💰 Think you need a 20% down payment to buy a home in Metro Detroit? Think again. This article breaks down the myths with 🏦 loan options, 📊 graphs, and real data—plus why many first-time buyers qualify without using a single 🧾 down payment assistance program.

💡 Do You Really Need a 20% Down Payment in Metro Detroit?

Saving for your first home can feel overwhelming, especially with all the outdated advice floating around. You’ve probably heard it before: “You need a 20% down payment to buy a house in Metro Detroit.” 🚫 Wrong! That’s one of the biggest myths in real estate.

✅ A 20% Down Payment Isn’t Always Required

Unless your loan type or lender specifically requires it, you don’t need to put 20% down. That rule? It’s old-school. Today’s buyers in Metro Detroit have more options than ever, especially first-time homebuyers like you. Thanks to flexible loan programs, you can own a home with far less upfront costs.

Let’s break down a few examples:

- FHA loans allow down payments as low as 3.5%.

- VA loans, for eligible Veterans, offer zero down.

- USDA loans also come with no down payment.

- MISHDA programs now provide up to a $ 25,000 Down Payment assistance for eligible buyers.

🎉 You Have Options—and That’s a Game-Changer

These programs open doors—literally. You can start building equity and stop renting sooner than you think. Putting more down may lower your monthly mortgage payment, but it’s not a requirement. The bottom line? You have choices. And that’s great news! 🎊

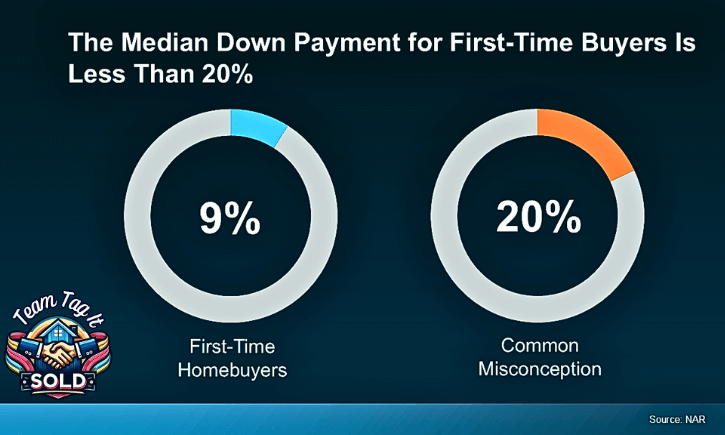

📉 Most First-Time Buyers Don’t Put 20% Down

Let’s talk about what buyers are actually doing today. According to the National Association of Realtors (NAR), the average down payment for first-time homebuyers is just 9% 💡. That’s less than half the traditional 20% down payment you’ve probably heard about in Metro Detroit.

So, if saving 20% feels out of reach, you’re not alone 🙌. Most first-time buyers start with less and still become successful homeowners. The truth is, you’ve got options. And they can help you buy a home in Metro Detroit faster than you think 🏡✨.

💸 Why You Should Look into Down Payment Assistance Programs

Here’s the big takeaway: You probably don’t need to save as much as you think to buy a home 🏡. Even better? There are programs designed to boost your savings, especially if you’re targeting that 20% down payment in Metro Detroit 💰. Many first-time buyers have never heard of these tools, let alone used them. But they’re out there… and ready to help 🤝.

Down Payment Assistance (DPA) programs are a smart way to cut upfront costs.

They can help cover your down payment, closing costs, or even both 💳✅.

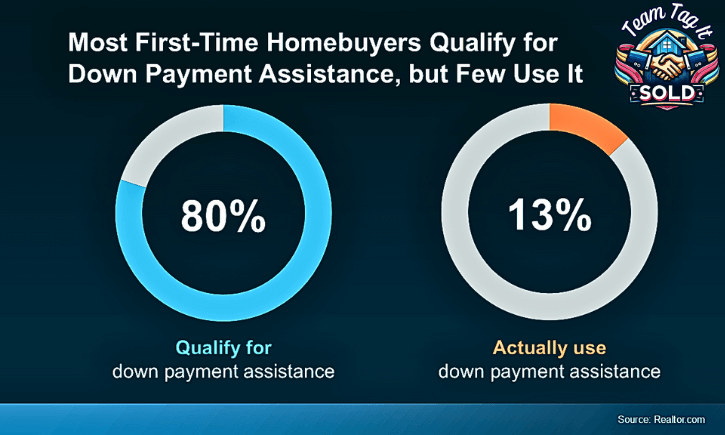

📊 The Numbers Don’t Lie

🔹 Nearly 80% of first-time homebuyers qualify for down payment help.

🔹 But only 13% actually use it. 😲

That means thousands of buyers in Metro Detroit are missing out on free or low-cost financial support. Why? Some think they make too much. Others don’t know where to look. That’s where I come in 🧭. As a local real estate agent, I help you uncover state and local programs matching your goals and budget 🎯.💬 The Bottom Line? You may not need a 20% down payment—and you definitely don’t need to do it alone. Let’s unlock those doors together! 🗝️✨

🚀 Don’t Miss Out on These Valuable Opportunities

That’s a huge missed opportunity for many first-time homebuyers in Metro Detroit 😕. And we’re not talking about small perks. Some Down Payment Assistance (DPA) programs offer thousands of dollars to help cover your purchase costs 💸🏡. As Rob Chrane, Founder and CEO of Down Payment Resource, puts it:

“Our data shows the average DPA benefit is roughly $17,000.”

That can give your savings—and confidence—a real jump-start 💥.

💰 Imagine Getting $17,000 in Help

Now picture this—you qualify for $17,000 in assistance 🤯. That’s a massive boost toward your 20% down payment in Metro Detroit. And guess what? Sometimes, you can even combine multiple programs to increase your home-buying power 🔑.

🎯 These Programs Aren’t Just One-Time Offers

These are strategic tools built to help first-time buyers like you overcome the down payment hurdle. Local grants and state-funded options in Metro Detroit can give your savings a serious lift 📈. You don’t want to leave money like this on the table. Let’s ensure you take advantage of every opportunity to turn your dream of homeownership into reality 🏠✨.

Down Payment Assistance: Your Key to Easier Home Buying

🏡 Are you dreaming of buying a home in Metro Detroit? Don’t let the down payment 😨 scare you off. You’ll learn how these programs can be your stepping stone 🪜 to owning a new home. Your home-buying journey doesn’t start with you saving a mountain of cash 💸.

🔑 Key Step in Purchasing a Home

Every day, I break down mortgage rates 📉 so you can understand the WHY, not just the WHAT. These insider tips 💡 could save you thousands 💰 over the life of your mortgage loan and give you the negotiation edge 🤝 you need when negotiating with lenders.

🚀 Boost Your Homebuying Power

Let’s Explore Together! ⤵️

Wow! 🤯 There’s a lot to think about when buying a home, and feeling a little overwhelmed is normal. The big question is: When is the perfect time financially to jump into the market and buy your dream home? 🏡💰Let’s connect and break it all down together! We’ll review recent rate cuts and home price trends and determine the magic numbers that work for you. We can schedule a Zoom call, and I’ll share my screen to walk you through everything step by step. Got questions❓ or prefer a quick chat 💬Call or Text 📞 248-343-2459. I’m here to help anytime! 🆘 Stay up to date and ahead of your future competition by visiting the website for updated articles 3 to 4 times a week. Mortgage Rates are updated daily.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

✅ Bottom Line: You Don’t Need a 20% Down Payment on a House

Saving for your first home doesn’t have to feel impossible 💭. Especially if you’re still thinking you need a 20% down payment—that’s just not true 🙅♀️. Many loan programs require far less, and powerful tools are designed to stretch your savings, especially if you’re buying in Metro Detroit 🏙️.

💸 Down Payment Assistance Can Help

Down payment assistance programs can add thousands to your budget 💰—you need to know where to look 🔍. Want to know which programs you qualify for? Need help connecting with a trusted local lender in Metro Detroit?

📞 Let’s Make It Happen

Call or text me today at 248-343-2459 📲. Let’s talk about how to get you home faster and smarter—without breaking your budget 🏡💡. We’ll turn your homeownership dream into a clear plan. You don’t have to wait—and you definitely don’t have to do it alone 🤝✨.

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Alert📢

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Your Home Didn’t Sell: Let’s Fix That! 🔄🏡

3% Mortgage Rate vs. Real Life: Is It Worth Staying Put❓🏡

Mortgage Rate Dips 📉 vs. Home Price Spikes📈Which Matters❓

More Homes for Sale: A Warining⚠️ or Opportunity💡

Mortgage Mistakes to Avoid After Applying🏡😱

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.