To know where we’re going, we must review where we’ve been. Crack the Mortgage Rate Code reveals how to spot headlines 📰 that trigger a rate spike ⬆️ or a dip ⬇️. With the latest insights 🔎, you’ll learn when rates may fall and stabilize. Time your purchase right and save thousands 💲 on your next home in Metro Detroit. 🚀

Let’s Crack the Mortgage Rate Code and Save🏡💰 ~ Week Ending October 3, 2025

Hey, Metro Detroit neighbors! 👋 I’ll provide fresh economic insights on where mortgage rates are headed, along with detailed analysis, weekly. Here, we don’t track the “WHAT“; I’ll focus on the “WHY.” In time, you’ll learn how to predict those shifts and lock in on a dip, not a spike. ⏳ For Next week’s predictions, 🔮 don’t miss What My Crystal Ball 🔮 is Telling Me Regarding Future Mortgage Rates in Metro Detroit at the very end of this article. 💯🏆⤵️

✨Bookmark this post for your weekly insider scoop. Don’t forget to check and bookmark 🔖 Today’s Mortgage Rates ~ For Dip and Spike Alerts 📢 for daily updates. Stay ahead of the game, time it right, and snag the best deal on your dream home! 🏠🔥

💌 Want exclusive alerts? Get updates straight to your inbox or phone. Subscribe to our newsletter for real-time rate shifts, text alerts, and expert insights! 📩📲 Don’t miss out on your chance to save big!

📉 Here’s Your WHY:

Buckle Up🎢Fed speeches could shake things up.

The only thing that could move the needle one way or the other regarding mortgage rates will be the several speeches from different Federal Reserve board members.🏛️ They may give us a glimpse into the economy and the job market. We’ll also get their thoughts on another potential interest rate cut. The last 3 interest rate cuts caused the yield to spike, and mortgage rates skyrocketed. I’m holding my breath; if they cut again, we could see higher mortgage rates. 👿

We are in a holding pattern and will need to review the trends on a day-by-day basis. I recommend bookmarking this blog post 🔖 and Today’s Mortgage Rate Alert 📢 so you’ll be ready to lock in your mortgage rate on a dip 🦸, not a spike. 🦹

Who’s Really To Blame for High Mortgage Rates Today

1 U.S. Treasury Department

- Why they matter: They issue massive amounts of government debt to fund spending.

- Impact: More debt = more Treasury bonds = higher yields = higher mortgage rates. 🚨 Today, the Treasury is auctioning T-bonds, and that’s also creating havoc and chaos in the bond markets.

- When the Treasury floods the market with bonds, investors demand higher returns. Mortgage rates typically follow the 10-year Treasury yield, so they also rise or fall in tandem.

2 Congress & Fiscal Policy

- Why they matter: They approve budgets, stimulus, and deficit spending.

- Impact: Large deficits force the Treasury to borrow more, driving up the 10-year Treasury Yield.

- Translation: If Congress keeps spending without offsetting revenue, it fuels the debt spiral and pushes mortgage rates higher.

3 Bond Market & Investor Sentiment

- Why they matter: Mortgage rates closely track long-term bond yields, particularly the 10-year Treasury yield.

- Impact: If investors fear inflation, recession, or political instability, they demand higher yields.

- Translation: Mortgage rates spike when bond buyers get nervous or expect more Treasury issuance.

4 Mortgage Lenders & GSEs (Fannie/Freddie)

- Why they matter: They price loans based on risk, demand, and bond spreads.

- Impact: If spreads widen (e.g., between mortgage-backed securities and Treasurys), rates go up.

- Translation: Even if Treasury yields are stable, lenders can raise rates to protect margins or offset risk.

📍 If you’re buying or selling in Metro Detroit, understanding why rates move is your edge. Knowing this helps you secure smarter deals and navigate the market with confidence.

💡Want to Crack the Mortgage Rate Code

🗓️ I’m watching the market by the hour ⌛and have no clue where the market will be heading next. There is no way to predict whether investors will run to or away from investments, causing mortgage rates to SPIKE📈 or DIP. 📉. It will be important to follow Today’s Mortgage Rate Alert 📢 to stay informed regarding the direction of mortgage rates.

📌Understanding the WHY behind the market and learning to predict mortgage rate trends gives you the power💪 to choose whether to lock now 🔒 or wait ⏳ with confidence.

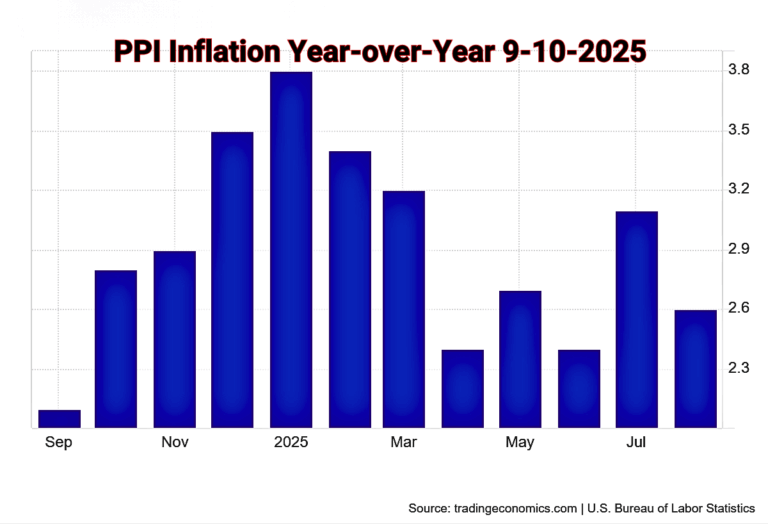

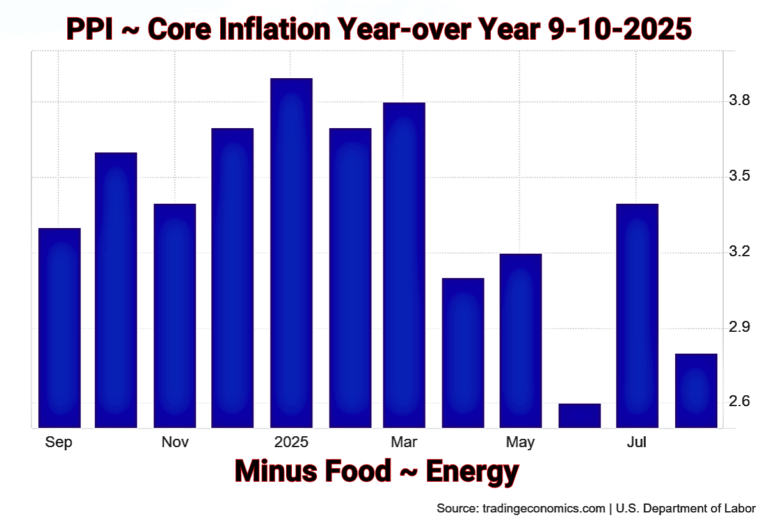

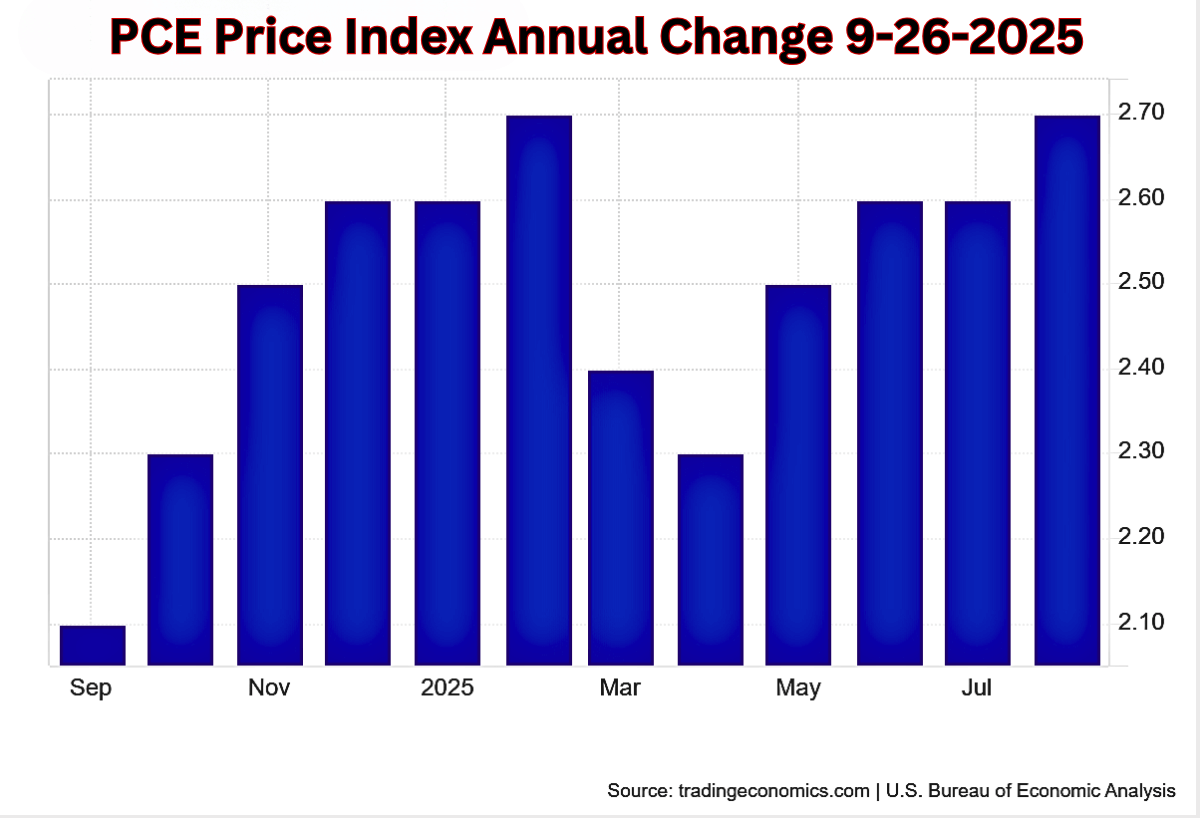

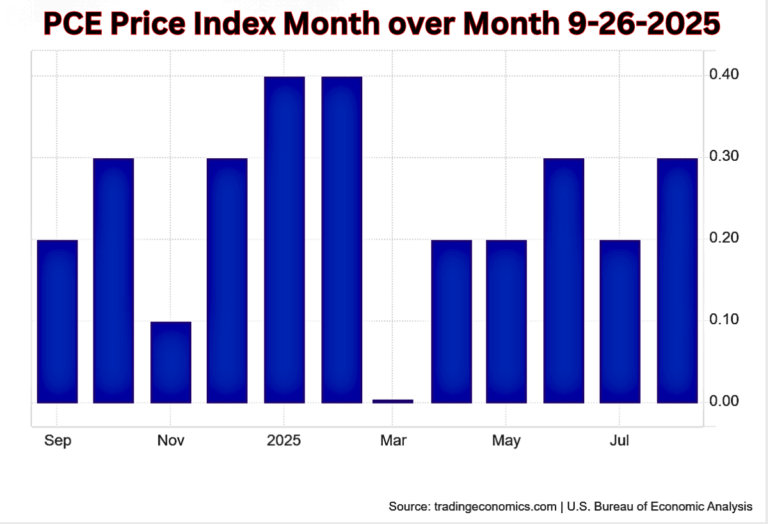

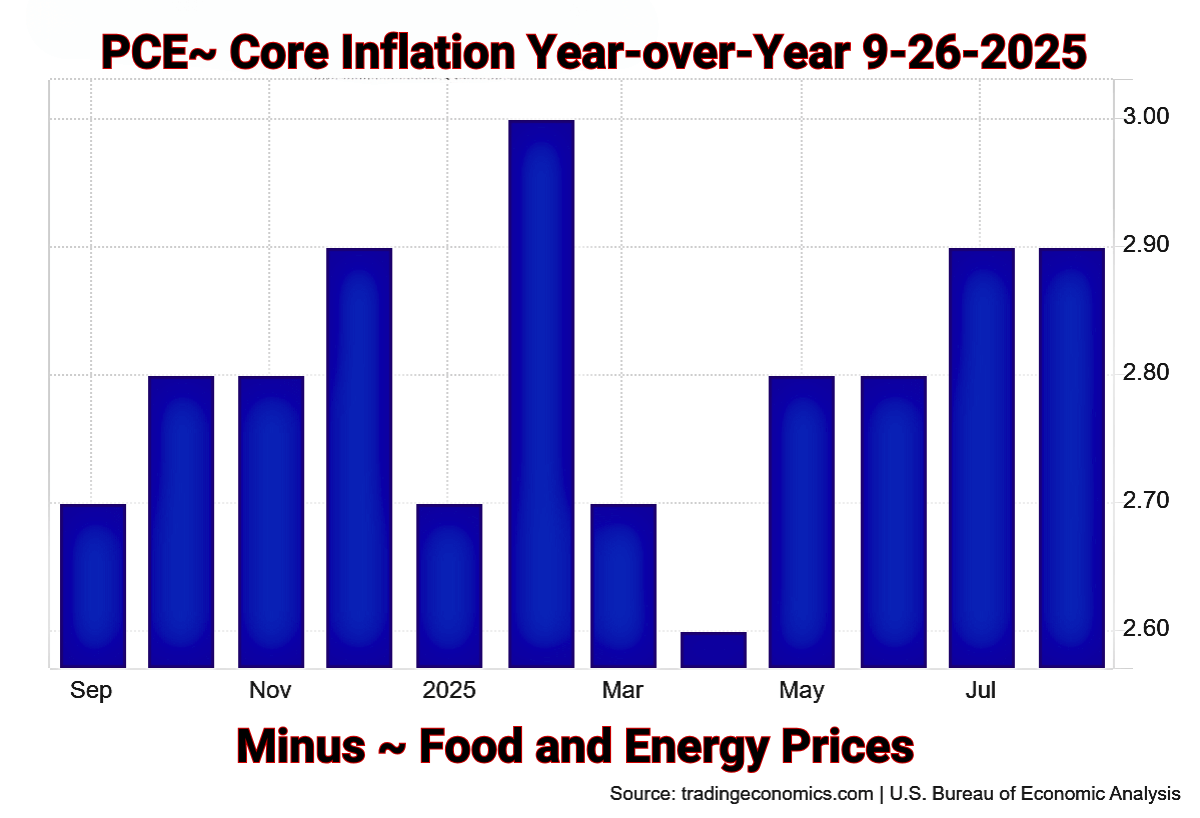

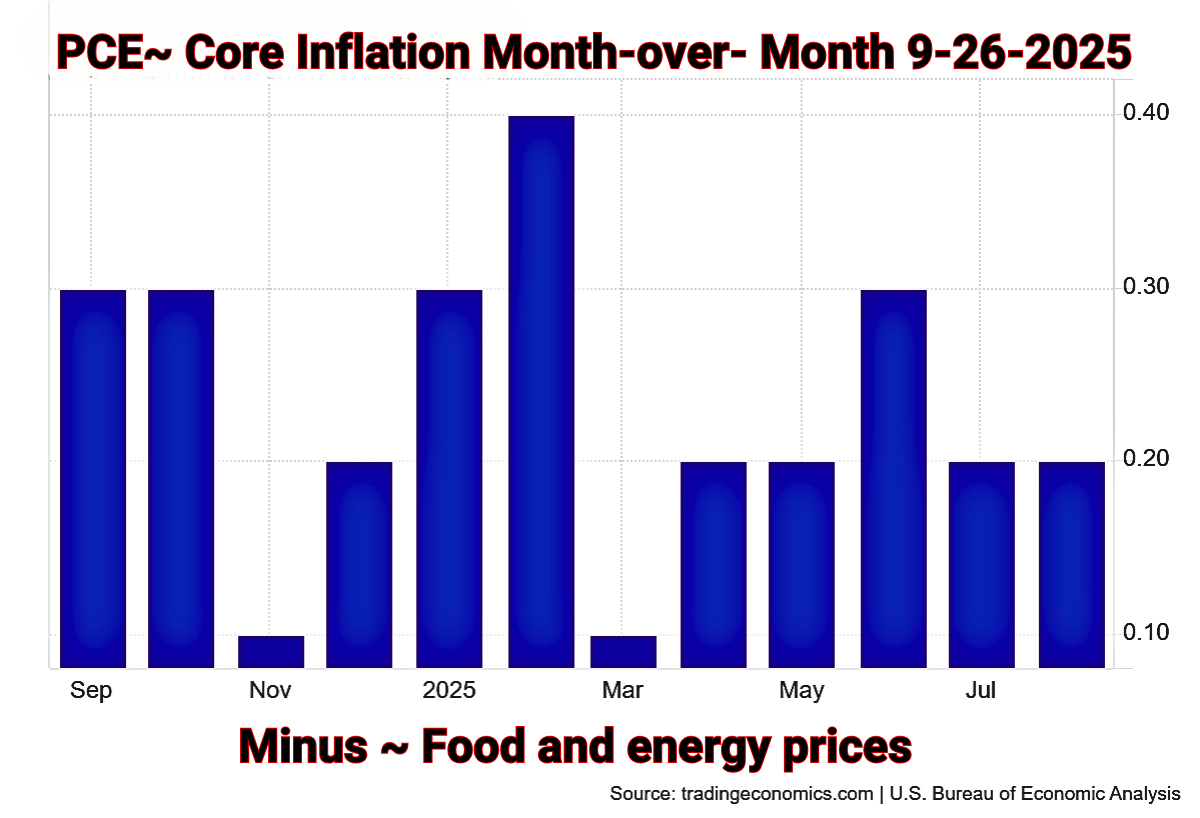

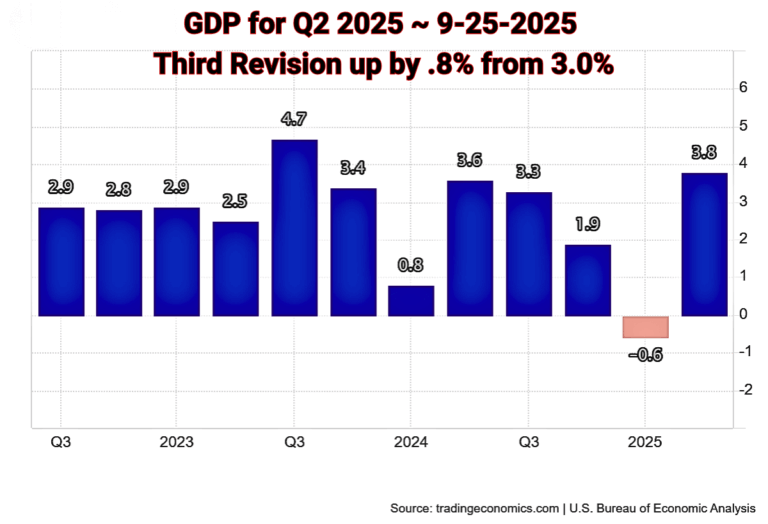

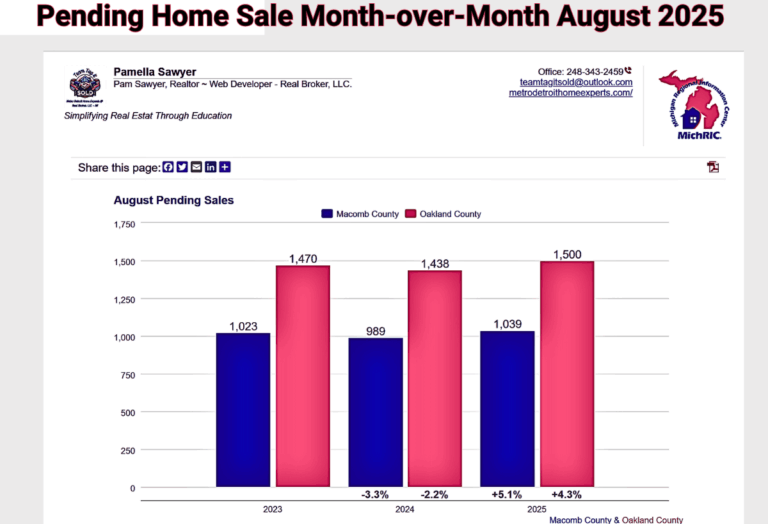

~ 🔎 Economic Reports that affect the bond Yield and your mortgage Rate 📈📉

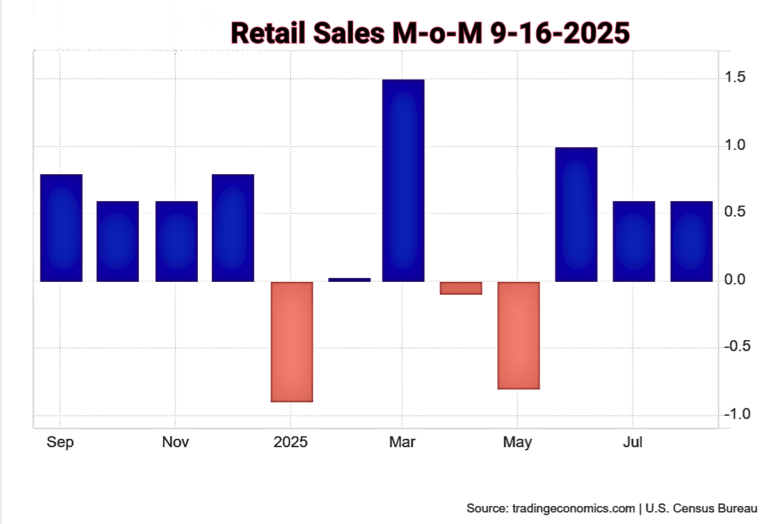

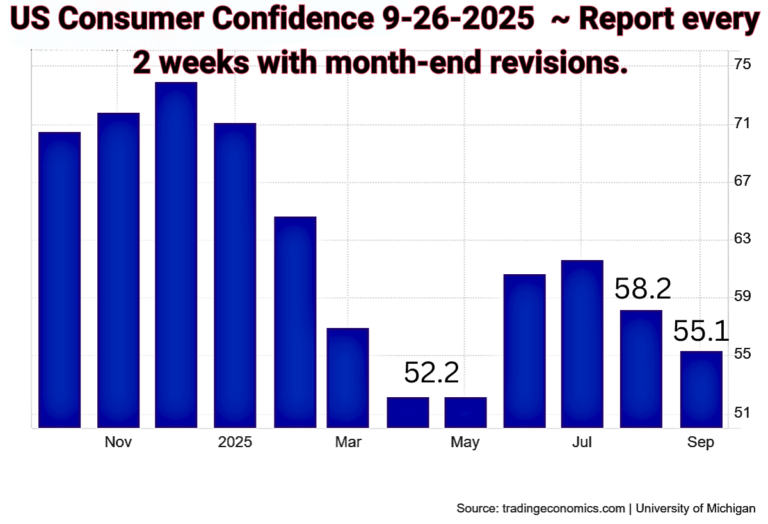

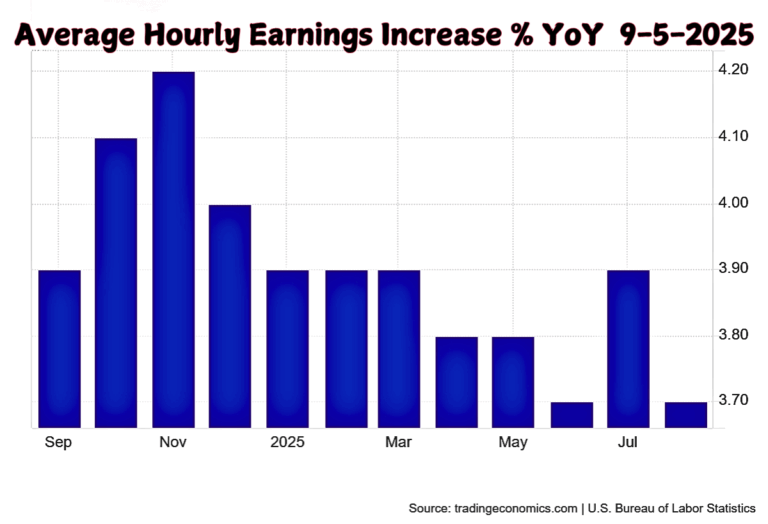

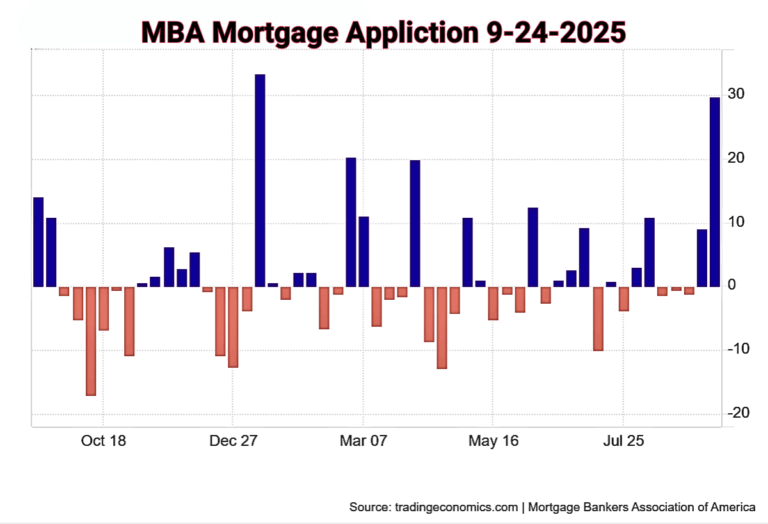

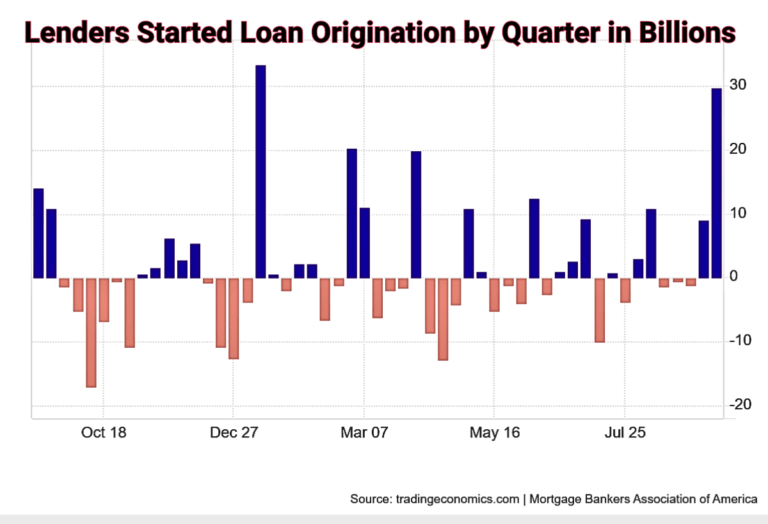

What follows is a carousel of up-to-date economic trend graphs from Trading Economics. I update all graphs as soon as the reports are released, so you can see exactly what I’m tracking in real time. When you’re thinking about buying a new home, a car, or the interest rates on your credit cards, all of these factors matter in determining how much money you spend each month. Mortgage rates and Interest rates play a huge role.

Due to the Goverment Shutdown, No reports are generated

CLICK PICTURE TO ACCESS DATA

🔎 Cracking the Mortgage Rate Code

Every day, I break down WHY mortgage rates rise or fall daily—so you don’t have to guess! 📉📈 Want to stay ahead? I highly recommend 🔖 bookmarking “Today’s Mortgage Rates” for daily updates on what’s moving the market.

The Weekly Review 🗓️

At the end of this post, I’ll reveal 🔮 What My Crystal Ball is Telling Me About Future Mortgage Rates in Metro Detroit! ⤵️🔮Stay tuned! 🚀🏡💰Now more than ever, you’ll need to track daily rates. ⤴️

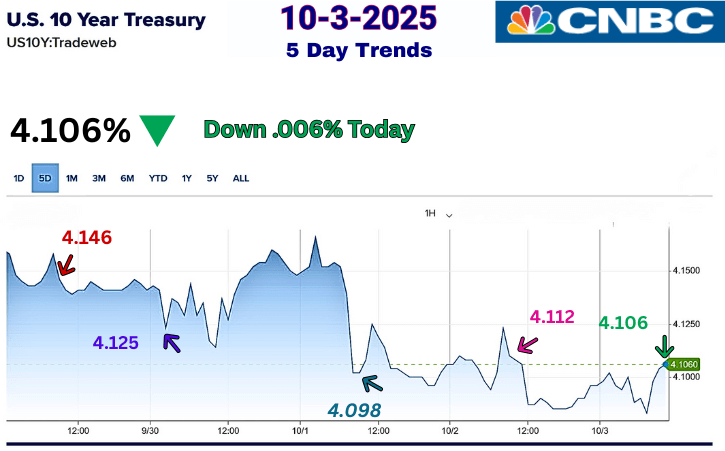

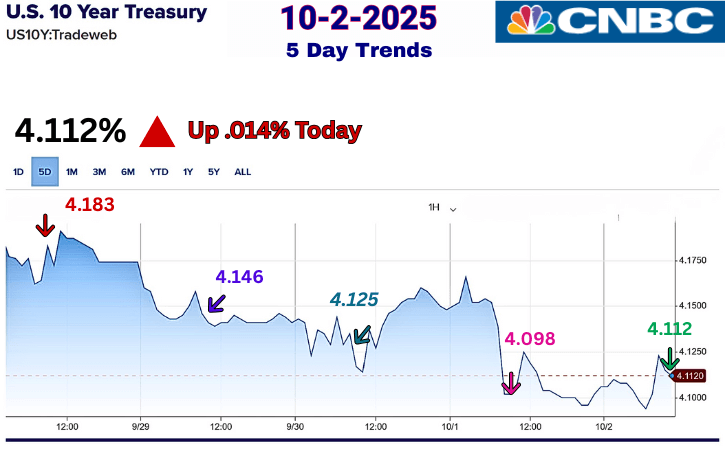

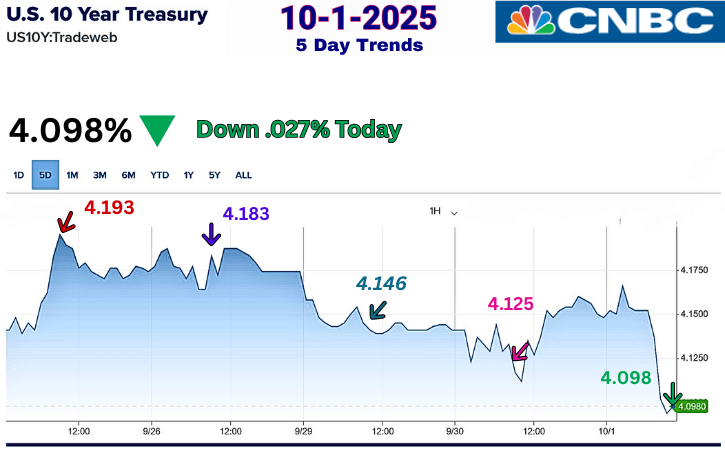

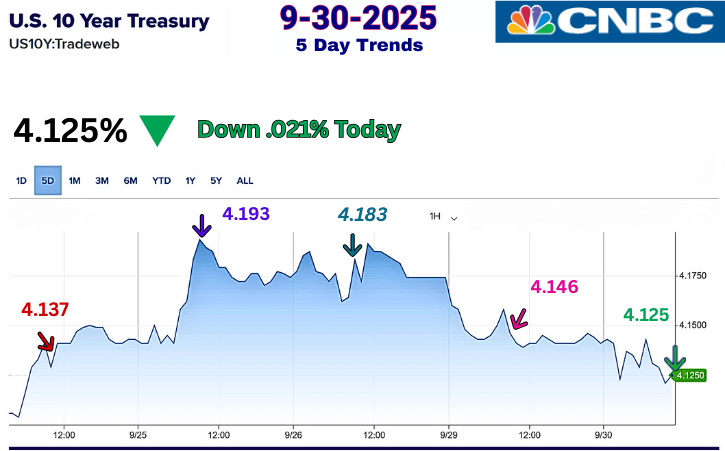

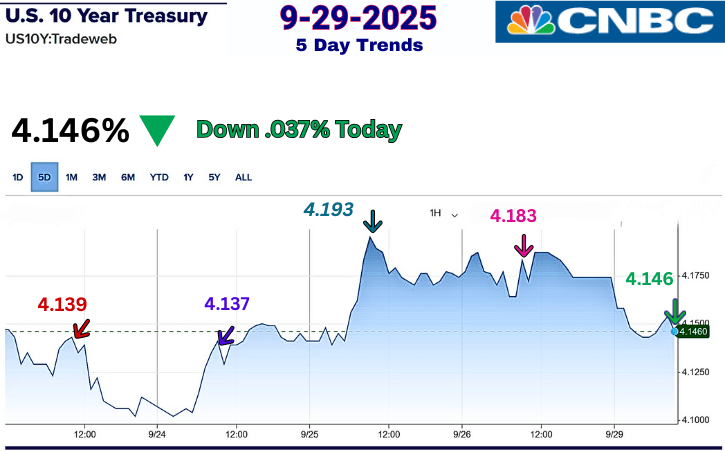

📊 Step #1 ~ Track the 10-Year Treasury Yield ~ iT’S yOUR baSE

To crack the mortgage rate code, you need to know one key fact: The Federal Reserve (the Fed) doesn’t set mortgage rates directly. Instead, the 10-year Treasury Yield is the base number for daily mortgage rates. 📊💡Where the yield goes, mortgage rates usually follow. Understanding these market shifts is KEY 🔑 to predicting where rates are headed next! 🚀🏡💰FOLLOW the BOND Market!

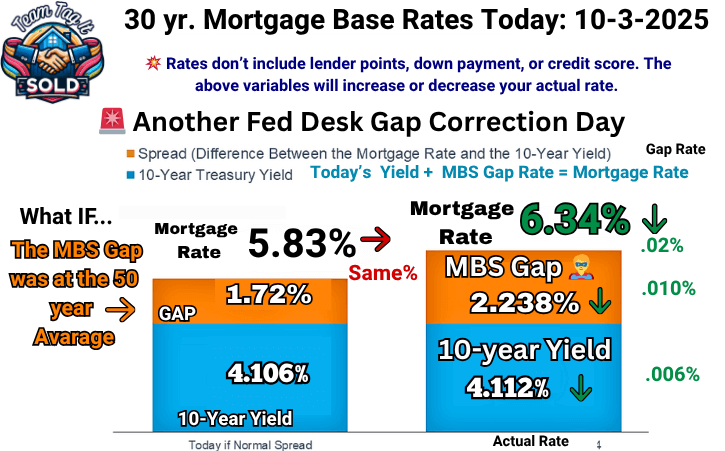

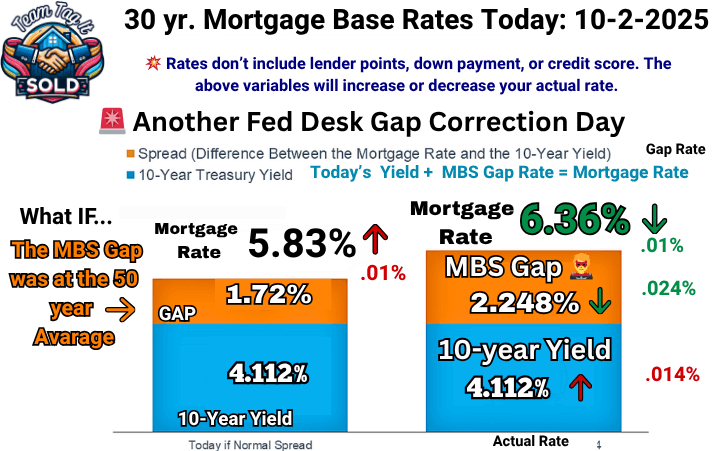

Step #2 ~ 💥 Yield + MBS Gap = Mortgage Rates 💥

💥 This is the most critical piece of the puzzle! 💥 If you want to predict mortgage rate movements, you must understand Mortgage-Backed Securities (MBS). 📊 Once you grasp these trends, you’ll know exactly when to lock your rate and buy your new home confidently, knowing you‘re saving money. 🔑💰

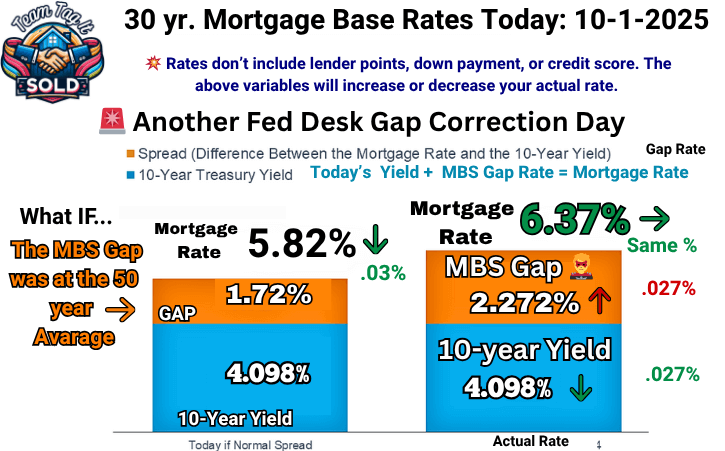

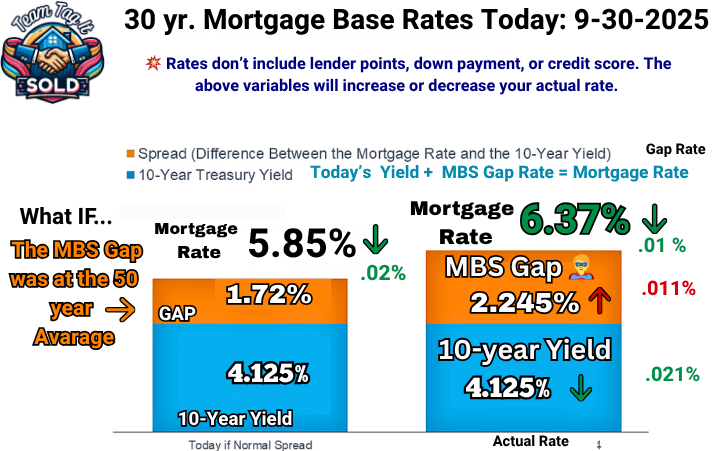

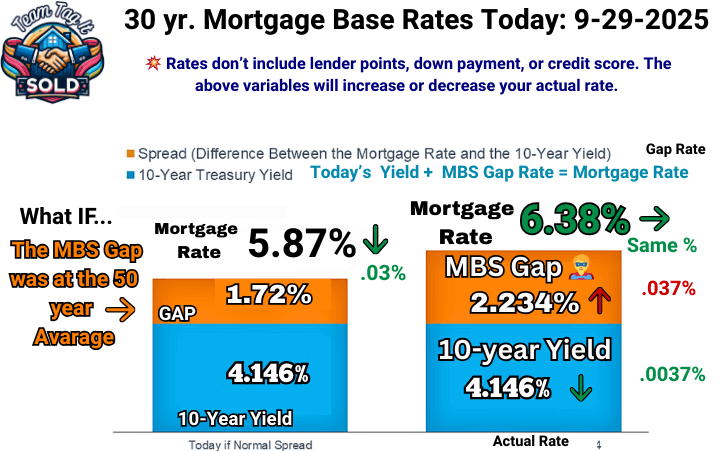

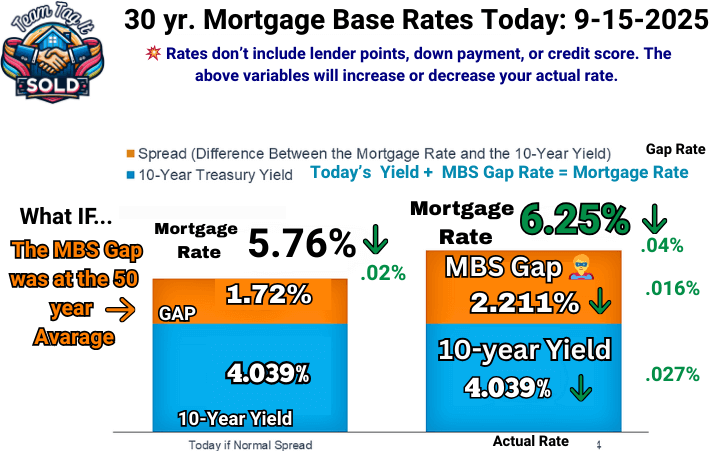

💡 How to Calculate Mortgage Rates

📊 Breaking it down on the Right: 🗓️ Current Mortgage Rates for the week

🔹 The teal graph represents the 10-year Treasury Yield Rate. 📉

🔸 The orange graph shows the MBS Price Gap Rate.📊

➕ Add them together, and you get the mortgage rate—your top number! 💡🏠

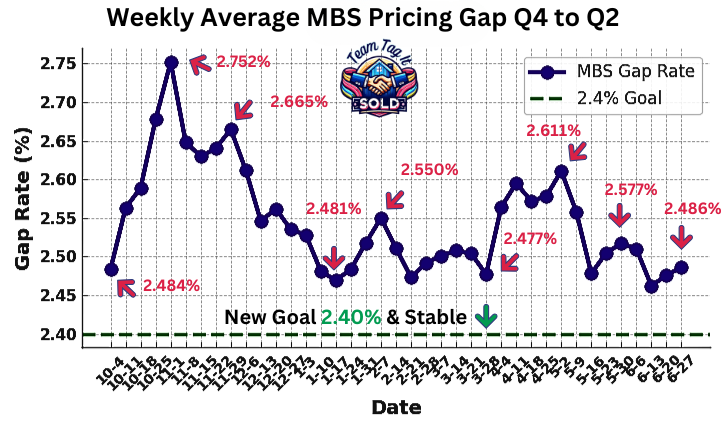

Now, let’s talk about the “What-If” on the left scenario. 📉📈 The left-side graph highlights why tracking the MBS Gap Rate is crucial—it directly affects your mortgage rate! Keeping an eye on this gap can help you predict when rates will rise or fall before they do.

🗓️Historical Trends: What the Past Tells Us: 📊 Over the past 50 years, the average MBS Price Gap Rate was 1.72%.📉 In March 2020, when the government stepped in to support the economy, the MBS Gap Rate jumped to 2.75%. At one point, the MBS Gap was higher in the 3.0% range, and Mortgage rates were pushed to 8%. 🚀

Scroll Through the Weekly Mortgage Rates vs. The What If

Orange = MBS Gap

Teal = 10-Year Treasury Yield

CLICK THE PICTURE TO ENLARGE

The Why Mortgage Rates Spiked

It all started with the interest rate cuts on September 18th, and the yield jumped. Wall Street investors shifted their focus to risk assessment in the bond and securities markets, keeping mortgage rates high throughout the week.

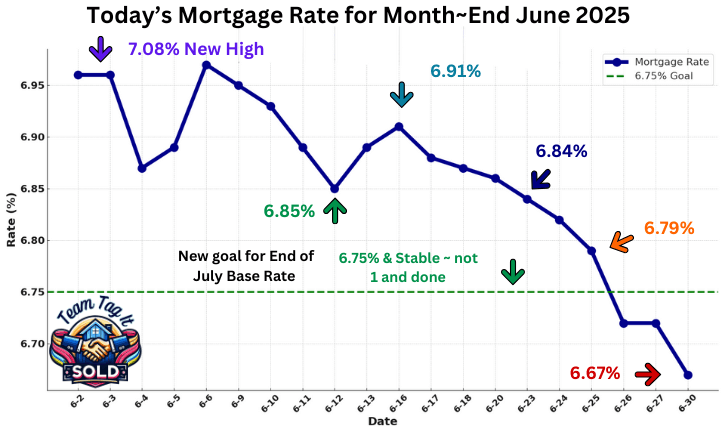

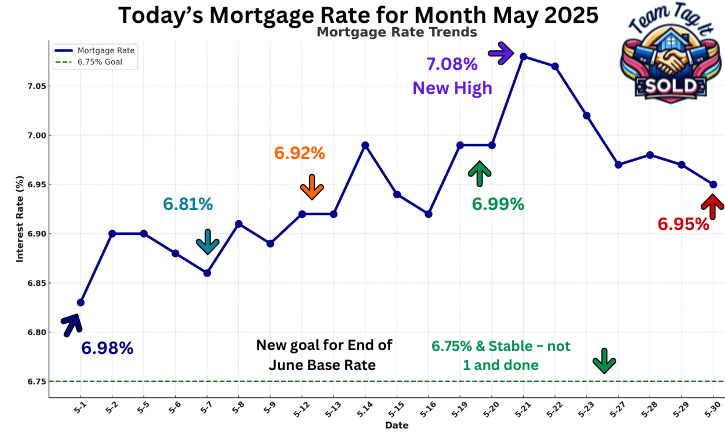

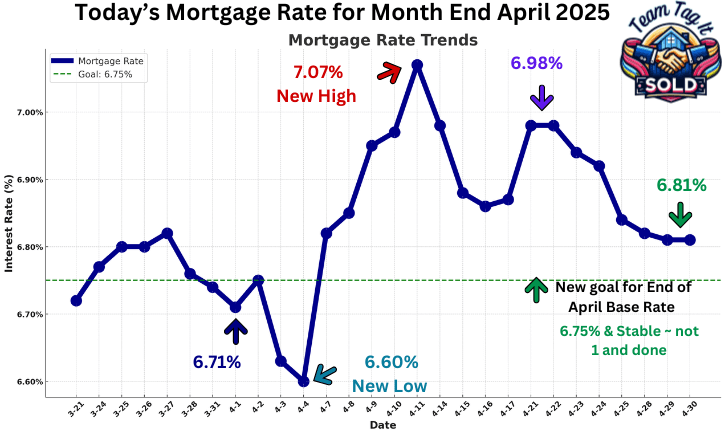

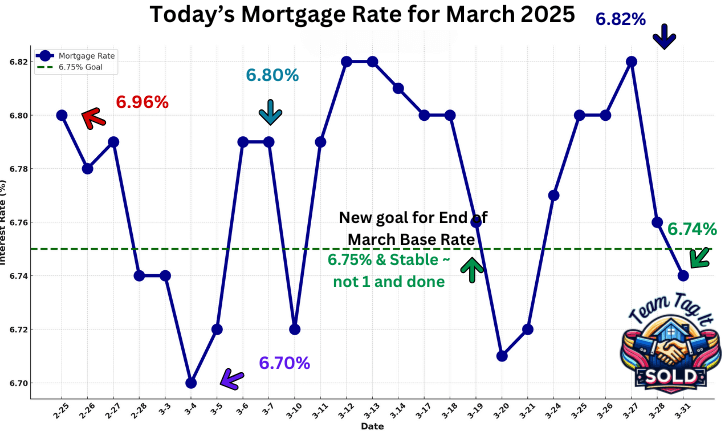

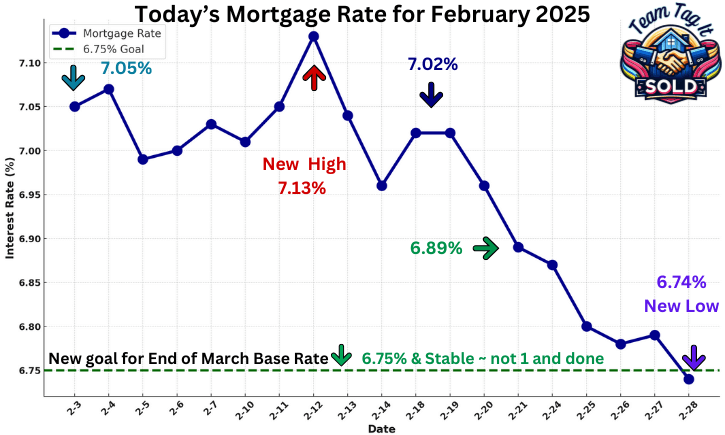

Scroll to view the LAST 9 9-month rate trends

📈 What Happened After the Last Three Cuts?

-

September 18, 2024: The Fed dropped rates by 50 basis points. 🔁 Mortgage rates on September 17, 2024, were 6.11% and on September 18, 2024, rose to 6.17%.

-

December 18, 2024: Another cut followed, but again, yields rose—not because of inflation, but because investors feared 😨 government debt expansion and weak Fed forward guidance. Rates on December 17, 2024, were 6.92%, and on December 19, 2024, rates spiked to 7.14%.

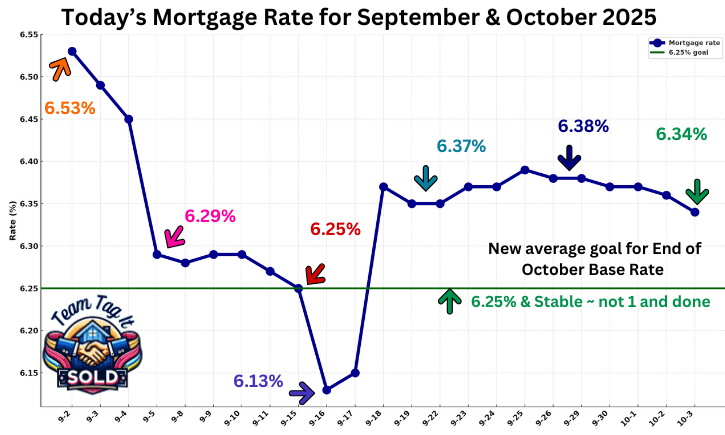

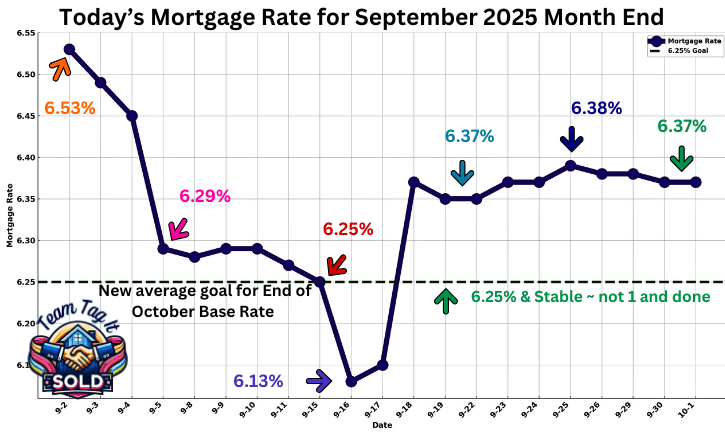

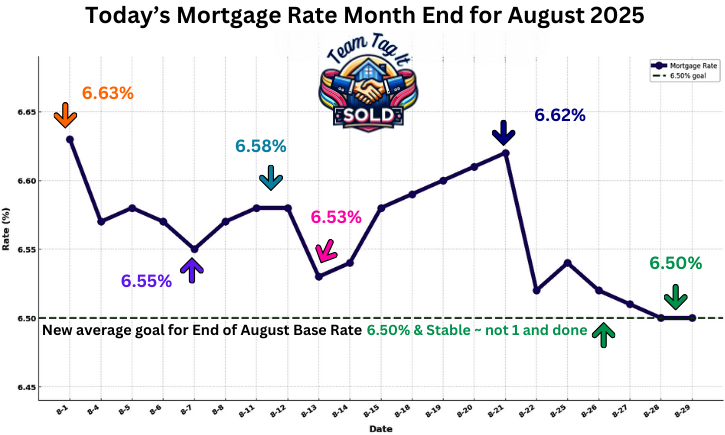

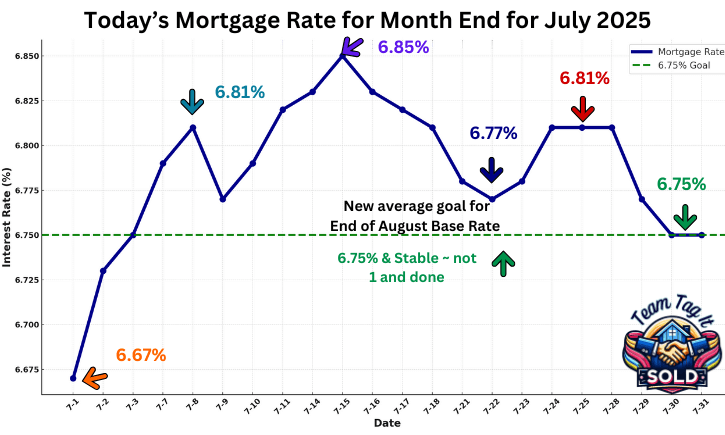

- September 18, 2025: Interest rates were cut by .025% and Wall Street investors hit panic mode, and I’m not sure why. The yield jumped from 4.024% to 4.126%, representing a 0.102% increase. But that’s not the only thing that happened that day to send rates soaring. The Fed desk GLS (think Freddie Mac and Fannie Mae) decreased the rate it would pay investors to buy securities from 5.5% to 5%. That caused the MBS prices to plummet, and the gap increased by .148%. Mortgage rates on September 17, 20255, were 6.15%, and on the 18th, they jumped to 6.37%. Mortgage Rates have stayed between 6.35% and 6.39% up to September 26.

So yes, lenders remember this pattern: Rate cut → market disappointment → yield spike → margin squeeze. When the yield spike occurs, Wall Street is in a state of panic, and chaos ensues. 👿

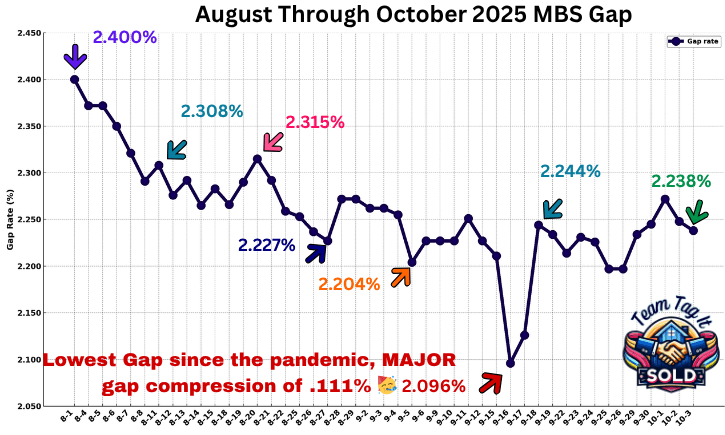

📉 MBS Gap Trends: Why the Fed Desk is engineering MBS Prices

The MBS gap for the past week is back to following the math. But that could all change on Thursday after the Fed Chair Powell provides an update on Interest Rate Cuts. Remember, the Feds don’t determine mortgage rates; the 10-year Treasury yield and the MBS gap do.

1️⃣ Gap Control 🎚️ — The Fed Desk actively engineers the spread (gap) between Treasury yields and mortgage rates. By widening or compressing it, they offset bond market moves.

2️⃣ Artificial Stability 🏦 — When yields rise, they compress the gap so rates don’t spike too high. When yields fall, they expand the gap to keep rates from dropping too far. This creates an engineered illusion of “stable” mortgage rates.

3️⃣ Policy Pressure 📊 — The GSEs (Fannie & Freddie) coordinate with the Desk, ensuring MBS prices align with policy goals — not just market supply and demand.

📉 To put that in perspective: we’ve gone from a market where spreads were holding closer to historical norms, to one where the gap is being forced tighter and tighter. This isn’t natural market behavior — it’s policy-driven compression at work.

Get online Mortgage Quotes from Mortgage Daily News⤵️Click to View More

🏡 Let’s Decode the Mortgage Market Together! 💰🔎

Let’s Connect ⤵️

Wow! 🤯 There’s a lot to take in, but don’t worry—I’ve got you! Mastering this step is key before searching for your dream home. 🔑Understanding how mortgage rates are determined and how to negotiate with lenders on rates and fees can save you thousands over time. 💵 But it doesn’t have to be complicated! Let’s simplify the process together.📅 Schedule a Zoom call with me, and we’ll review the data step by step. I’ll share my screen, giving you a clear view of market insights so that you can make confident and informed decisions about your next steps. ✅✨Got questions❓ or prefer a quick chat

💬Call or Text 📞 248-343-2459. I’m here to help anytime! 🆘 Stay current and ahead of your future competition by visiting the website for updated articles 3 to 4 times a week. Mortgage Rates are updated daily.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

What My Crystal Ball 🔮 is Telling Me about Future Mortgage Rates in Metro Detroit

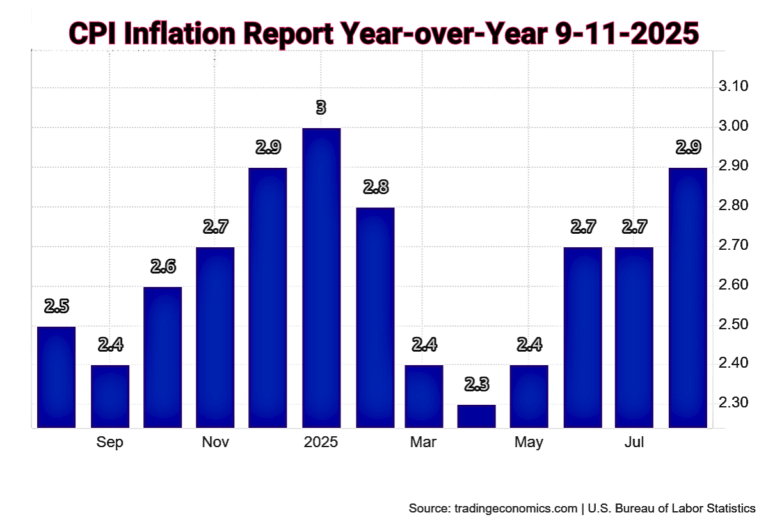

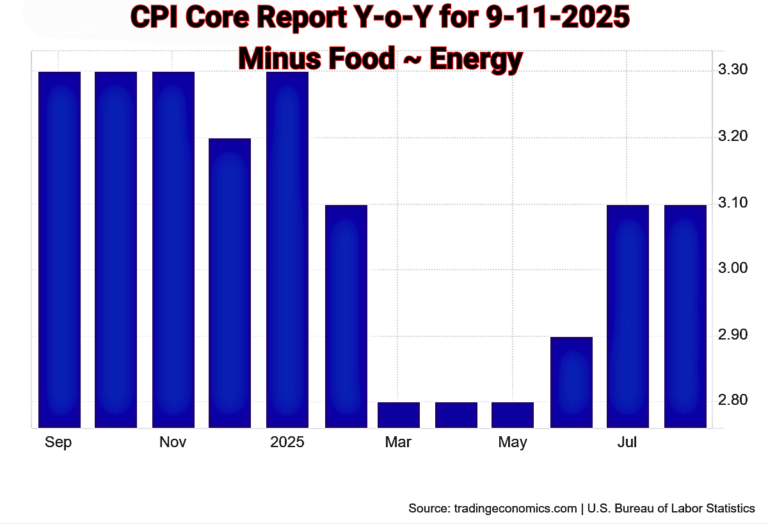

My crystal ball 🔮 is so upset. Inflation remains volatile due to tariffs, and the bond market is fighting for its survival. 🆘 Moving forward, I’ll be expanding my watch 👀 to help bring the future back into focus. 🔮Next week, it will all depend on how Wall Street reacts to the numerous jobs reports released next week.

🚦 Stop, Slide, or Spike? Rates on the Edge

The week kicks off on Tuesday and builds momentum with several key jobs reports. Here’s what I’m watching:

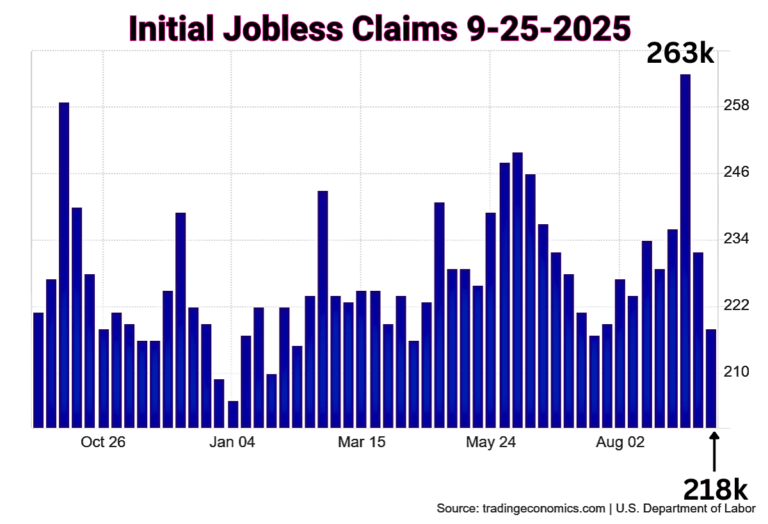

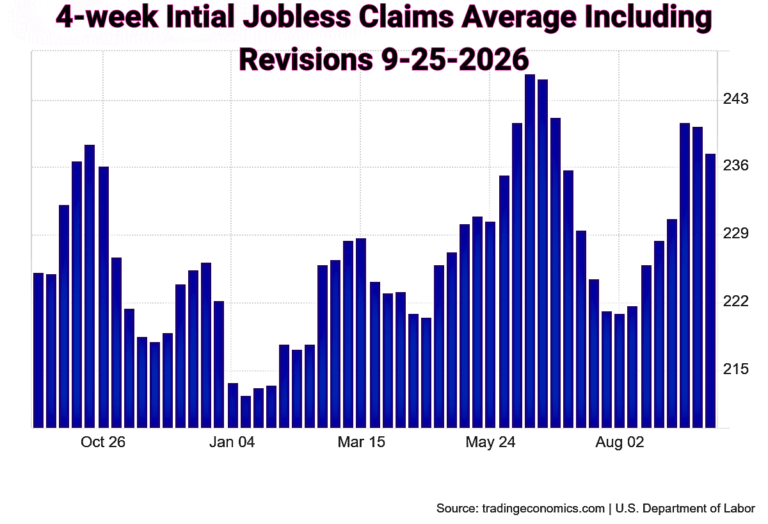

👷♂️ Jobless Claims: The 4-week average revisions for September came in much higher than the original headlines suggested. That signals more weakness than first reported.

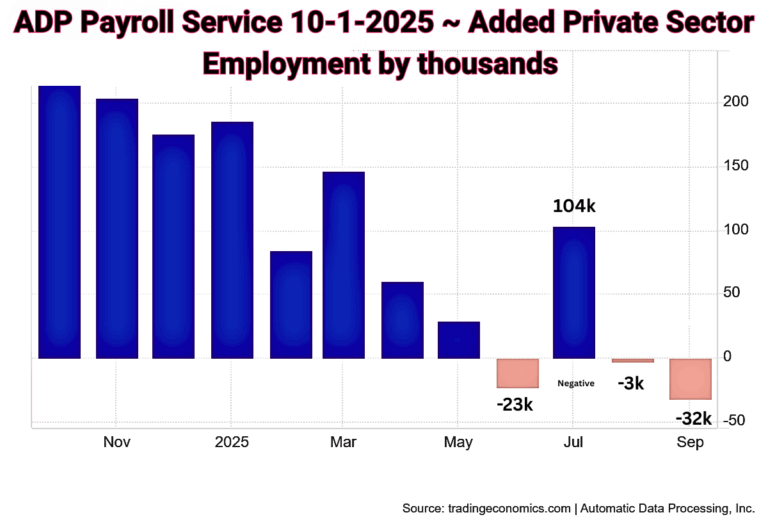

👨💼 Private Sector Hiring: The ADP employment report is expected to show very low new hires, confirming a slowdown in the private sector.

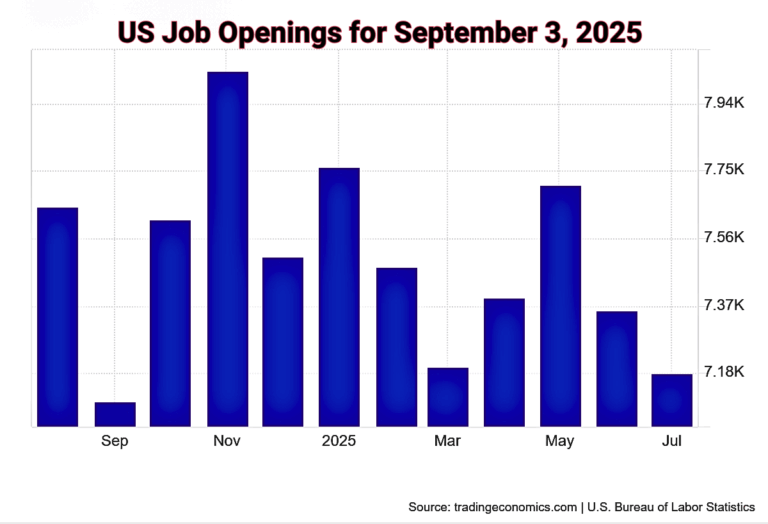

🏢 Job Openings: Predictions call for available jobs to slip from 7.2 million to 7.1 million, another sign the labor market is cooling.

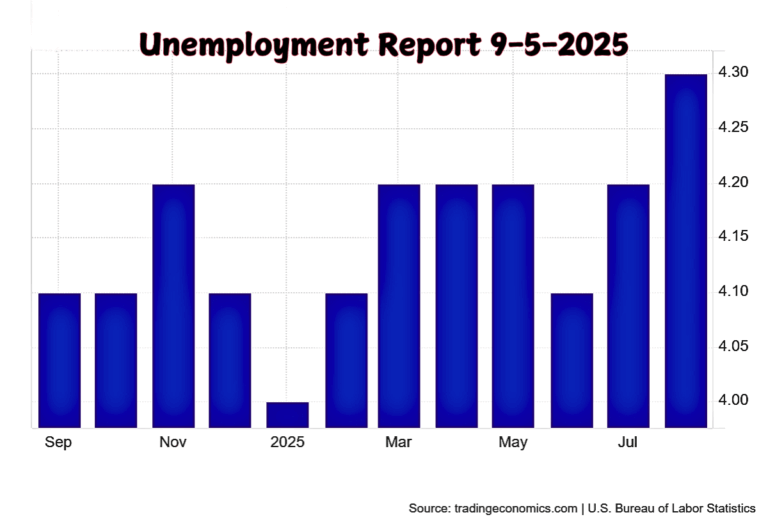

📊 Market Watch is predicting that mortgage rates will remain steady. However, here’s where I see 👀 things differently: Unemployment could rise to 4.4%. The 10-year Treasury yield has a strong chance of sliding lower — and if the data lines up, it could plummet by Friday. 👉 Translation: while the official outlook is “steady rates,” my forecast points toward a week where mortgage rates could move lower as the labor market weakness takes center stage. 🎭 I recommend bookmarking 🔖: Today’s Mortgage Rate ~ Dip or Spike Alert 📢 below ⤵️and track where rates are heading next week. 🗓️

💬Call or Text 📞 248-343-2459 with any questions, I’m here to help anytime! 🆘 Stay current and ahead of your future competition by visiting the website for updated articles 3 to 4 times a week. Mortgage Rates are updated daily.

More Help Is 1️⃣ Click Away⤵️

Pick Your Topic by Scrolling

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Today’s Mortgage Rate: Your Why Alert with Video 📢

Metro Detroit Home Prices and Real Estate Trends by City~Oct.📊

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

Real Estate Guides for Buying & Selling ~ Metro Detroit Video🏡📰

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

What Is A True Real Estate Expert: How to Find One🏡💥

Selling Your House As-Is OR Make Repairs Pros🌟 and Cons🚫

Top 3 Home Selling Questions in Metro Detroit Answered 🏡❓

Top Real Estate Agent Skills for Selling Your Home🏡💲

Thinking of Selling Your House: How Long Will It Take?

Is Now a Good Time to Sell Your House❓Let’s Find Out 🥳

Downsizing Your Home Can Help You Fuel Your Retirement🤩🏡💲

Master Your Mortgage Rate: Control the Controllable💰🏡

Inspection vs. Appraisal: Understaning the Key Difference🕵️🏡💲

Discover How Home Equity Can Fund Your Next Move💰

Metro Detroit Sold Home Prices by City: Live MLS Data🥳🏘️

Should You Rent or Sell Your House❓🏡

How to Market Your House for More Money💲🏡🎥

How to Tell if Your House is Priced Right? Let’s Find Out 💲🤯

Homes for Sale – Search with MLS Access Like the Pros🗺️📍

More Help Is 1️⃣ Click Away⤵️

Adjustable Rate Mortgage (ARM): Smart Move or Mistake❓

Today’s Mortgage Rate: Your Why Alert with Video 📢

Metro Detroit Home Prices and Real Estate Trends by City~Oct.📊

Home Value vs Price in Metro Detroit: Myth Busting Revealed 🤫

Mortgage-backed Securities Effects on Mortgage Rates💲📉

Negotiation Strategies for Home Buyers and Sellers 🙌🏡

Your Home Equity Gains: Game Changer When You Sell🏠📈

Mortgage Pre-Approval: The Secret Power Buyers Need to Know 🎓💲

Buying a Fixer-Upper: Hidden Benefits Most Buyers Overlook 👀

Is it Still a Sellers Market Today in Metro Detroit🏡❓

Will Foreclosures Crash the Housing Market in Metro Detroit Winter 2025

Home Pricing Missteps: What Every Metro Detroit Seller Should Know

How to Choose the Right Buyers Agent: A Must for Home Buyers’ 🛒

Real Estate Guides for Buying & Selling ~ Metro Detroit Video🏡📰

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

What Is A True Real Estate Expert: How to Find One🏡💥

Selling Your House As-Is OR Make Repairs Pros🌟 and Cons🚫

Top 3 Home Selling Questions in Metro Detroit Answered 🏡❓

Top Real Estate Agent Skills for Selling Your Home🏡💲

Thinking of Selling Your House: How Long Will It Take?

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.