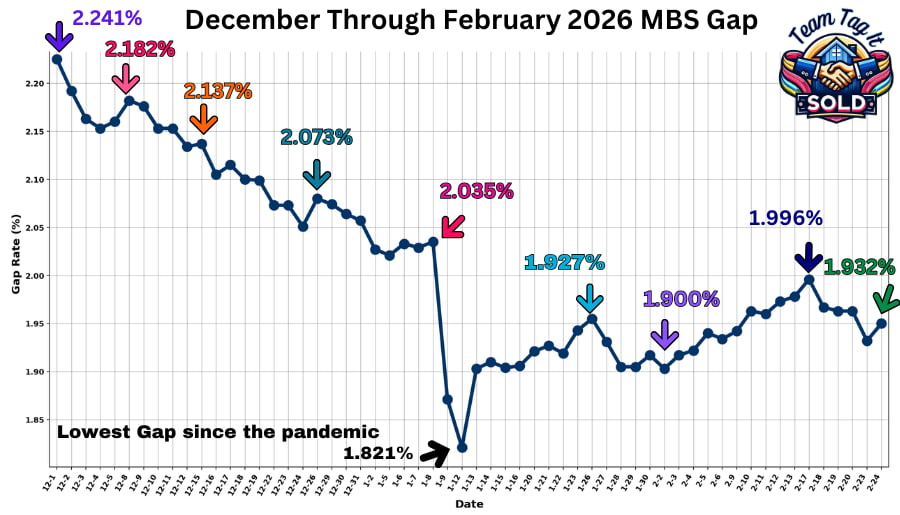

🚨 The second piece in determining mortgage rates is the all-important Mortgage-Backed Securities. Historically, the 50-year average between the 10-year Treasury yield and MBS rates has hovered around 1.72%. Currently, the average range has plummeted from 2.528% on January 3rd, 2025.

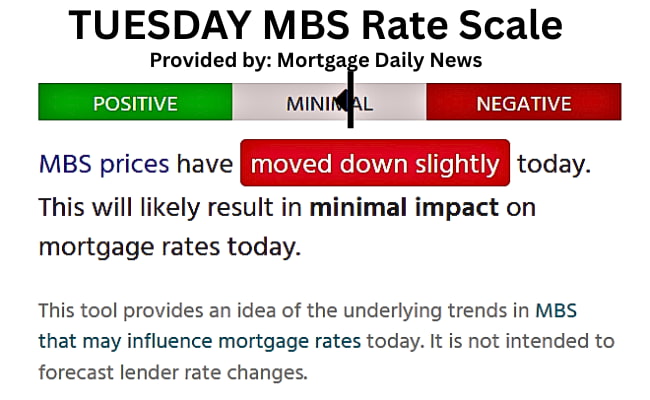

📌 Today’s MBS Gap: Hero 🦸 or Villain 🦹 with prediction at 11:00🕚

🔮 The prediction range today is 5.97%-5.99%, see the calculations below. 📰 Mortgage Daily News reports that MBS prices have moved down slightly and could have a minimal impact on Mortgage Rates today. 🚨 Due to the FHFA Fed Policies, they are using the MBS Gap to balance mortgage rates. The FHFA policy desk could decide rates today, and a UMBS pricing shift from 5 to 4.5. If they do, we may see a wobble in slightly higher rates, but this would be excellent news, meaning the UMBS is moving back towards the pre-pandemic pricing at UBMS 3 -3.5%.

🦸 Hero Mode:

When Mortgage-Backed Securities (MBS) prices go up, it means investors are willing to accept lower yields in exchange for the stability of mortgage payments. Today’s Math: I don’t see a hero scenario today, given that the FHFA compressed the gap by 0.031% yesterday. But they have fooled me before. 🦸♂️

⚖️Balanced:

Today’s Math: The Yield at 4.040% plus the same MBS Gap as yesterday at 1.946% would equal a mortgage rate of 5.97%.

🦹Villain Mode:

Falling MBS prices mean investors demand higher yields to take on mortgage risk, creating upward pressure on mortgage rates.❌ Result: Lenders increase rates to keep spreads profitable or temporarily pause quoting. Additionally, when the yield skyrockets, 🚀 the Fed Security Desk or Freddie and Fannie 🏦 have been using the gap to correct and stabilize volatility in the Mortgage market. Buyers lose buying power, and the urgency to lock on a dip becomes critical. Today’s Math: 4.040 + MBS Gap up +0.010% to +0.018 (1.942 to 1.950) would equal a rate range of 5.98% to 5.99%.

Important 📢 Know Your Lender’s Policy on Rate Revisions – Morning vs Afternoon

⚠️ Before locking your rate, always understand how your Lender determines their daily mortgage rate. Remember: yield and MBS prices fluctuate throughout the day, so knowing the Lender’s timeline before locking your rate is crucial to saving. 🔏

📊 Mortgage Daily News article on the importance of understanding why lenders adjust mortgage rates midday. 💥Know your Lender’s 🏦 protocol for rate changes. 🔁💡 Do you offer rate revisions if the bond market shifts lower in the afternoon? ❓Know the WHY and save.💵

Today’s Mortgage Rate: WHY Answered

Today, the math did apply. The market is finally starting to react to math, mechanics, and market structure. Today, seeing the MBS gap was compressed yesterday, today the Fed policy desk increased the gap to offset the decline in the yield.

Mortgage Rates Trends

Why the FHFA is compressing MBS Prices

📌 The MBS gap hasn’t been following the math consistently since August. 🧮 The FHFA Policy Desk is determining the outcome of where they want rates to land. Remember, the Federal Reserve doesn’t determine mortgage rates; instead, the 10-year Treasury yield (set by Treasury Department bond sales) and the Mortgage-Backed Securities (MBS) gap (set by the Federal Housing Finance Agency) do.

FHFA Policy Desk

⬇️⬇️⬇️

Fannie Mae & Freddie Mac

Capital Markets Desks

⬇️⬇️⬇️

MBS Market

(Pricing & Spreads)

⬇️⬇️⬇️

Lenders

(Rate Sheets

⬇️⬇️⬇️

Borrowers

(Final Mortgage Rate)

Get online Mortgage Quotes from Mortgage Daily News ⤵️ Click to View

Base Rate: adjustment not made for your FICO score, your down payment, location, purchase price, and MORE! access Morgage Daily News for Quotes ⤵️

What My Crystal Ball Tells Me About the Future Mortgage Market

Based on months of prior bond auctions, we know Wall Street isn’t taking the bait. To purchase bonds, investors are demanding higher coupon rates. The Treasury needs to STOP🛑increasing the deficit; they are burning through cash. If we don’t get our spending in check and stop feeding the deficit, we won’t see a significant change in mortgage rates.

Next, we have a new problem: the White House is using tariffs as a weapon to get what it wants. The last fiasco, involving tariffs on countries that opposed the Greenland takeover, sent mortgage rates skyrocketing. WHY? Because countries hold Millions to Billions of our bond debt. When countries decide to sell bonds prematurely to get their message to the White House, their policies won’t be tolerated.

The next fiasco to watch 👀 Bond Sell-Offs

That bond sell-off will cause the 10-year Treasury yield to spike, and mortgage rates will follow. The bond market is still volatile. If you understand the WHY, you can predict the next dip and save thousands over the lifetime of your loan.

More Help Is ONE Click Away⤵️

Pick Your Topic by Scrolling

Home Purchasing Power – Do You Know Your’s❓🏡

FHA Mortgage: What is It and How Can You Benefit in Metro Detroit

Today’s Mortgage Rates: What’s Driving the Change 📈📉

Real Estate Guides for Buying and Selling a Home📚

Discover How Home Equity Can Fund Your Next Move💰

Top 3 Home Selling Questions Answered 🏡❓

Metro Detroit MI Housing Market Trends by City 🔎📊

Metro Detroit MI Homes for Sale by City 🏘️🎯

Metro Detroit MI Sold Home Prices by City

Learn How To Master Pricing Your Home Like a Pro 💥🏡

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

What Is A True Real Estate Expert: How to Find One🏡💥

Selling Your House As-Is OR Make Repairs Pros🌟 and Cons🚫

Top Real Estate Agent Skills for Selling Your Home🏡💲

Thinking of Selling Your House: How Long Will It Take?

Is Now a Good Time to Sell Your House❓Let’s Find Out 🥳

Downsizing Your Home Can Help You Fuel Your Retirement🤩🏡💲

Master Your Mortgage Rate: Control the Controllable💰🏡

Inspection vs. Appraisal: Understaning the Key Difference🕵️🏡💲

Should You Rent or Sell Your House❓🏡

🏡 Let’s Decode the Mortgage Market Together! 💰🔎

Wow! 🤯 There’s a lot to take in, but don’t worry—I’ve got you! Mastering this step is key before you even start searching for your dream home. 🔑Understanding how mortgage rates are determined and how to negotiate with lenders on rates and fees can save you thousands over time. 💵 But it doesn’t have to be complicated! Let’s simplify the process together.📅 Schedule a Zoom call with me, and we’ll review the data step by step. I’ll share my screen to give you a clear view of market insights so you can make confident, informed decisions about your next steps! ✨If it’s easier, contact my cell at 📞248-343-2459.

☎ +1 (248) 343-2459

© 2017–2026 Pam Sawyer @ Metro Detroit Home Experts. All Rights Reserved.

The information contained and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Pam Sawyer does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts or Pam Sawyer will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.