Is one of your goals this year to purchase a new home in Metro Detroit? Are you unsure how much Home Down Payment you need or what down payment assistance is available?

Understanding Home Down Payments and Programs

Are you thinking about buying your first home in Metro Detroit? Gathering enough cash for all the expenses might seem overwhelming, especially the down payment. You’ve probably heard the rule: save 20% of the home’s price for the down payment. But guess what? That’s not always true.

There is no need to stress over saving 20% unless your specific loan or lender demands it. So, you might be nearer to owning your dream home than you thought.

According to The Mortgage Reports:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

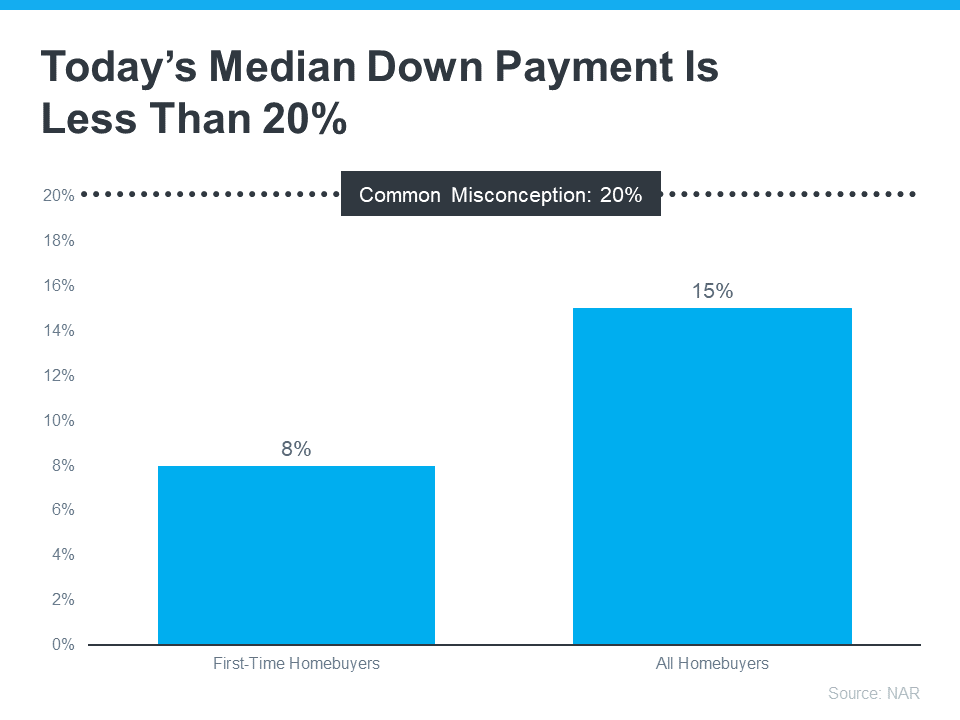

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today, it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you initially thought.

Your Resources to Help You Towards Your Goal

The traditional 20% down payment is often recommended because it can help you avoid paying Private Mortgage Insurance (PMI), which protects the lender if you default on your loan. However, it’s essential to know that many lenders offer mortgages with down payments as low as 3-5% for qualified buyers. According to Down Payment Resource, over 2,000 homebuyer assistance programs are also intended to help with the down payment.

Programs to Help First-Time Homebuyers

FHA Loans: The Federal Housing Administration (FHA) offers loans with down payments as low as 3.5% for first-time homebuyers. These loans are popular because of their lenient credit score and income requirements.

VA Loans: If you’re a veteran or active-duty service member, you may be eligible for a loan from the Department of Veterans Affairs (VA). VA loans require no down payment and no PMI.

USDA Loans: The U.S. Department of Agriculture (USDA) provides home loans in eligible rural areas. These loans require no down payment and offer lower interest rates.

Conventional 97 Loans: Some conventional loans, known as Conventional 97 loans, allow for down payments as low as 3%. Fannie Mae or Freddie Mac backs these loans, which have more stringent credit requirements than FHA loans.

Down Payment Assistance Programs: Many state and local governments offer down payment assistance programs for first-time homebuyers. These programs can provide grants or low-interest loans to help cover down payment and closing costs.

HomeReady and Home Possible: Fannie Mae’s HomeReady and Freddie Mac’s Home Possible programs are designed for low-to-moderate-income homebuyers and allow for down payments as low as 3%. They also offer flexible funding options and reduced mortgage insurance premiums.

Tips for First-Time Homebuyers in Metro Detroit

- Budget Wisely: Determine how much you can realistically afford to pay for a down payment without straining your finances.

- Improve Your Credit Score: A higher credit score can help you qualify for better loan terms and lower down payment requirements.

- Explore All Options: Research various loan programs and down payment assistance options available in your area.

- Consult with a Mortgage Lender: A lender can help you understand your options and guide you through the mortgage application process.

Find out what you can afford in your new home in Metro Detroit and your monthly mortgage payment. Also, add in your yearly homeowner’s insurance divided by 12 months. The most important is your taxes. Don’t go by what the current seller is paying. Your taxes will be higher overall. Call the municipality you want to move to get their current tax millage rate. Divide the sale price in half, multiply by the millage rate for the new tax amount, divide by 12, and add to the payment.

It’s not just about the numbers; it’s about knowing how mortgage rates are calculated, what economic factors are causing them to go up or down, and what changes the Fed is making to policy that may cause a shift impacting mortgage rates in Metro Detroit. These trends impact mortgage rates and your monthly payment. Find out how you, too, can learn to predict where mortgage rates are heading.

Boost Your Homebuying Power ~ Let’s Explore Together!

Wow 🤯, that’s a lot to take in. I’m sure you’re feeling a little a little overwhelmed. There is a lot to consider: when is the perfect time financially to jump into the market and buy your ideal home? Let’s connect to discuss how recent rate cuts and home price trends and figure out the magic numbers! We can schedule a Zoom call where I’ll share my screen and walk you through the details. Would you prefer an in-person meeting or a phone call? Let’s set up a time that suits you best. I’m here to help you make the most of these opportunities.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

Final Thoughts

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Slight Rise Alert📢

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Your Home Didn’t Sell: Let’s Fix That! 🔄🏡

3% Mortgage Rate vs. Real Life: Is It Worth Staying Put❓🏡

Mortgage Rate Dips 📉 vs. Home Price Spikes📈Which Matters❓

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

More Homes for Sale: A Warining⚠️ or Opportunity💡

Mortgage Mistakes to Avoid After Applying🏡😱

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.