Mortgage rate impacts home affordability in Metro Detroit, affecting monthly payments and buyer demand 📉📈. When rates drop, more buyers jump in, driving up home prices, but when they rise, demand cools, creating opportunities for better deals 💡💵. Stay ahead of the market—know when to lock in your rate and make smart moves toward homeownership! 🚀

💰Mortgage Rate Impact: Track the Trends 📊

Thinking about buying a home? 🏠 Then Mortgage rate impacts home affordability should be at the top of your radar! 📉📈 These rates directly impact your monthly payments, making them a crucial part of your financial plan. But with headlines shifting daily, it’s easy to feel overwhelmed. 😵💫 Don’t worry—we’ve got you covered! Here’s a simple, no-nonsense guide to help you stay on top of mortgage rate trends without the confusion. ✨

📊 What’s Up with Mortgage Rates? 🤔🏡

Lately, mortgage rates have been on a rollercoaster 🎢—rising, dipping, and keeping homebuyers on their toes. But what’s behind these unpredictable changes? Several key factors come into play, including the economy, employment rates, inflation, and Federal Reserve decisions. 🏦💡

As Odeta Kushi, Deputy Chief Economist at First American, explains: 💬 “Factors like an ongoing inflation slowdown, a cooling economy, and geopolitical uncertainties can drive mortgage rates down. Conversely, data indicating potential inflation risks could push rates higher.”

Understanding these trends can help you make smarter financial decisions, stay ahead of the market, and learn how mortgage rates impact home affordability. 📈📉 Stay tuned for expert insights! ✅✨

📊 Understanding Mortgage Rates Impact & Home Prices 🏡💰

Let’s break it down! 📉📈 Mortgage rates and home prices go hand in hand when shaping your monthly payment. When rates rise, home prices tend to cool off, causing some buyers to hit pause ⏸️—building up pent-up demand. But when rates drop, the market heats up 🔥 as buyers jump back in, increasing competition.

With the ongoing home supply shortage, we could see another frenzy like the “Unicorn Years” 🦄—when prices soared due to multiple buyers bidding on the same homes! 🏠💨Mortgage rate impacts home affordability, affecting monthly payments and buyer demand 📉📈

💡 Know Your Options

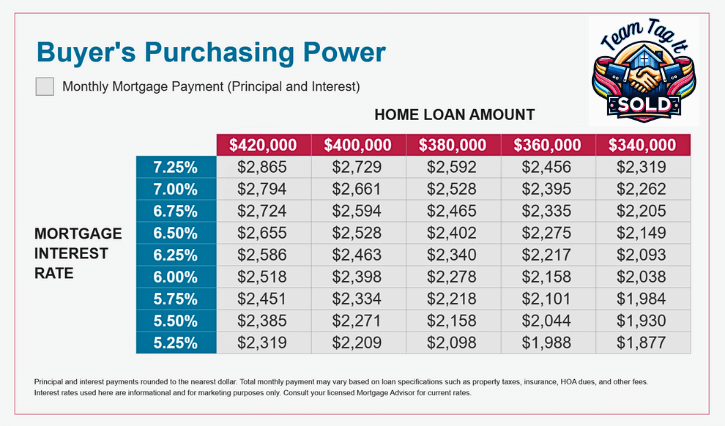

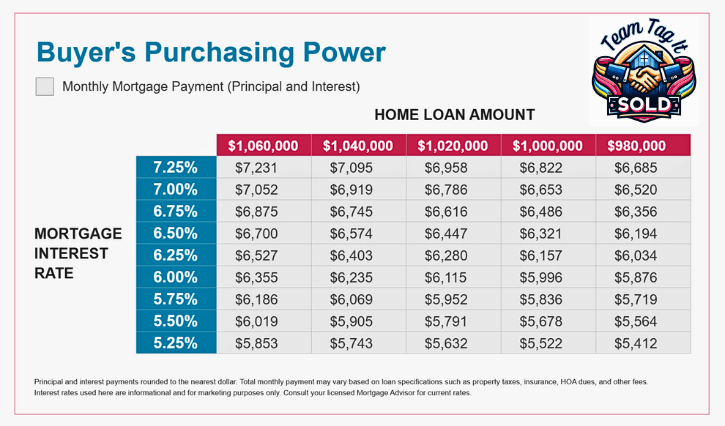

📊 Time to crunch the numbers! Would you rather:

✅ Buy now with higher mortgage rates, aiming to refinance later and snag a better deal on the home price?

☑️Wait for lower rates, but risk paying more for the house due to increased demand?

Both impact your monthly payment, so understanding these key factors is crucial. With talks of a potential recession, making an informed decision is more important than ever—especially in Metro Detroit’s housing market! 🏙️📊

📌Metro Detroit Sold Homes by City 🏡

Take control of your home-buying or home-selling journey with direct MLS access—no middleman, no guesswork! 🚀 Our exclusive bridge access lets you explore what homes are selling for 💰,all at your own pace. 🖥️

✨ You’ve got instant access to up-to-date sold data—so you can skip the headlines and go straight to the facts!

Start exploring now and make informed decisions with confidence! 💡📊

Macomb County Sold Homes by City

Oakland County Sold Home By City

📊 Today’s Mortgage Rates: Crack the Code & Save! 💰🔍

If you’re on the path to buying a home in Metro Detroit 🏡, you’ve probably been keeping a close eye on Today’s Mortgage Rates 📉📈. But did you know that most lenders start the day with yesterday’s rates and then adjust mid-day? ⏳💡

🔎 Want a sneak peek at where rates are heading? Keep an eye on the 10-Year Treasury Yield—it’s a key indicator of upcoming rate shifts! 📊💰

⚠️ Important Reminder: I track baseline mortgage rates—which don’t include:

✅Lender points (fees to buy down your rate)

☑️Your credit score 🏦

✅Your down payment 💵

Your final mortgage rate will vary depending on these factors! 📌

🚀 Rates have been ALL over the place lately—hitting record lows ⬇️ and soaring to new highs ⬆️. But why the big swings? Let’s break down what’s really driving these changes. Updated mortgage rates typically drop between 12 PM and 2 PM—stay tuned! ⏰📢

🏡 Let’s Find Your Home Purchasing Power 💰🔍

Now that you know how to track home prices 📉 and monitor mortgage rates 📊, it’s time to focus on your budget! ✅ Before locking in a loan, make sure you’re calculating your true monthly payment—not just principal & interest.

💡 Pro Tip: When shopping for a lender, ask how much it would cost to refinance later 🔄 and work that into your overall budget.

📌 What Goes Into Your Mortgage Payment?

☑️Principal & Interest (P&I) 💵

✅Property Taxes 🏡

☑️Homeowner’s Insurance 🔥

✅PMI (if you put down less than 20%) 🏦

📊 Calculating Your Property Taxes in Metro Detroit

🚨 BIG factor alert! Property taxes WILL increase based on your home’s purchase price—not what’s posted! 📈 Tax rates are adjusted June 1 & November 1, so be prepared for an increase.

📞 Call your local municipality and ask for their millage rates (these vary by school district!). Then, use this formula:

🧮 Home Sale Price ÷ 2 = X

📊 Millage Rate× X ÷ 12 = Your Monthly Tax Payment

🔎 Explore Buyer Scenarios

To make things easier, I’ve prepared several charts showing different monthly payment scenarios based on principal & interest only. Click the picture to enlarge! 📸

📌 Your Monthly Payment Formula:

💲 P&I + Taxes + Homeowner’s Insurance + PMI (if applicable) = TOTAL Monthly Payment ✅

Start calculating your buying power today and make informed financial decisions with confidence! 🚀💡

🚀 Boost Your Homebuying Power

Let’s Explore Together! ⤵️

Wow! 🤯 There’s a lot to think about when buying a home, and feeling a little overwhelmed is normal. The big question is: When is the perfect time financially to jump into the market and buy your ideal home? 🏡💰Let’s connect and break it all down together! We’ll review recent rate cuts and home price trends and determine the magic numbers that work for you. We can schedule a Zoom call, and I’ll share my screen to walk you through everything step by step. Would you prefer an in-person meeting or a quick phone call 📞 instead? No problem! Let’s set up a time that fits your schedule. I’m here to help you make the most of these opportunities! ✅✨

💡 Need to sell first? Check out the Top 3 Home Selling Questions Answered. I’ll guide you through Steps 1 & 2 of the Price-Driven Approach, so you’ll know exactly what your home is worth and how much equity you can gain! 💰📈Let’s get started on your home buying journey today! 🎉🔑

Contact me with any Questions

Schedule an Appointment ~ Call | or Zoom Consultation Here

🏡 Final Thoughts: Mortgage Rates Impact on Home Affordability 🚀

Are you curious about the Metro Detroit housing market and how it impacts your home-buying plans? 🤔💰 Let’s connect! I’ll help you navigate the current market, break down key trends, and understand what it all means for you. ✅

Now that you understand your purchasing power, it’s time to take control! 🎯 With direct Multiple Listing Service (MLS) access, you can browse homes for sale in real-time—no middleman, no guesswork! 🏠🔎

🎥 Watch the Video! Learn to use the MLS just like a Realtor—adjust your criteria, change status filters, and compare prices & features with ease! 📊💡

🔑 Why This Matters:

☑️Stay informed & prepared with real-time listings 📉📈

✅Become a pro at market research 🎓💼

☑️Compare prices & features to find the perfect home 🏡

📩 Want to stay ahead of the market? Sign up for our newsletter, and I’ll keep you updated on the latest trends, insights, and opportunities—so you never miss a beat! 📰✨

More Help Is 1️⃣ Click Away⤵️

Crack the Mortgage Rate Code: Know the Why💡 and Save💲

Today’s Mortgage Rates: Rate Drop Alert📢

Metro Detroit Home Prices and Real Estate Trends by City 🏡💲

More Homes for Sale: A Warining⚠️ or Opportunity💡

Should You Rent or Buy a House in Today’s Market💲📊

Home Staging FAQ: What Matthers Most When You Sell🏡💰

Adjustable Rate Mortgage (ARM): Pros➕ and Cons➖

Home Pricing Disconnect:Buyers and Sellers on Different Pages🤔

Homeowners Association Fees: What Buyers Need to Know📜💡

Common Real Estate Terms: Explained for Metro Detroit 🏡Buyers

How Veteran Home Loans Can Help You Buy a House💲🏡🤩

Why Mortgage Rates at Risk: Trade War Fall Out 🎢🚀

Home Values are not as Volatile as the Stock Market🛡️🏠💰

Don’t Let Student Loans Hold You Back from Homeownership🏡🆘

Seller Concessions: A Strategic Home-Selling Tool💡📢

Home Projects That Boost Value👏💲🎯

Should You Buy a Home Now in Metro Detroit or Wait❓🏡

Home Purchasing Power – Do You Know Your’s❓🏡

How Mortgage Rate Cuts Affect Your Home-Buying Power💪

Will a Recession Crash the Housing Market in 2025🌩️🏠

☎ ~ +1 (248) 343-2459

Contact Us

Website Development, Production, and Content by Pam Sawyer @ Team Tag It Sold © 2017 to the current year. All Rights Reserved

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Metro Detroit Home Experts ~ Team Tag it Sold does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Metro Detroit Home Experts ~ Team Tag It Sold will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.