Mistakes Home Buyers Make Today and How to Avoid Them

Let’s Find Out How to Avoid Mistakes Home Buyers Make Today

Buying a home is challenging in any market, and today’s market in Metro Detroit is no exception. There’s much to consider with higher mortgage rates, rising prices, and a limited supply of homes for sale. To avoid pitfalls, take the time to find the right agent.

Start by visiting their website to see their content. Question their knowledge and education style. As a home buyer, understanding the process is crucial. Can they explain it so you can make informed decisions? Interview them about home prices, the housing market, avoiding mortgage mistakes, and negotiating with a lender. Don’t just listen to what they say; ask for graphs, trends, or documentation to support their opinions. An expert’s insights will help you avoid common mistakes home buyers make today.

Mistake Home Buyers Make #1: Putting Off Pre-Approval

First, you need to understand how mortgage rates are determined. Every day, I post a blog titled”Today’ss Mortgage Rate: What’s Causing the Change” “⤵️ Did you know you can predict where mortgage rates are going? I’ll show you how. Once you understand the trends, you can negotiate and spot a suitable lender. Did you know that your Mortage Pre-Approval secret power? A lender looks at your finances to determine how much they will loan you for a mortgage. This helps you understand your budget before house hunting in Metro Detroit.

Crack the Code and Save

Instead of worrying about WHAT mortgage rates are daily, find out Why and learn to predict where they’re going. If you don’t know the formula to calculate mortgage rates, your base number is the 10-year Treasury Yield + Mortgage-backed Securities Price Gap = Mortgage Rate. If you understand the WHY, lenders can’t take advantage of you and you’ll save thousands over the lifetime of Your loan

Mistake Home Buyers Make #2: Holding Out for Perfection

Don’t get too caught up in the “eye candy” when looking for your new home in Metro Detroit. You might have a long list of must-haves and nice-to-haves, but be realistic about your home search. Finding a home that checks every box is ideal but unlikely, especially with low inventory. Plus, the perfect home may be too expensive.

Instead, look for a home with most of your must-haves and good bones, where you can change or add anything else you need later. Is buying a fixer-upper right for you? It’s helpful to compare what homes are selling for move-in ready with all your wants. Then, check your budget. You may have to rethink the must-haves vs. the wants. Is a larger home ready for improvements, or is something smaller and done more critical? I recommend looking up-sold data and starting to build your list.

Find Out What Homes are Selling For By City

Macomb County Sold Home Prices

[sp_wpcarousel id=”51560″]

Oakland County Sold Home Prices

[sp_wpcarousel id=”12297″]

Mistakes Home Buyers Make #3: Don’t Be House Poor

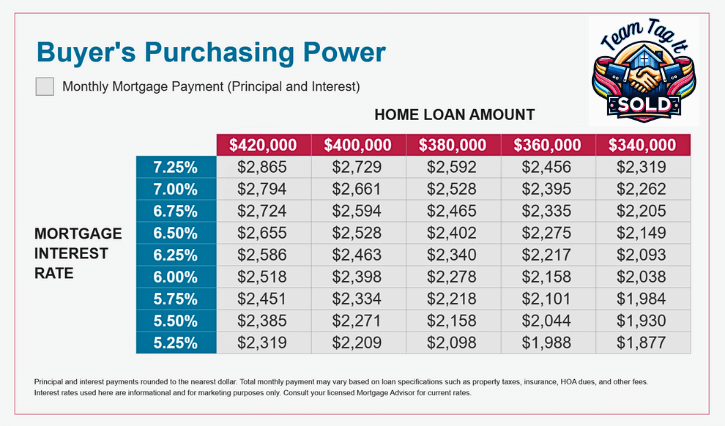

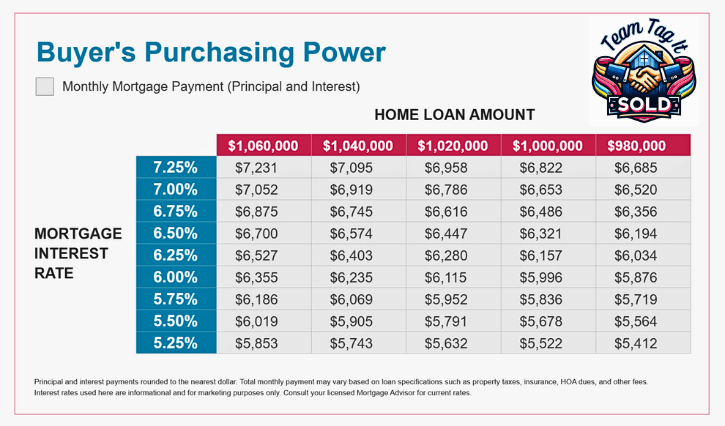

Now that you know current home prices in Metro Detroit and feel comfortable with your budget, the next step is to verify your home purchasing power in two ways: with a lower price and higher mortgage rate and with higher prices and lower mortgage rates.

Property Taxes

Property taxes are part of your budget, and depending on the area, there could be a huge difference in your monthly payment based on property taxes. Here is the Michigan Millage Tax Rate. Contact the municipality and ask for the Assessor’s office; they can also tell you the millage rate by school district. The formula goes like this: The purchase price of the house ➗ 2 = X. Now take X and times that by the millage rate and ➗ 12 and add that to your monthly payment. Your initial payment will be lower until the municipality gets notified of the new owners and updates the home’s value. If you would like more clarification, give me a call at 248-343-2459. Taxes bills go out in June and November. Work the higher taxes into your budget; you’ll thank me later.

Your Home owners Insurance

Next, contact several homeowner insurance companies to get bundle quotes for home and auto insurance for a rough estimate. Use the graphs in the carousel to determine your principal and interest, then add taxes and insurance to see if you’re still within budget or need to make adjustments.

Know Your Purchasing Power ⤵️

Click the Picture to Enlarge ⬆️

With today’s mortgage rates and home prices, buying a home is expensive. It might be tempting to stretch your finances to get the house you want, but avoid overextending your budget. Don’t forget to add the fun things you enjoy to your budget, like vacations and hobbies. It’s crucial to nail down your mortgage payment within reason based on needs, not wants.

Don’t Miss Out on Assistance Programs That Can Help

Planning for the upfront costs of buying a home takes careful budgeting. You’ll need to account for closing costs, the down payment, and other expenses. But did you know there are assistance programs that can ease these costs? Many buyers overlook them, even though these programs could save thousands.

According to Realtor.com, nearly 80% of first-time homebuyers qualify for down payment assistance, yet only 13% use these opportunities. This means most people miss out on valuable support that could make buying a home easier. Talking with an experienced lender is a significant first step. They can walk you through options that fit your needs, whether you’re buying your first home or your fifth.

Not Working with an Expert Buyer’s Agent

This point might be the most crucial of all. Buying a home involves numerous steps, paperwork, and negotiations. Instead of handling everything alone, having a professional agent by your side is a wise decision. The right agent will alleviate your stress and ensure a smoother process. As CNET explains:

“Attempting to buy a home without a real estate agent makes the process more arduous than it needs to be. A real estate agent can provide you with professional legal guidance, market expertise, and support, which will save you time, money, and stress. They can also increase your chances of finding the right home, so you don’t have to spend hours scouring the internet for listings.”

Take the time to interview different agents, and don’t just pick the first one you find online because you saw a house you like. Find your agent first, then start looking for your new home.

Schedule a Buyer’s Consultation ⤵️

That’s a lot to take in 🤩 Ready to explore the market and find your perfect home? Schedule a Zoom call with me, and we’ll review the sold data, understand your purchasing power and property taxes, and answer your questions and concerns. I’ll share my screen to give you a clear view of the market insights and help you make informed decisions. If you need to sell first, visit Top 3 Home Selling Questions Answered. I’ll walk you through Step #1. Find what your home is worth in today’s market and your equity gains.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

Final Thoughts

Mistakes can cost you time, frustration, and money. If you’re looking to buy a home in today’s market, having a professional can help you avoid these pitfalls. Let’s connect to ensure a smooth and successful home-buying experience.⤴️

More Help Is 1️⃣ Click Away⤵️

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Crack the Mortgage Rate Code: Know the WHY and Save💲

Today’s Mortgage Rates: What’s Driving the Change 📈📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Learn How To Master Pricing Your Home Like a Pro 💥🏡

Real Estate Guides for Buying and Selling a Home📚

New Construction in Metro Detroit Homes for Sale🏡🔍

Discover How Your Home Equity Can Fund Your Next Move💰🚚

FHA Mortgage: What is It and How Can You Benefit in Metro Detroit📊💰

Home Purchasing Power – Do You Know Your’s❓🏡

Metro Detroit MI Housing Market Trends by City 🔎📊

Top 3 Home Selling Questions Answered 🏡❓

Metro Detroit MI Homes for Sale by City 🏘️🎯

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓📊

Home Pricing Missteps 😱🏡

Metro Detroit MI Sold Home Prices by City💰🏠

1st-Time Homebuyers: Tips to Make Your Dream Come True🏡🥳

1st-Time Homebuyers Saving Strategies🔑💲

Is Owning a Home Still Your Dream – Help is Here💥🏡

Home Down Payment Assistance Programs : Need Help? 🥰💯

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.