Buying Your First Home Is a Smart Move Against Inflation in Metro Detroit! While rent keeps rising faster than inflation, homeownership lets you lock in a fixed payment and build equity as home values climb. Don’t let rising costs hold you back—see why buying now makes financial sense!

Buying Your First Home is a Smart Move to Help Beat Coast

It’s no secret that everything is getting more expensive—groceries, gas, and everyday services. Inflation has stuck around longer than expected, making people think twice about big financial decisions. If you’ve considered buying a home, you might wonder: Is now the right time?

The good news? Owning a home is one of the best ways to protect yourself from the impact of inflation. While costs are rising in many areas, homeownership can offer financial stability and long-term benefits.

A Fixed Mortgage Locks in Your Housing Costs

One of the biggest perks of homeownership is financial stability. When you buy a home with a fixed-rate mortgage, your principal and interest payments remain the same for the life of your loan. That means your most significant housing expense won’t change while other costs may rise.

Your property taxes and homeowner’s insurance might fluctuate slightly, but your core mortgage payment remains predictable. This makes budgeting much easier, giving you a sense of financial security.

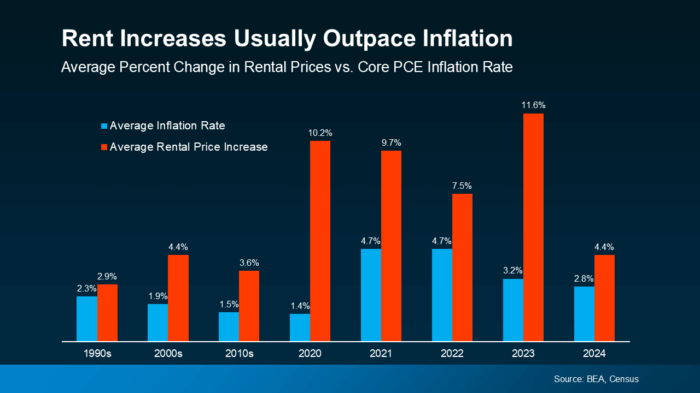

Renters, on the other hand, face a different reality. Rent prices tend to increase year after year—and often at a rate that outpaces inflation. Data from the Bureau of Economic Analysis and the Census Bureau show that rental costs typically rise faster than the overall cost of living.

If you’re renting, there’s no guarantee your monthly payment will stay the same. Landlords frequently raise rent to keep up with inflation, which can strain your budget over time. Buying your first home in Metro Detroit can protect you from this financial uncertainty.

Home Prices Often Rise Faster Than Inflation

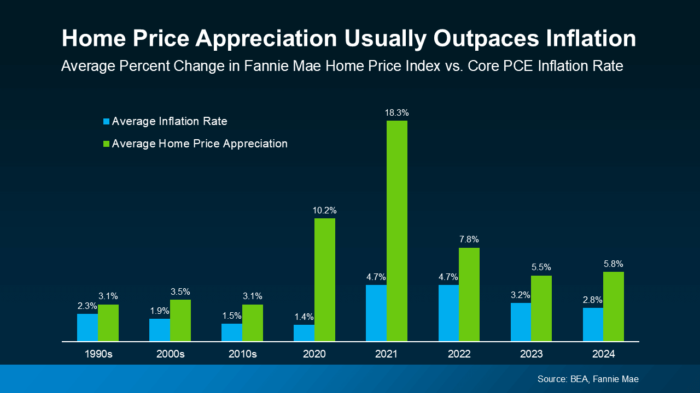

Beyond stabilizing housing costs, owning a home offers another major perk: home values tend to rise over time. Real estate has proven to be a substantial long-term investment, often growing in value even faster than inflation.

Why does this matter? Because inflation can lower the value of cash savings over time. Money sitting in a bank account may not keep up with rising costs, but homeownership provides a way to build wealth. As your home increases in value, so does your equity—the portion of the home you truly own.

Renting, on the other hand, doesn’t offer the same financial benefit. While homeowners see their net worth grow as their property value increases, renters face rising costs without gaining anything in return.

Additionally, when inflation pushes up prices, landlords often pass those costs onto tenants through higher rents. This means renting becomes more expensive over time while homeownership remains a stable and appreciating asset.

Experts predict that home values will continue to rise, meaning that buying now could put you in a strong financial position for the future.

Why Buying Your First Home is a Smart Move Against Inflation in Metro Detroit

Buying a home isn’t just about having a place to live—it’s about creating financial stability and long-term security. Here’s why homeownership is a powerful hedge against inflation:

- ☑️Stable Monthly Payments: A fixed mortgage keeps your housing costs predictable, unlike rent, which tends to rise over time.

- ☑️Home Appreciation: Home values typically increase over time, helping homeowners build wealth.

- ☑️Equity Growth: Instead of paying rent with no return, homeownership allows you to build financial equity.

- ☑️Long-Term Financial Security: A home is an investment that usually outperforms inflation.

For many first-time buyers in Metro Detroit, purchasing a home now can provide long-term financial benefits. And with inflation continuing to impact costs across the board, locking in a stable mortgage payment can offer peace of mind

Key Step in Purchasing a Home

Every day, I break down mortgage rates so you can understand the WHY, not the WHAT. These tips will save you thousands over the life of your mortgage loan and provide better negotiation skills with lenders.

Now Move to Step #2

For more homebuying tips and strategies, visit Home Buying Tips. ⤵️

I separate blog posts for first-time home buyers only, and homebuying tips are for everyone, including you.

Boost Your Homebuying Power ~ Let’s Explore Together!

Wow 🤯, that’s a lot to take in. I’m sure you’re feeling a little a little overwhelmed. There is a lot to consider: when is the perfect time financially to jump into the market and buy your ideal home? Let’s discuss how recent rate cuts and home price trends can work in your favor and figure out your magic numbers! We can schedule a Zoom call where I’ll share my screen and walk you through the details. Would you prefer an in-person meeting or a phone call? Let’s set up a time that suits you best. I’m here to help you make the most of these opportunities.

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

Final Thoughts

Inflation can make everyday expenses unpredictable, but homeownership provides stability. Unlike rent, your monthly mortgage payment remains steady. Plus, your home will likely appreciate over time, increasing your wealth.

If you’re wondering how owning a home could improve your financial future, now may be the perfect time to make a move. Buying your first home is a smart move against inflation in Metro Detroit—offering protection from rising costs and helping you build a stronger financial foundation.

How would a fixed housing payment impact your long-term budget?

More Help Is 1️⃣ Click Away⤵️

Today’s Mortgage Rates: Alert📢

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Your Home Didn’t Sell: Let’s Fix That! 🔄🏡

3% Mortgage Rate vs. Real Life: Is It Worth Staying Put❓🏡

Mortgage Rate Dips 📉 vs. Home Price Spikes📈Which Matters❓

More Homes for Sale: A Warining⚠️ or Opportunity💡

Mortgage Mistakes to Avoid After Applying🏡😱

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.