This article explains how Mortgage Rate Cuts can directly increase your Home-Buying Power, especially in competitive markets like Metro Detroit. 📉🏡 You’ll learn how rates shape your budget, influence monthly payments, and impact when to buy or refinance. 💰 Whether you’re buying or selling, this guide gives you the timing advantage you need to make smarter moves. 🎯

🏡 How Mortgage Rate Cuts Impact Your Home Buying Power

Mortgage rates are one of the most powerful forces in your home-buying journey. But guess what? Most people completely overlook them. 😮 If you’re like many buyers in Metro Detroit, especially if this is your first rodeo, you’re probably focused on the fun stuff. 🏡You might daydream about the perfect backyard, browsing listings, or zooming in on school ratings.

All of that matters. But let’s be honest—none of it matters more than your mortgage rate. Why? That tiny percentage controls your home-buying power. When mortgage rate cuts happen, your Home-Buying Power increases. It’s like stretching a dollar further at the grocery store. 🛒 But when rates rise, the opposite happens. That same monthly budget? It won’t go as far. Even a slight dip in the rate can unlock major savings. That’s why understanding Mortgage Rate Cuts is key to buying smarter, not just dreaming bigger.

🏦 What Is a Mortgage Rate—and Why Does It Matter?

Let’s keep it simple. A mortgage rate is the cost of borrowing money to buy your home. It’s shown as a percentage and added to your loan by the lender. It might sound boring, but trust us, it’s anything but. This rate determines your monthly payment and can swing your budget in big ways. Here’s where things get interesting: Even a tiny drop in the rate, like 0.25%, can make a noticeable difference.

With mortgage rate cuts, you can go one of two ways:

✅ Stretch your home buying power – Get more house for the same budget.

💰 Lower your payment – Save money each month while keeping your budget steady.

Let’s say you’re shopping in Metro Detroit, and rates fluctuate slightly. Suddenly, that bigger yard, extra bedroom, or second bathroom is totally within reach. That’s the magic of mortgage rate cuts. Knowing how they impact your Home-Buying Power helps you time your move and save big over the life of your loan.

📉 Rate Cuts vs. Home Buying Power: A Direct Relationship

Mortgage rate cuts aren’t just headlines—they’re tools that directly increase your Home Buying Power. 📊 When interest rates fall, your money goes further. 💵 That’s the bottom line.

🏡 Picture this: You’re pre-approved and exploring homes in Metro Detroit. You’ve set a budget that feels realistic. But your budget doesn’t live in a bubble—it moves with mortgage rates.

📉 When rates drop, lenders often allow you to borrow more, without increasing your monthly payment. That’s the power of mortgage rate cuts.

So, why do buyers take action when rates fall? It’s not hype—it’s math. ➕ A lower rate gives you more home for the same payment. That might mean an extra bedroom, a better school district, or a larger backyard. 🌳

📌 This is why understanding the link between mortgage rate cuts and Home Buying Power is essential, especially in a competitive market like Metro Detroit.

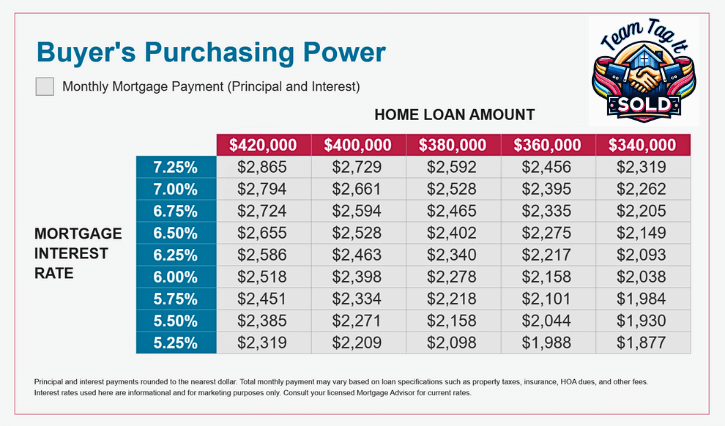

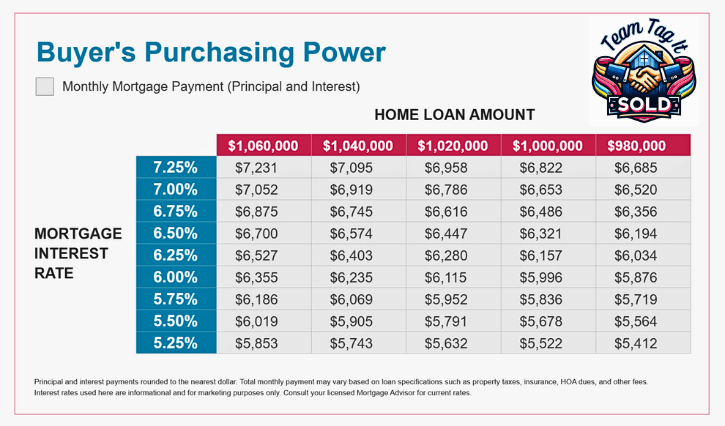

To help you visualize this, we’ve included a 📊 carousel of graphs. These clearly show how small rate changes can reshape your buying power.

Each slide tells a simple story: how much home you can afford as rates rise or fall. Use it as your guide before making your next move. 🧭

🔁 Swipe the Carousel: See the Difference Yourself

We understand—no one wants to stare at spreadsheets. 📉 Each slide tells a simple story: how much home you can afford as rates rise or fall. Use it as your guide before making your next move. 🧭 These charts reveal exactly how Mortgage Rate Cuts influence your Home Buying Power, especially in Metro Detroit. 📍As you swipe through, watch for these key insights:

✅ How much more can you borrow when rates fall

✅ How far can your budget stretch in today’s market

✅ How lower rates improve long-term affordability 🏠

Even a small rate drop can reshape both your budget and buying timeline. That’s where these graphs come in.📊 Our visual breakdown helps you:

🔹 Set realistic expectations based on current mortgage rates

🔹 Decide whether to buy now or wait for a better opportunity

🔹 Know when refinancing might save you money later on

Each slide gives you a new perspective on the rate-to-payment relationship. Together, they show the complete picture of your buying power in any market.

💡 Pro Tip: Don’t skip the carousel. It’s your visual guide to smarter, money-saving decisions—whether you’re buying, selling, or waiting. ⤵️

🎯 Why Timing Matters in a Volatile Market

Trying to time the real estate market can feel like chasing shadows. It’s difficult—but not impossible. 🕵️♀️When it comes to Mortgage Rate Cuts, timing matters more than most buyers realize. One smart move at the right moment can either boost your Home Buying Power or save you thousands. 💰

Here’s what you need to know:

📉 When mortgage rates fall, your pre-approval gets stronger. That means more buying power and lower monthly payments.📈 But when rates rise, your budget shrinks. That perfect home in Metro Detroit could suddenly be out of reach. 🏡Now here’s the catch—rate changes happen fast. A mortgage pre-approval you receive today might look very different in 30 days. 📆

That’s why it’s critical to know your market—from home prices to mortgage trends—and build a plan first. 🗺️As rates drop, more buyers jump in. That can increase competition and drive up home prices, especially in markets with low inventory and pent-up demand like we’re seeing now.

So what’s the right move? Ask yourself:

🧠 Is it smarter to buy your ideal home before prices increase and refinance later when rates are lower? It’s a question every buyer should consider.✅ You can always refinance to lower your monthly payment.❌ But you can’t change the price you paid for the home. Timing isn’t just about the rate—it’s about knowing when to act before the market shifts. That’s where planning ahead gives you the edge.📊 The carousel graphs ⤴️ in this post will help you understand the whole picture. Use them to spot your sweet spot—before everyone else jumps in.

💡 Understanding Mortgage Rates: The WHY, Not Just the WHAT! 🏡📉

Every day, I break down mortgage rates so you can see the WHY behind the numbers—not just the WHAT! 🔍 These insider tips can save you thousands 💰 over the life of your loan and give you the negotiation edge you need with lenders. 🤝💡Want to learn how to predict 🔮where mortgage rates are heading? ⤵️

🛠️ How to Prepare for Mortgage Rate Cuts & Shifts

You can’t control the market, but you can control your readiness. And that makes all the difference when Mortgage Rate Cuts appear. If you’re buying or selling a home in Metro Detroit, staying prepared puts you one step ahead. Here’s how to make the most of changing rates.

✅ 1. Get Pre-Approved Early: Don’t wait until rates drop. Start your lender search now to see who is offering the best incentives. Get pre-approved —even if you’re browsing. It helps define your Home Buying Power right away. Even a soft pre-approval offers a helpful peek at your price range.

📉 2. Track Mortgage Rates Weekly: You don’t need to wait for breaking news. Even tiny changes in rates can shift your buying power overnight. Set a reminder to check rates each week. Staying in the loop gives you an edge.

🏃♂️ 3. Work With a Quick-Acting Lender: Speed matters. If rates dip, you want someone who can quickly lock that rate in. Choose a lender who communicates well and responds quickly—it can save you big money.

🔒 4. Ask About Rate Lock Options: Many buyers don’t realize they can lock in today’s rate while still shopping. Don’t miss that chance. Please talk with your lender and ask what lock-in options they offer.

📲 5. Set Up Mortgage Rate Alerts: Technology can help! Use your favorite finance site or app to get alerts when rates shift. That way, you never miss a chance to act fast during Mortgage Rate Cuts—and improve your Home Buying Power right on time.

📌 Prepared buyers make powerful moves. When you understand how interest rates work, you get more control, more choices, and a real edge in today’s market.

🚀 Boost Your Homebuying Power

Let’s Explore Together! ⤵️

Wow! 🤯 There’s a lot to think about when buying a home, and feeling a little overwhelmed is normal. The big question is: When is the perfect time financially to jump into the market and buy your dream home? 🏡💰Let’s connect and break it all down together! We’ll review recent rate cuts and home price trends and determine the magic numbers that work for you. We can schedule a Zoom call, and I’ll share my screen to walk you through everything step by step. ✨ Got questions❓ or prefer a quick chat 💬Call or Text 📞 248-343-2459. I’m here to help anytime! 🆘 Stay up to date and ahead of your future competition by visiting the website for updated articles 3 to 4 times a week. Mortgage Rates are updated daily.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

🧭 Final Thoughts: Rate Awareness Is Real Estate Power

Knowledge isn’t optional in today’s fast-moving market—it’s your biggest advantage. 📚 Understanding how Mortgage Rate Cuts impact your Home Buying Power is essential. Whether you’re actively looking or just starting, being rate-aware gives you control

💰 Control your finances

⏳ Control your timeline

🏡 Control your lifestyle and home goals in Metro Detroit

Don’t sit back; instead, take action and prepare.

🧮 Calculate how much home prices could rise versus how much a lower mortgage rate could save you. This helps you decide when to buy your new home with confidence and strategy.

📊 Dive into the carousel of mortgage rate graphs

% Study how interest rates impact monthly payments and loan amounts

📉 Calculate how a lower rate expands your buying potential

When the right home comes along, be ready. 📦 Because when rates drop, doors open—and you should be ready to walk through them confidently. 📈💰 Let’s get you started. Have a smarter, stronger homebuying journey with the power of timing on your side.📲 Call or text 248-343-2459 to get expert help and personalized strategies. Your future keys are closer than you think. 🎉🔑

💡 Curious what your home is worth? Visit Top 3 Home Selling Questions Answered, where I’ll walk you through steps 1 & 2 of the Price-Driven Approach. Knowing your home’s value is the first step toward maximizing your equity! 💰📈 Let’s kickstart you! Let’s buy today! 🚀🏡

More Help Is 1️⃣ Click Away⤵️

Mortgage Pre-Approval: Your Secret Power 🎓💲

Fixer-Upper Homes for Sale: See the Hidden Benefits 👀

Today’s Mortgage Rates: What’s Driving the Change 📈📉

Home Value Vs. Price Driven Approach to Home Pricing: Myth Busting Revealed 🤫⛓️💥

Learn How To Master Pricing Your Home Like a Pro 💥🏡

How to Choose the Right Buyers Agent:🏠 🛒

Crack the Mortgage Rate Code: Know the WHY and Save💲

Metro Detroit MI Homes for Sale by City 🏘️🎯

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Real Estate Guides for Buying and Selling a Home📚

New Construction in Metro Detroit Homes for Sale🏡🔍

Discover How Your Home Equity Can Fund Your Next Move💰🚚

FHA Mortgage: What is It and How Can You Benefit 📊💰

Metro Detroit MI Housing Market Trends by City 🔎📊

Home Purchasing Power – Do You Know Your’s❓🏡

Top 3 Home Selling Questions Answered 🏡❓

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓📊

Metro Detroit MI Sold Home Prices by City💰🏠

Home Selling Missteps 😱🏡

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.