🏡 Homeowners insurance is essential for protecting your home and investment, but rising costs are making it more expensive than ever. 📈 This article explains why rates are increasing, factors affecting your premiums, and how to find the right coverage without overpaying. 💰✨ Learn smart strategies to save money while protecting your home in Metro Detroit! 🔍✅

Homeowners Insurance: What You Need to Know

Homeowners insurance is a must-have when it comes to protecting what’s likely your biggest investment—your home. While no one wants to think about worst-case scenarios, the right coverage acts as a financial safety net 🛡️ when unexpected events happen. Here’s how it works:

☑️ Covers Repair & Rebuilding Costs – If your home is damaged by fire, storms, or other covered events, your insurance helps pay for repairs or a complete rebuild 🔨.

✅ Protects Your Belongings – Most policies cover personal property like furniture, electronics, and clothing if they’re stolen or damaged 🛋️📱👕.

☑️Provides Liability Coverage – If someone is injured on your property, your insurance can help cover medical bills 🏥 or legal fees ⚖️ if you’re held responsible.

At its core, homeowners insurance = peace of mind. Knowing you’re financially protected from disasters reduces stress and makes homeownership feel more secure. 🏠💙.

But here’s something many homeowners don’t realize—your first yearly insurance payment is rolled into your closing costs, but it’s not a one-time expense. You’ll need to budget for it monthly as long as you own your home, and future payments are rolled into your escrow account along with your taxes.

Costs and Claims Are Rising

Over the last few years, homeowners insurance costs have been climbing in Metro Detroit. According to Insurance.com, four primary factors are behind the increase in premiums:

- 🔺More severe weather and wildfires are leading to higher claims.

- 🔺Insurance companies are leaving high-risk areas, reducing options for homeowners in certain states.

- 🔺Previous rate increases haven’t kept pace with rising claim costs.

- 🔺The cost of rebuilding has gone up due to higher prices for materials and labor.

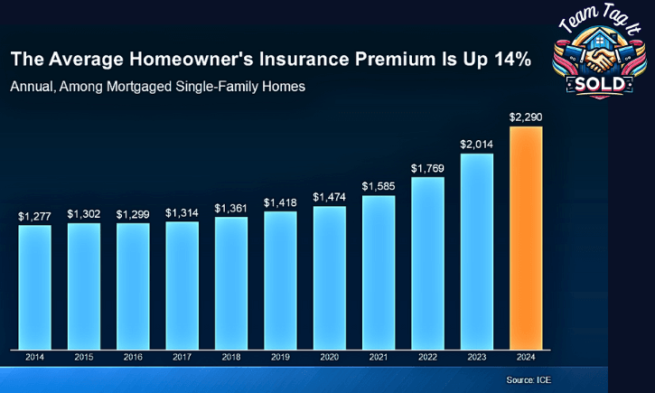

In short, disasters happen more often, repair costs rise, and insurance companies adjust their rates to keep up. ICE Mortgage Technology data shows how much the average annual premium has increased over the last decade (see graph below).

🔥 What You Can Do About Rising Homeowners Insurance Costs

Homeowners insurance isn’t just a good idea—it’s a must-have for protecting your home and investment 🏡. But with rates climbing, finding the right balance between quality coverage and affordability is more important than ever.

💡 Compare Rates & Shop Around – Insurance costs vary based on location, provider, and policy details. Don’t settle for the first quote—get multiple estimates to find the best deal.

💰 Unlock Discounts – Many insurers offer ways to lower your premium. Ask about:

☑️ Security system discounts – Installing alarms or cameras can reduce costs.

✅ Safety upgrades – Reinforcing your roof, adding storm shutters, or updating wiring can make a difference.

☑️ Bundling policies – Combining homeowner insurance with auto could lead to significant savings.

Being proactive pays off. A little research can help you secure solid coverage—without overpaying 💪.

Contact me with any Questions ~ 📲248-343-2459

Schedule an Appointment ~ Call | or Zoom Consultation Here

🏡 Key Takeaways

Buying a home isn’t just about the mortgage payment—there are other key costs to consider, and homeowners insurance is a big one. It protects your investment from unexpected disasters, giving you peace of mind when life throws a curveball.

Yes, homeowners insurance costs are rising, but that doesn’t mean you’re stuck with sky-high premiums. You have options! 💡 By shopping around, asking about discounts, and tailoring your coverage, you can find a policy that fits your budget without cutting corners on protection.

🔹 What’s your biggest concern about budgeting for homeownership? Let’s discuss it and ensure you’re set up for success! 💬💙

More Help Is 1️⃣ Click Away⤵️

Home Purchasing Power – Do You Know Your’s❓🏡

FHA Mortgage: What is It and How Can You Benefit in Metro Detroit

Today’s Mortgage Rates: What’s Driving the Change 📈📉

Real Estate Guides for Buying and Selling a Home📚

Discover How Home Equity Can Fund Your Next Move💰

Top 3 Home Selling Questions Answered 🏡❓

Metro Detroit MI Housing Market Trends by City 🔎📊

Metro Detroit MI Homes for Sale by City 🏘️🎯

Metro Detroit MI Sold Home Prices by City

Learn How To Master Pricing Your Home Like a Pro 💥🏡

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.